When it comes to disputes and investigations, dealing with the South African Revenue Service (SARS) may be a terrifying experience. As a taxpayer, you likely want reassurance that SARS will respond to your issues promptly and with the full attention they deserve. Yet, it may be difficult to decipher the procedures and timeframes for settling issues with SARS.

In this post, we’ll examine the timelines you may expect when dealing with SARS disputes and investigations, as well as the information you need to know regarding the dispute process and presenting supporting papers. You should read on if you want to know how long it takes SARS to resolve a disagreement.

How long does SARS take to respond to disputes?

When you have a dispute with SARS, one of the most pressing questions you may have is how long it will take for SARS to respond. Unfortunately, the answer is a complex one. SARS has 60 business days to respond to an objection, but this time frame may be extended if SARS requests more information or documentation from you. The time it takes for SARS to resolve a dispute may also depend on the complexity of the case, the workload of the specific SARS office handling your dispute, and the quality and completeness of the information and evidence you provide to support your case.

In addition, if your objection is disallowed, you have 30 business days from the disallowance to submit a notice of appeal with the grounds for your appeal. SARS will then have another 30 business days to respond to your appeal. If SARS does not respond within this timeframe, it is considered a deemed response, and you can take further action to resolve the dispute.

It is important to note that while it can be frustrating to wait for a response from SARS, it is important to give them the time they need to review and consider your case properly. By submitting complete and accurate information and evidence to support your dispute, you can help expedite the process and increase the chances of a successful resolution.

What does dispute mean by SARS?

A dispute with SARS refers to a situation where you, as a taxpayer, disagree with a decision or assessment made by SARS regarding your tax return. It is a conflict between you and the tax authority. If you feel you have been unfairly assessed, you have the right to dispute it.

Disputes may arise in various situations, including late payment penalties and interests, VAT assessments, personal income tax, corporate income tax, unemployment insurance fund, and PAYE. You can initiate the dispute resolution process by filing a notice of objection or notice of appeal, and the process can involve requesting reasons or suspension of payment.

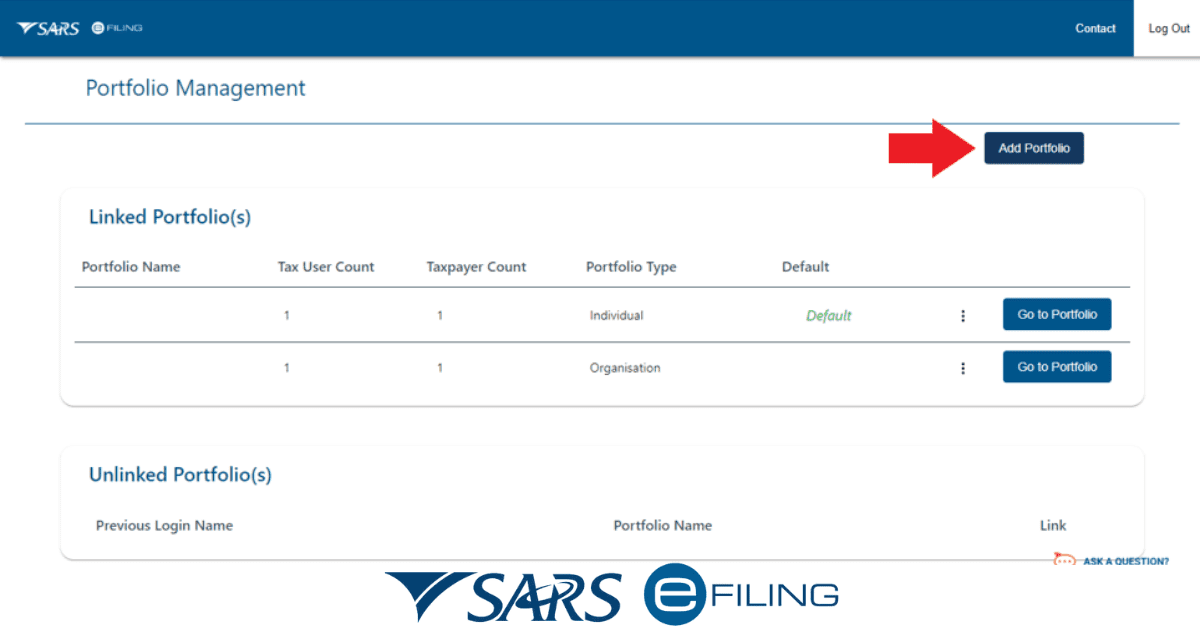

You can use the eFiling option to dispute a decision or visit a SARS branch office to submit your objection form. It is crucial to abide by the statute of limitations when filing a dispute to avoid penalties.

Remember, the dispute resolution process takes time, and SARS has 60 business days to allow or disallow your objection. If you are unhappy with their decision, you can appeal within 30 business days of disallowance. So, be patient throughout the process and gather all the necessary documents that support your claim.

How long does a SARS investigation take?

SARS investigates taxpayers to guarantee tax compliance, and the investigation may require income, expenses, assets, and liabilities.

Moreover, SARS can verify financial records, assets, and liabilities at your business, and to prevent tax evasion, the investigation may be intrusive and uncomfortable.

Also, remember SARS can randomly or selectively audit or investigate taxpayers and notify the taxpayer in writing if selected. Moreover, SARS investigations are unwarranted if you file your tax filings honestly. It’s a compliance check.

Provide all SARS-requested papers promptly to avoid delays in the inquiry. Remember, penalties, interest, or legal action may occur for not providing the requested information.

In conclusion, a SARS investigation can take 30 business days to 12 months, depending on case complexity and taxpayer cooperation. Therefore, to prevent delays and penalties, be honest and cooperative during the investigation and supply any requested information promptly.

How long does SARS take to review supporting documents?

SARS will review your supporting documents to ensure accuracy when you submit your tax return. Moreover, to validate the data, the tax office will compare it to other sources. And depending on transaction volume and complexity, supporting document evaluation can take up to 21 business days.

Ensure all supporting documents are accurate, up-to-date, and arranged to streamline the review process. Avoid delays by submitting all essential paperwork. Furthermore, to avoid delays, SARS may seek additional papers.

If SARS finds discrepancies or inaccuracies during the review, they may issue a further assessment or seek more information. Inaccurate information might result in increased assessments, fines, and interest costs.

In conclusion, accurate and full supporting materials are essential for a fast and efficient evaluation. Therefore, avoid delays and penalties by updating, organizing, and correcting all documentation.

Conclusion

In conclusion, the time it takes for SARS to reply to disputes might vary greatly depending on the particulars of each case. The issue’s complexity, the volume of transactions, taxpayer cooperation, and SARS’s responsiveness to the dispute are all important variables that might lengthen or shorten the time frame.

Although resolving a disagreement can be difficult and time-consuming, you must follow the correct steps to make a fair decision. Taxpayers will be better able to decide how to handle disputes and appeals if they have a clear picture of the timetable and process involved.