Taxpayers are obliged to submit annual tax returns, but they also get a chance to receive refunds from the South African Revenue Service (SARS) for overpaying their taxes during the tax year. Different things are considered by SARS when processing tax returns, which affect the time it takes to complete the process. This article explains everything you need to know about the duration it takes for SARS to process your tax return.

How Long Does It Take To Get Tax Refund 2026?

A tax refund in 2026 usually took approximately 72 hours or about three business days. The refund is usually processed after an assessment of your tax returns. An assessment comes as verification or an audit, and you can view it by logging into eFiling or SARS MobiApp.

If you agree with the assessment, you can check if there is a refund due to you, or you may be owing SARS. If you are due to get a refund, it will be automatically deposited into your account, and you don’t have to ask for it. You can expect to get it within 72 hours from the date you receive your assessment, although it can take a bit longer in some cases.

Make sure your banking details are correct. If you owe SARS, you should make your payment via eFiling or SARS MobiApp to avoid penalties and interest. If you disagree with the assessment, access your tax return via SARS MobiApp or eFiling and complete it.

File the tax return within 40 days from the date you received an assessment from SARS. However, this means any return that may be due after the second assessment will take even longer.

How Long Does It Take for SARS to Approve eFiling?

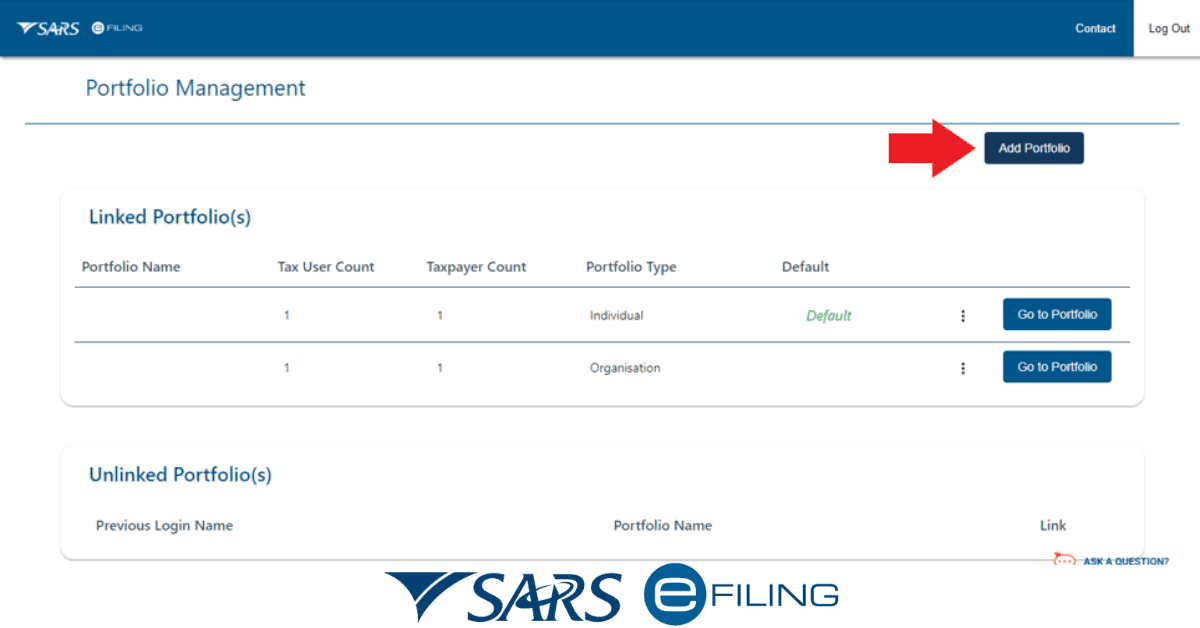

If you are a registered taxpayer, you need to sign-up for the eFiling service, which you can use to make payments to SARS, file returns, request tax clearance certificates, and access several other benefits.

To register for the eFiling service, follow the steps below.

- Go to the SARS eFiling website www.sars.gov.za and click on the tab “Register”.

- Download the MobiApp and click “Register”.

Once your eFiling registration is complete, you can administer your taxes. However, the registration process involves different steps, which can affect the time it takes for SARS to approve eFiling.

SARS will verify the information you provide upon registration. The outcome will be communicated to you via email or your eFiling verification page. If your registration is approved, you will receive a One-Time Pin (OTP) via your preferred channel of communication to complete it.

The status you can get is either “Registration Successful,” “Awaiting Supporting Documents” or “Rejected.” You cannot use eFiling if your registration status is not successful. You need to respond according to the correspondence received. If your documentation is in order, SARS will activate your new eFiling profile within 48 hours.

If your eFiling registration is not processed within 48 hours and you have been requested to provide additional documents, visit www.sars.gov.za and log in under the eFiling banner. Click Home, User, and Pending Registration. Follow the prompts to complete the registration process.

How Do I Track My SARS Refund 2026?

If you want to track your refund, you need to obtain your Statement of Account (ITSA) to get details about your tax account, including penalties, interest, and transaction history per each tax year. To access your ITSA, you must log in to eFiling and click on the icon of your Statement of Account on the top right position of your screen.

The refund amount and payment date will reflect on the ITSA if SARS owes you some money from the 2026 tax period. If you have a refund, you need to wait for the payment due date since there is nothing you can change. The entire tax refund system is automated, so you need to be patient.

How Do I Find Out if My Tax Return Has Been Processed?

When you submit your annual tax return, known as ITR12, SARS will give you a document called the ITA34. You will receive an SMS or email instructing you to log in to your eFiling account and go to the notices section where you can view your documents.

When you visit the first page of ITA34, you will know if you owe SARS any money or if they should give you a refund. If you see a minus sign in front of the figure, it means you are owed a refund after an assessment.

SARS usually sends you the details of your annual tax return outcome via email. For instance, you will be notified if you have a refund or if you owe SARS some money. All refunds are electronically processed and will be reflected in your bank account within three days after the ITA has been issued.

If you have outstanding returns, SARS will insist that you submit them before a refund is issued to you. Tap on the Returns tab on SARS eFiling to check if you have outstanding returns. Click on SARS correspondence, where you can request historic IT notices. You can view your statement of account, where you can get insight into any outstanding returns.

Once you complete the old tax returns, SARS will release your tax refund, but you should not have late penalties for late filing. Even when you have not earned significant income, you should submit your annual tax return. This will help you keep your tax returns up to date and make an assessment that determines refunds easily.

Every taxpayer is required by the law to make tax payments and tax returns to SARS. The complexity of your tax determines the time it will take SARS to process your tax return. SARS will automatically send a refund to your bank account if you have been overpaying your taxes. However, you can only get a refund after SARS conducts an automated assessment of your tax regime.