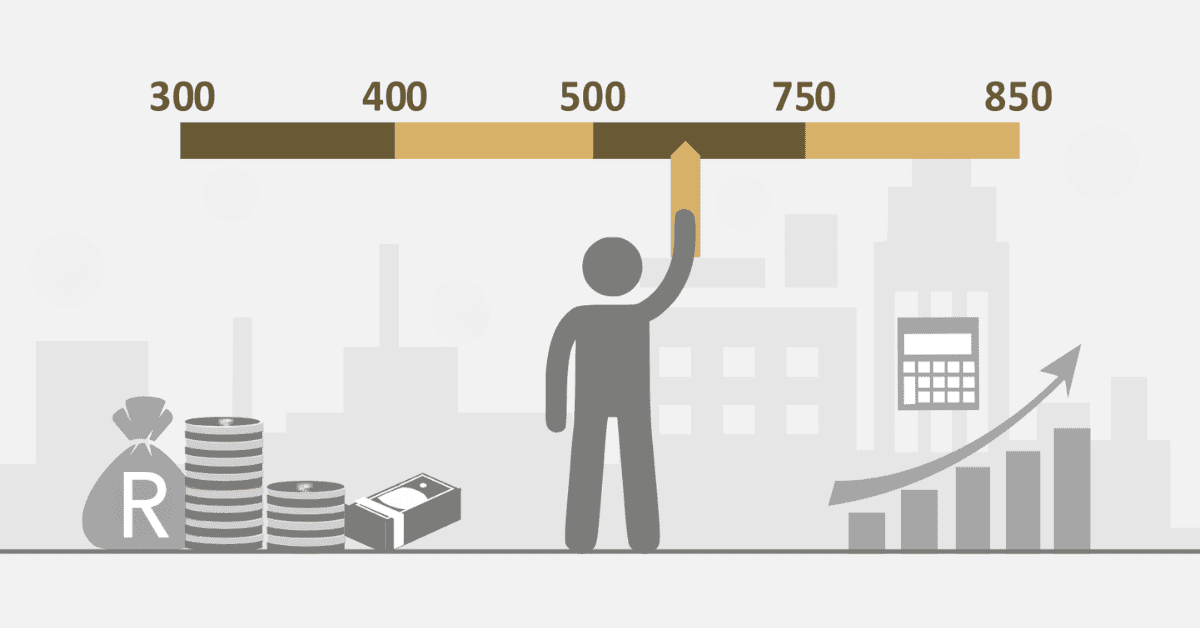

In South Africa, credit scores are like the financial heartbeat, influencing how much individuals can borrow. A not-so-good credit rating can affect receiving credits and other monetary services. However, here’s what to mark – improving a credit rating isn’t a sprint; it’s a marathon. It needs a good grasp of your financial habits, careful planning, and steady effort. This article is your guide to understanding how long it takes to spruce up a credit score in South Africa, the time it takes for a credit score to bounce back after paying off debt, quick fixes to clear a credit score, and whether credit indeed clears after five years.

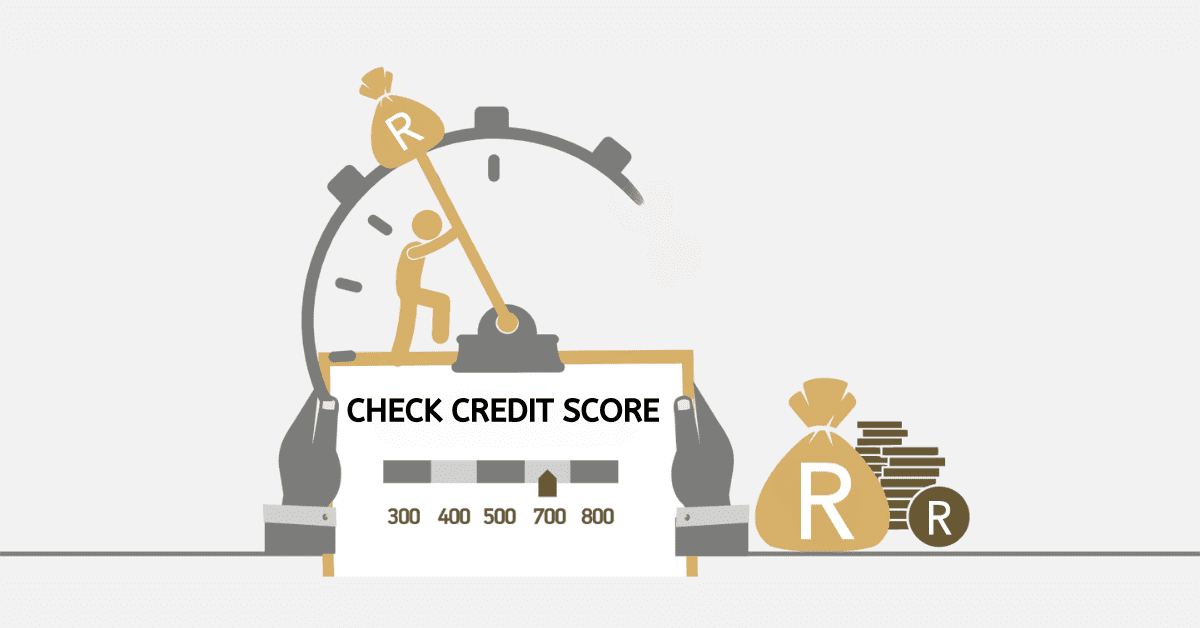

How Long Does Clearing Credit Score Take?

Deleting your credit rating in South Africa is not an easy task. It demands time, persistence, and a good dose of diligence. The period that requires relies on a few elements, including the kind and intensity of the negative details, the moves you make to boost your rating, and the terms of the credit agencies.

Usually, such negative stuff as missed payments, defaults, or judgments can hang around on your credit report for up to five years. Credit enquiries? Up to 12 months.

But here’s some good news – if you pay your debts off, dispute errors, and establish good credit habits, you may see positive changes in that score within as few as three to six months.

How Long Does A Credit Score Last After Clearing Off Debt?

Clearing the dues is recommended to enhance your rating, as it lowers your loan utilization percentage, affecting as much as thirty percent of your score. To explain that further, the utilization percentage measures how much credit you utilize at any given time. For instance, say you have one credit card with an R1,000 balance against an R2,000 limit; you would utilize 50% of your authorized credit utilization. Credit scoring models examine the amount of available credit you use on the individual cards and across all your accounts. But there’s no magic number to aim for — generally, any credit utilization higher than 30% will drag down your credit score. Keeping your credit utilization below that rate could help you improve your credit. Experian states that people with the best credit scores have credit utilization rates in the low single digits.

When paying off a balance on a credit card without closing the account, you are doing yourself a huge favor in terms of your credit because you are decreasing what percentage of available credit you are using. This enhancement from clearing off an account could be observed on your credit statement faster; creditors mainly update account records at the climax of the billing cycle; hence, it may take 30 to 45 days to impact your credit report. If you’re tempted to close the account, remember that you’d be giving up that available credit line. If you carry other card balances, closing a credit card might boost your loan utilization percentage, resulting in lower credit scores. For that purpose, you’ll mainly enjoy more advantages from maintaining a paid-off account unlocked unless the urge to rack up fees is too high or you’re forwarding a yearly charge that doesn’t match your budget.

You may see some difference as quickly as a few days or weeks, but it can take months for your score to adjust to a change in your card balances fully. Give the credit card company a few billing cycles. One to two months is enough for the firm to update your new info and for credit grading models to confirm that you aren’t instantly processing a new loan. Once your details are updated and a fresh rating is computed, you can observe a rise in your credit grade.

How Can You Clear The Credit Ratings Quickly?

Are you looking to clear your credit score quickly in South Africa? Here’s a condensed guide:

Regularly check your credit report for errors. If found, dispute them with the credit bureau. You could receive a zero-cost statement from TransUnion, Experian, Compuscan, and XDS. Agree with lenders for repayment terms that match your budget. Clear off dues on time and avoid fresh credits until the current ones are paid. If payments are challenging, consider debt counseling or review.

Ensure prompt, 100% monthly payments to create a positive clearance record, which adds 35% to your rating. Maintain minimal credit card balances and don’t exceed 30 percent of your credit curb. Divide spending across varied cards and clear balances monthly.

Build a diverse credit history by responsibly using different credit types. Apply for credit only when needed and avoid too many applications, which can lower your score by 10%.

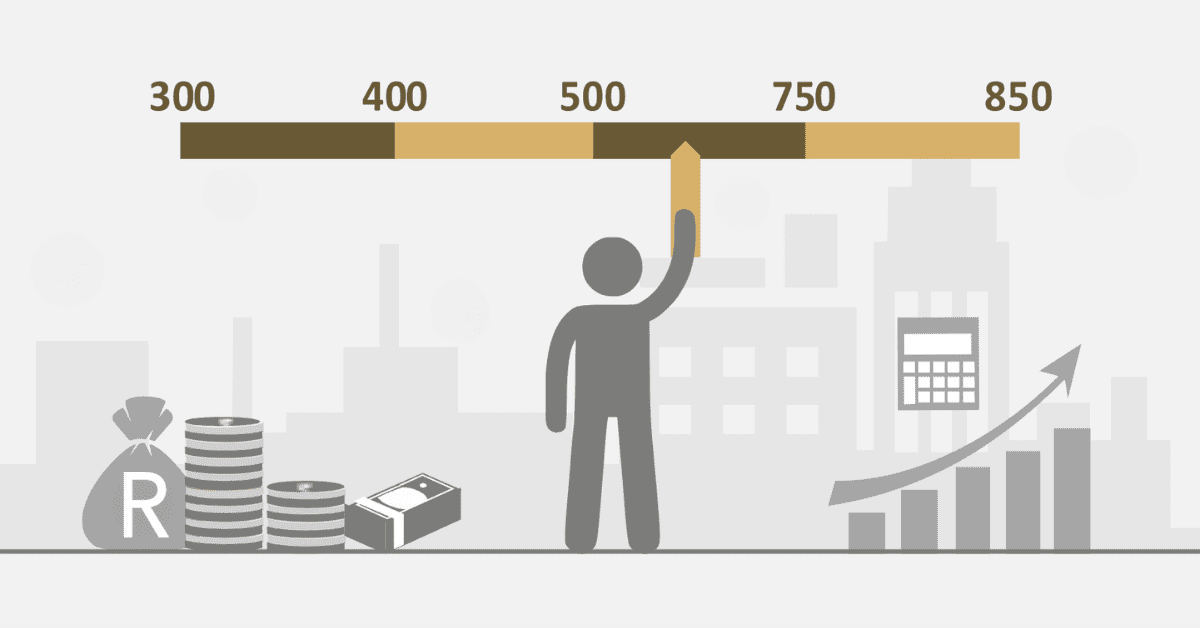

Is It True That A Credit Becomes Clear After Five Years?

In South Africa, the duration of the negative information staying on your credit report varies. Missed payments, defaults, and judgments can remain for up to five years, or until you settle the debt and provide a paid-up letter. Debt restructuring, a legal process to restructure your debt, stays until the debt counselor issues a clearance certificate, which can take five years or more. Sequestration, a process declaring you insolvent, allowing asset sale to pay debts, can stay for up to 10 years or until a court grants a rehabilitation order, which stays on your report for an additional five years.