You need credit. Then you find out you have a poor credit score, and lenders aren’t as willing to engage with you. While this can feel very discouraging, stay positive! If you make positive changes to how you use credit, and how much you use, you will see your credit score rise with time. Today we take a closer look at credit score timelines and when you can expect to see those changes work their magic for you.

How Long Does it Take for a Credit Score to Update?

Technically speaking, lenders update the credit bureaus that create your credit score monthly. However, the timing of this update varies significantly, and not all lenders are on the ball. Sometimes they are slow to send updates, and you may not see monthly payment progress as you should. Have patience- it will get reported and reflect on your credit score eventually! It’s just a matter of bureaucracy, as usual.

If you are in the process of trying to improve your credit score, it can take a while for those efforts to show. Simply check your report regularly, and hang in there. If you are interacting with your report regularly, it will also give you a chance to see if any specific debt or lender is being slow to update so you can plan accordingly.

What Day of the Month Does Your Credit Score Update?

There is no set day of the month when your credit score updates. In fact, while South African bureaus typically update their credit information every 30 days, it isn’t guaranteed. Sometimes you will see a month or two lapse in the data, as they haven’t yet received an update. So you can never quite know when your next credit score update will be.

We know it is frustrating to be held back by a poor credit score. Instead of trying to ‘game the system,’ however, focus on making steady improvements to how, and how much, credit you use. Your score will rise with time and be ready for you when you need it.

How Often Does Your Credit Score Update (South Africa)?

As we mentioned above, changes in any line of credit you have typically reflect monthly on your credit report in South Africa. Lenders are supposed to update your progress (or lack of it) with loans you have every 30 days or so. However, not all lenders report timeously, and sometimes it will take a little longer to see changes in the information reflected on your credit report. Don’t worry, they will show up eventually!

Technically speaking, your credit score will update with every reported movement in lines and types of credit you have. However, not all interactions with credit are ‘worth’ that much on your credit report. For example, making the minimum payment on one credit card or loan won’t make all that much difference to your total score and may not push it up at all, or maybe just by a point or so. Paying off a substantial debt, closing a credit line, or taking on new debt will have much more dramatic impacts on your credit score.

Remember, as long as it isn’t going down, no news can be good news! If you are managing to maintain an average or better credit score, you’re doing better than many South Africans. Even if the number isn’t moving up as much as you wish.

How Much Can My Credit Score Go Up in a Month?

It’s impossible to know how much your credit score will go up in a month. That’s because of the nature of credit reports. They aren’t a set, predictable, and consistent thing we share. Instead, they are a profile, or snapshot, of how you handle your lines of credit. A huge variety of factors go into the bureaus assembling your score. This varies from how much credit you have vs what you are earning, right through to how reliably you settle monthly payments, how much of your credit you have used, and other factors.

It is possible to see big jumps in your credit score in a month. Some lucky souls who have taken their finances in hand have seen jumps of up to 100 points. This is not typical, however. It is more normal to see incremental rises. Especially if you have a tight budget and can’t pay off massive amounts of credit in one go. A spate of poor behavior, however, will quickly drop your credit score- it falls more easily than it rises, unfortunately.

The best thing you can do to boost your credit score is to keep consistent, healthy use of credit, pay all credit you have regularly, and keep yourself generally in good financial habits. It may not be immediate, but it will pay off for you!

What is a Healthy Credit Score in South Africa?

You don’t have to have your credit score at max for it to be healthy. As long as you are at the South African average or higher, you are doing well. Each bureau and lender is different and will be looking for different things. However, here’s the average credit score bands for South Africa:

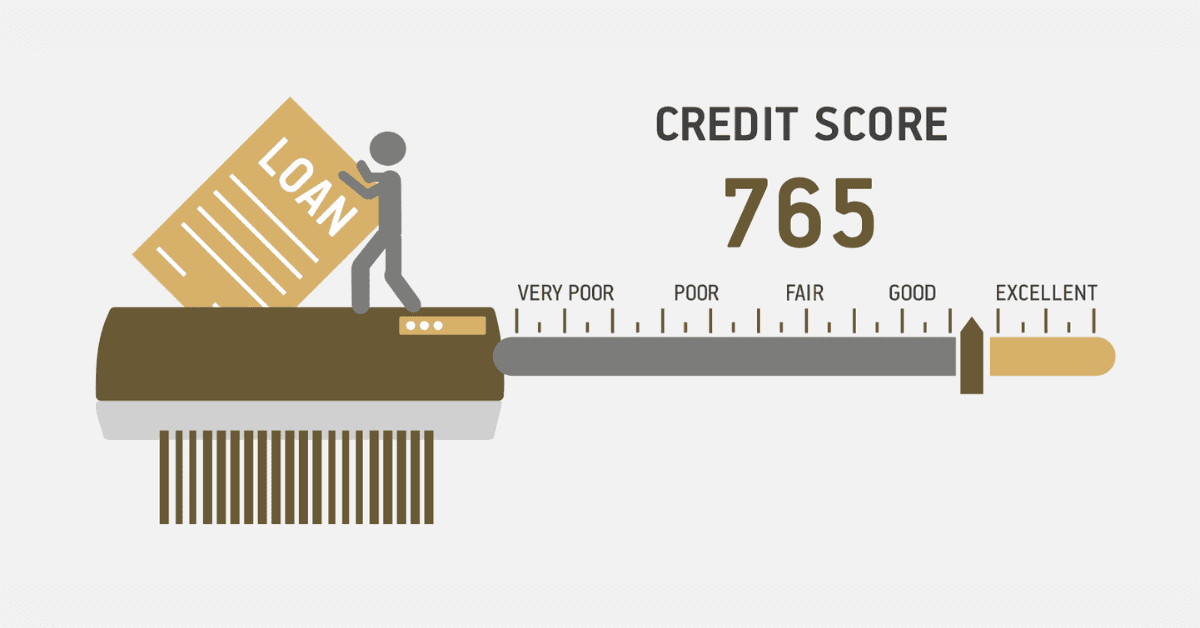

- Below 300: You have no credit record, good or bad

- 300-579: This is considered a poor credit score in South Africa. Sadly, this is also where the South African average score (560-580) lies, showing how poorly many of us manage our money!

- 580-669: Called ‘fair’ by bureaus, this is an ambivalent score and is neither good nor bad. It is, you will notice, above the SA average!

- 670-739: This is the official ‘good’ credit score band in South Africa

- 740-799: This is ‘very good’ by all measures

- 800-850: If you have a credit score in this range in South Africa, you are doing excellently.

The best possible credit score in South Africa is 850. If you see higher numbers mentioned, it is probably for the US market.

Waiting for improvements in your credit score is frustrating. This is why it is smart to consistently work on boosting your credit score, instead of trying to quickly push it up in a panic. If you are using credit smartly, pay regularly, and don’t overextend your lines of credit, you will have a healthy credit report before you know it.