The length of a credit check is determined by the lender’s discretion and the loan amount involved.

A credit check is a way for lenders trying to view and assess your credit history to know how much you have committed to your debt. This commitment looks at your entire creditworthiness; your ability to pay your debt and pay them on time.

Before a credit score can be done, this means you have already applied for your credit and enrolled on the credit score system.

Applying for the credit means you are ready to work on your credit score. However, these acts sometimes go wayward and become problematic for individuals looking to build their credit.

If your credit score does not favour you, you may find it difficult to secure loans with favourable interest.

Lenders who may check your credit and see how bad your credit score is can either deny you the loan or hit you hard with huge interest.

But in all these checks, how long does it take? If a lender should check my credit, does it affect my credit score? These and many more questions are asked about credit checks. Let us delve into more credit checks to gain some insight.

How long does a credit check affect your score?

A credit check simply means you are about to receive some inquiry on your credit score. Before a credit check happens, it means you the credit holder have authorised the lender to look into your credit. The lender without your power can not check your credit.

But did you know the checks we speak of are commonly known to be two? There is the soft and hard check. Both of these check play different roles when it comes to credit score.

Your credit check in a way affects your credit but that is only for the hard inquiry. If a lender needs to check your credit, they need to request more information from your credit bureau which can affect your entire score.

But if you check your credit score which is mostly regarded as a soft credit; there is no effect on your score. Sometimes during the pre-approval process, a soft check is done to know your current score.

These checks are deemed necessary and therefore it is important to know the kind of check that will be done on your credit.

How long does it take for credit score to recover from credit check?

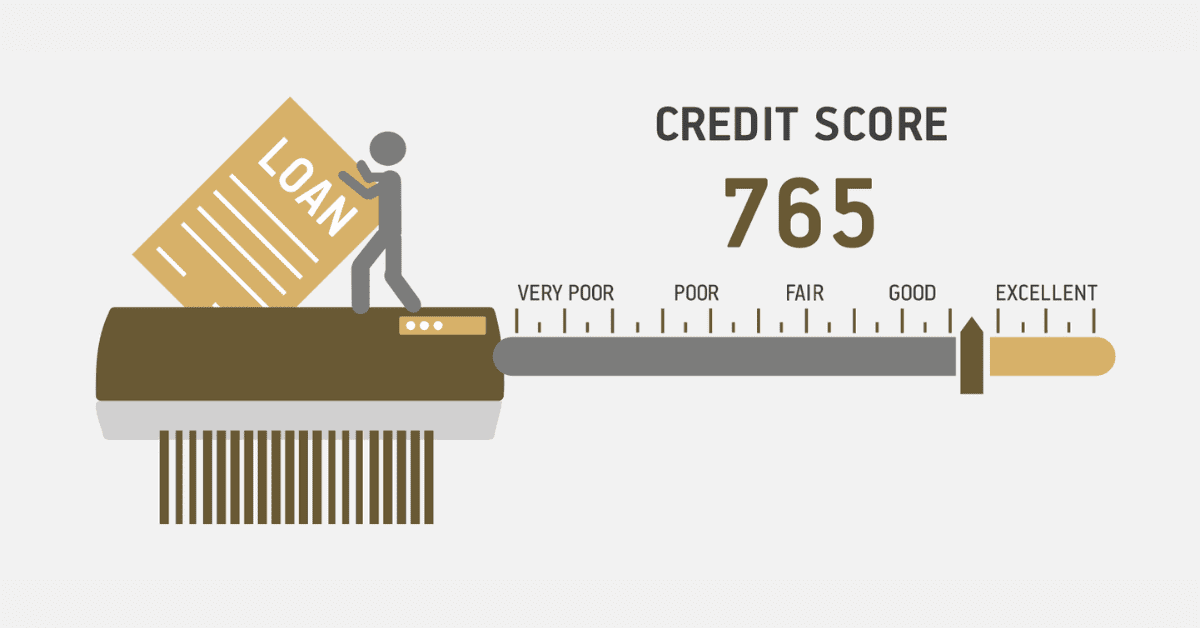

When you go through a credit check in South Africa, your credit score might drop for a short time. This is true whether it is for a loan, credit card, or something else related to money. The reason for this is that the check leaves what is called a “hard inquiry” on your credit record. Lenders know that you have applied for new credit if they see a hard inquiry. This could mean that you are at a higher risk financially than you were before.

A single credit check will, however, usually not have a big impact on your score and will only last for a short time. There is a chance that your score will drop by a few points soon after the inquiry is done. If you keep using credit well, though, your score should go back up over time, usually in a few months.

This is important to remember because the exact time it takes for your credit score to recover will rely on several things, such as your overall credit history and how many times you have applied for credit.

Usually, it takes about 1 year to 2 years for a credit score to recover from a credit check. Once the credit check is legit and there has not been a dispute, this can be part of your credit for not more than 2 years,

How many points does a hard inquiry affect credit score?

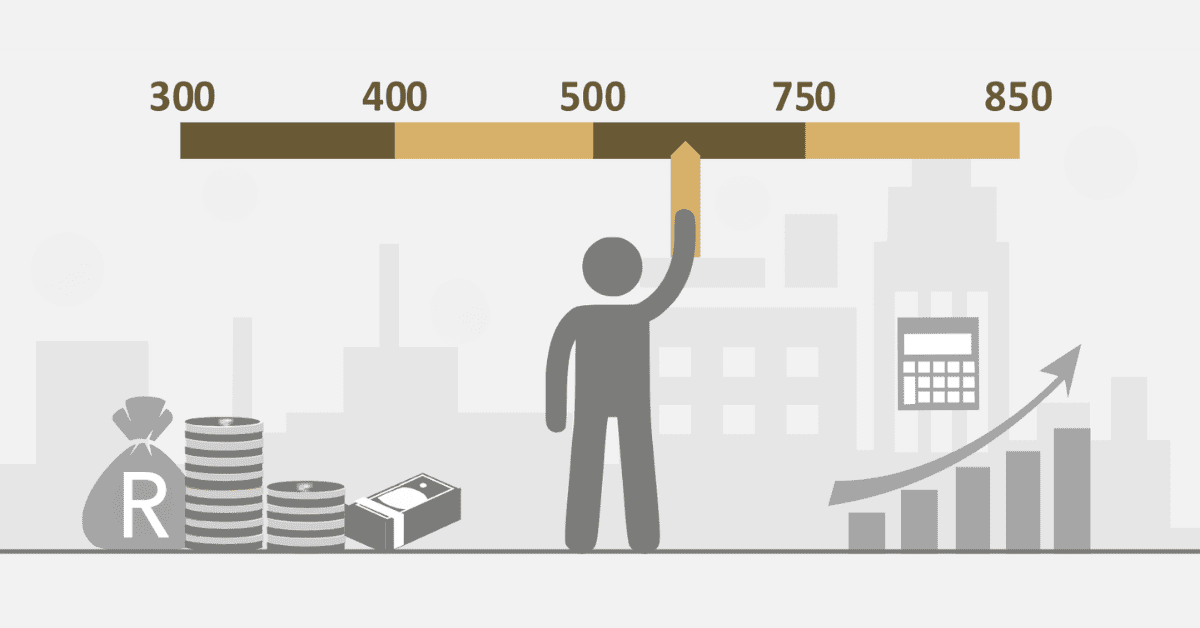

As we already know credit scores are built using points. Each activity has its own point and they are worked through percentages form. Some factors contributed to the calculation of the credit score

On the other side, these same factors when not checked well can cause you to lose some points. It is a way of ensuring people are disciplined and ready to make a commitment to their finances.

These accumulated points define your overall creditworthiness. In the sense that, should you apply for a loan, any lender who is ready to dig deeper into your credit must do a hard inquiry. This is to review your entire credit to know if you can back the loan on time and right.

A hard inquiry is considered to be a check that affects your credit score. Many people who are unfamiliar with hard inquiry do not know its effect on their credit score.

Certainly, hard inquiry affects your credit score by making you lose some points. These points, to some people, are insignificant, but have you thought about the number of points you could lose every day if a hard inquiry is done?

You could lose between 5 to 10 points from your credit score anytime a hard inquiry is done. However, these points can be determined by the amount, what the lender seeks and the loan process.

Based on past checks from some individuals, the most points one could lose after a hard inquiry is 10 points.

How many times can your credit be checked before it affects your score?

When it comes to hard inquiry, just a single check can make you lose 10 points. Once the lender requests to review your credit, it does affect your score about some points.

Too many inquiries on your credit may seem insignificant but multiple credit checks within a short period can greatly affect your score.

If a soft inquiry is done on your credit, you have nothing to worry about. You can do this as many times as you wish.

But when it comes to hard inquiry, multiple inquiries from different lenders on the same application affect your credit but not as compared to multiple credit checks done within a short period.

At least 1 hard inquiry can affect your credit score. It has to be only one before you can see the effect on your score.

How do I remove a credit check from my credit report?

Soft credit checks do not need to be removed as this does not impact your credit score. Only hard checks have an effect on your score.

Getting rid of hard inquiries from your credit report might sound like a good way to raise your credit score. There is a way to get rid of credit checks from your credit report. And here is how to go about it.

A real credit check can not be taken off of your credit record in South Africa.

You can dispute wrong information with the credit company, though. First, go to a credit bureau like TransUnion or Experian and get a free copy of your record.

If you discover a mistake on your credit report, you should get proof to back up your claim, like letters or records that show you did not approve the check.

Next, dispute the error with the credit bureau either online or by mail, making sure to include proof of the mistake. They will look into it and let you know the results within 20 business days. If it works, the credit check will be taken away.