A credit check is a process whereby an individual credit history is reviewed to advise on creditworthiness. This process can take time; some can be done in hours, some in days, and some in weeks. The whole review process is not entirely straightforward.

Each creditor or lender has a way of doing these checks. This means that the timeline of the process may differ; where in case an individual wants to buy a car, how long does a credit check

These checks could be a soft inquiry or hard inquiry, but the question that may follow is about the number of checks.

Having a lot of credit checks can negatively affect your credit score. But how does it happen? And how many checks are there? Are there too many credit checks in South Africa? Let us get deeper into the credit check limitation and its associated consequences.

How many credit checks are too many in South Africa

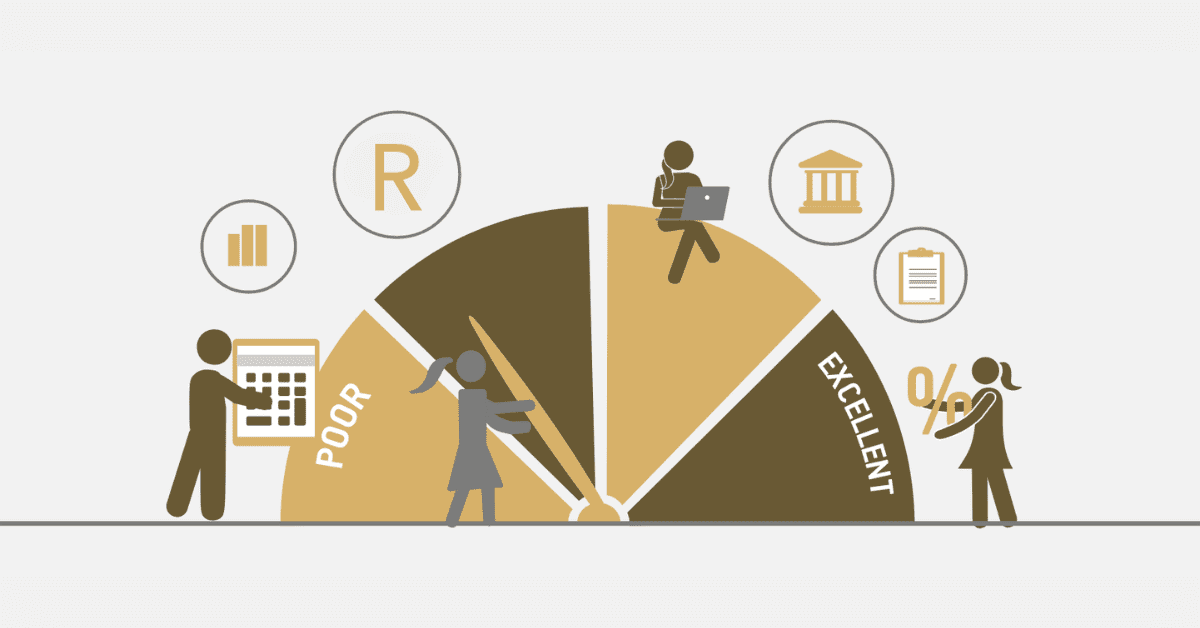

Credit checks can show if someone is creditworthy, but having many checks can lower your score.

Lenders are concerned about people who have a lot of credit inquiries in a short amount of time because it could mean that the person is having trouble with money.

However, there is no set number of inquiries that are considered “too many” by lenders.

But before we understand what it means to have too many credit checks, it is important to understand the types of checks: soft and hard.

A “soft inquiry” is when someone looks at their credit score. A “hard inquiry” is what a lender does when someone applies for credit. Hard inquiries can slightly lower your credit score, but soft inquiries do not change it.

People in South Africa can avoid worse things happening by limiting and sharing hard inquiries over time.

Also, people can make smarter choices about their credit if they know what affects their credit scores and how things like payment records and credit use work.

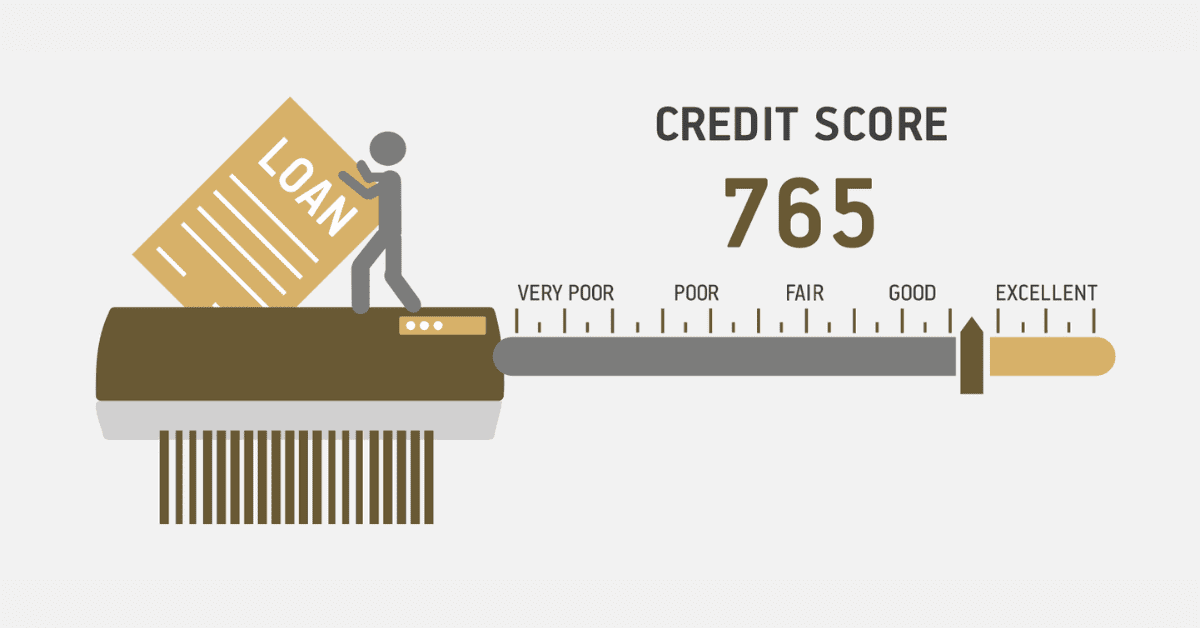

It is too many credit requests if your credit report shows six or more checks.

The reason for this is that a major breach of credit happens when a customer has six or more inquiries. These numerous checks can hurt an individual’s credit check.

Once you have 6 or more hard inquiries on your credit within a year, it can be considered as too many. This is because hard inquiries will happen with huge credit and from a lender who needs to thoroughly review your credit.

How can I remove hard inquiries from my credit report fast?

Removing hard inquiries from your credit can be frustrating. Not because of the process, but how proactive you can be, by providing strong claims to this issue.

Of course, you can remove hard inquiries from credit reports but the aspect of how “fast” can be deceptive.

Some may have their hard inquiries removed in less than 2 months others may take weeks. The question of “how fast” depends on how you approach the situation.

To tackle this, you must be well vexed with your credit report to understand the gaps. These will give you a better view and analytical perspective on what could have caused the hard inquiry.

Should you find out all these details, the fastest way is to submit a letter or an email to your credit bureau requesting the removal of the hard inquiry. This could be as a result of an eros or past check that does not exist on your radar anymore. You can have a valid reason for your credit bureau to assist you in removing these hard inquiries.

How many inquiries affect credit scores in South Africa?

Considering the two types of inquiry, which are hard and soft, there is a clear distinction on what affects your credit score.

Soft inquiries are more of an internal check; where a credit holder checks his or her credit score. The soft inquiry is more of a quick check without affecting your credit score.

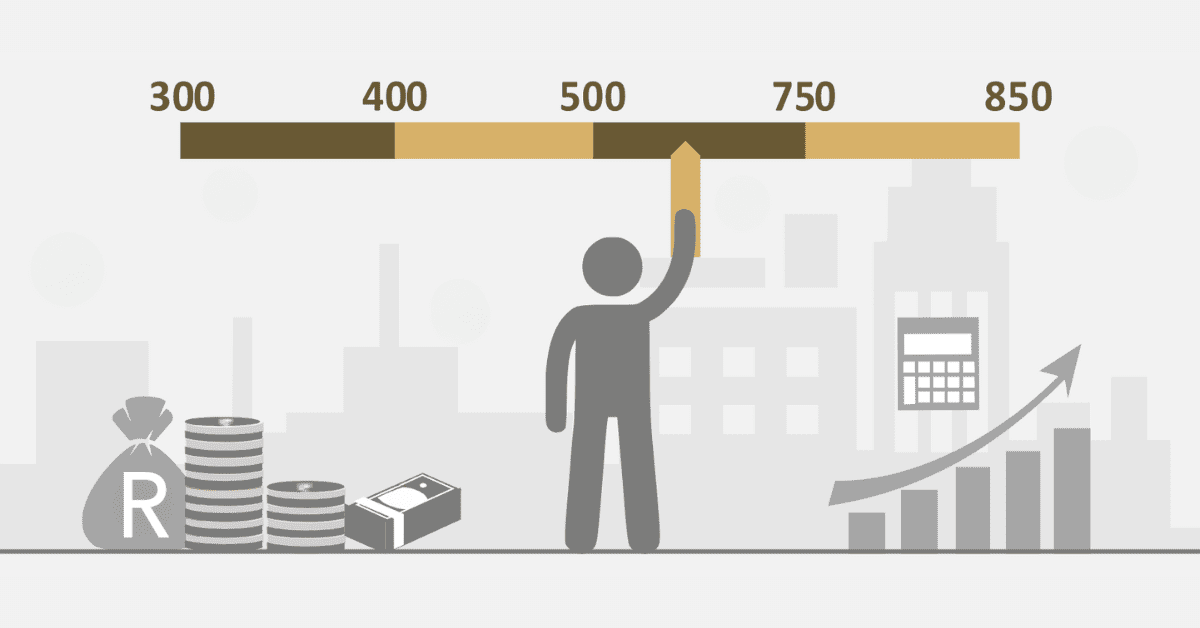

But when it comes to the inquiry that affects your credit score, at least one inquiry can reduce your credit. A single inquiry can make you lose 5 to 10 points from your credit. The minimum point one can lose is 5 points and 10 points for the maximum points on a hard inquiry.

Hard inquiry usually tends to stay on your credit for a while. And this in the long run repels lenders from giving you loans after checking your credit history.

When you have too many hard inquiries on your credit, there is so much limitation on the credit or loan you may want to acquire.

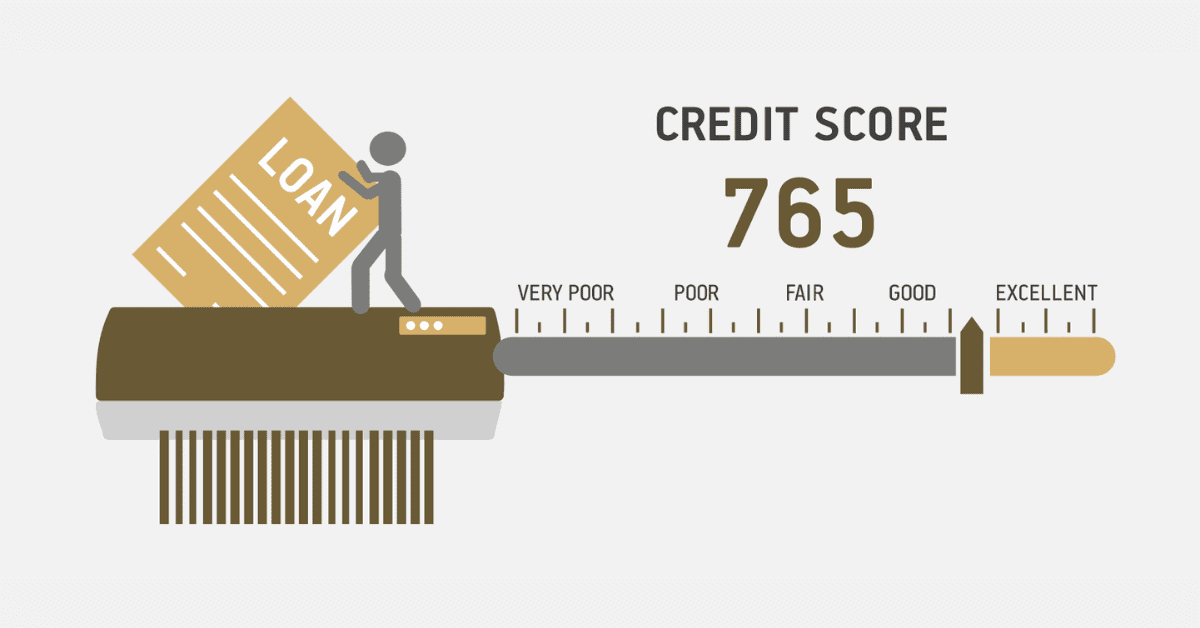

Why did my credit score drop 50 points after a hard inquiry?

Many things could make you lose some points after a hard inquiry. But losing 50 points at once can be a big deal.

The only thing that could make your credit score drop 50m points after a hard inquiry is opening a new credit account without fulfilling the late payment. Once you have an existing credit with debt to clear one, without making the effort applying for a new credit can make your score drop 50 points.

At this point, you should know it is not just about the inquiry that made you lose 50 points but about opening more credit accounts without the need to fulfill late payments. There is a mixture of things that were triggered by the hard inquiry to make you lose 50 points.