When it comes to a company’s financial obligation and creditworthiness, the business credit score speaks more. The business credit score is a numerical representation of how financially disciplined a company may be.

There has been a significant emphasis on the role’s significance in securing favourable financial deals and partnerships in recent years.

As part of the evaluation process, various factors are taken into consideration, including payment history, credit utilization, and financial stability.

How can one build a business credit score? What actually is the business credit about? Join us as we take you through the composition and how business credit score is calculated.

What is a business credit score?

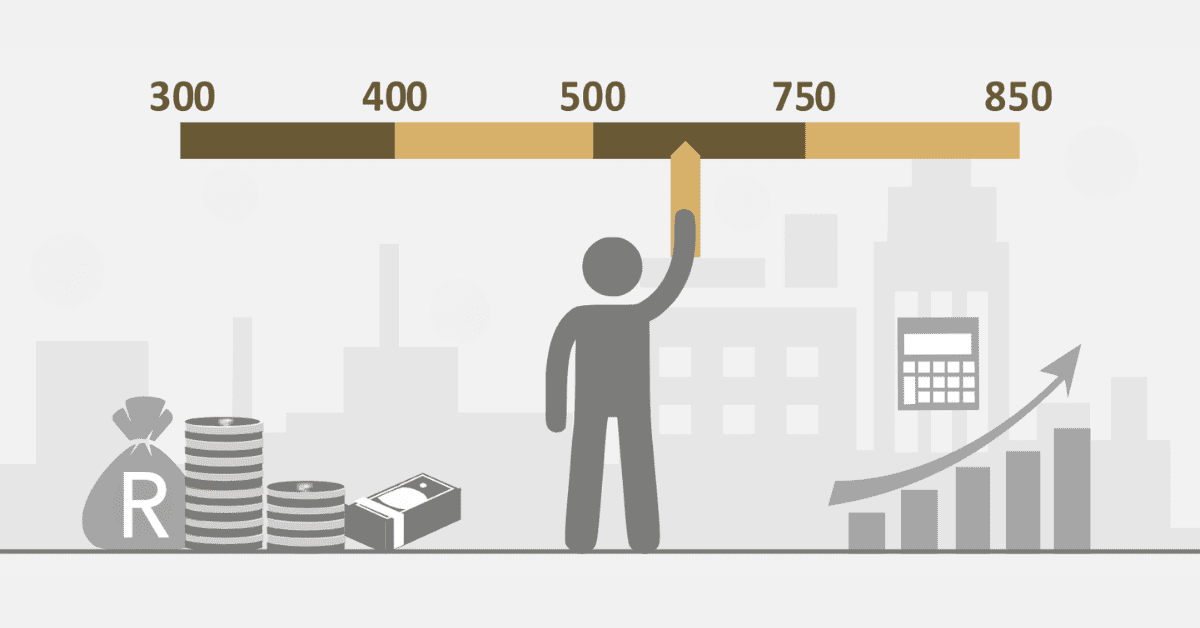

A company’s ability to pay its bills on time is reflected in its creditworthiness, which is quantified by a corporate credit score. A score between 0-100 indicates that the credit score range could be lower or higher. This score is based on a number of factors, such as the borrower’s payment history, the amount of credit used, and public records. It is a common tool for both lenders to assess the reliability of a loan and the likelihood of on-time payments.

To attract investors and build trust with potential partners, a company’s credit score must remain positive. A company’s creditworthiness can be enhanced and protected by effective financial management and regular monitoring.

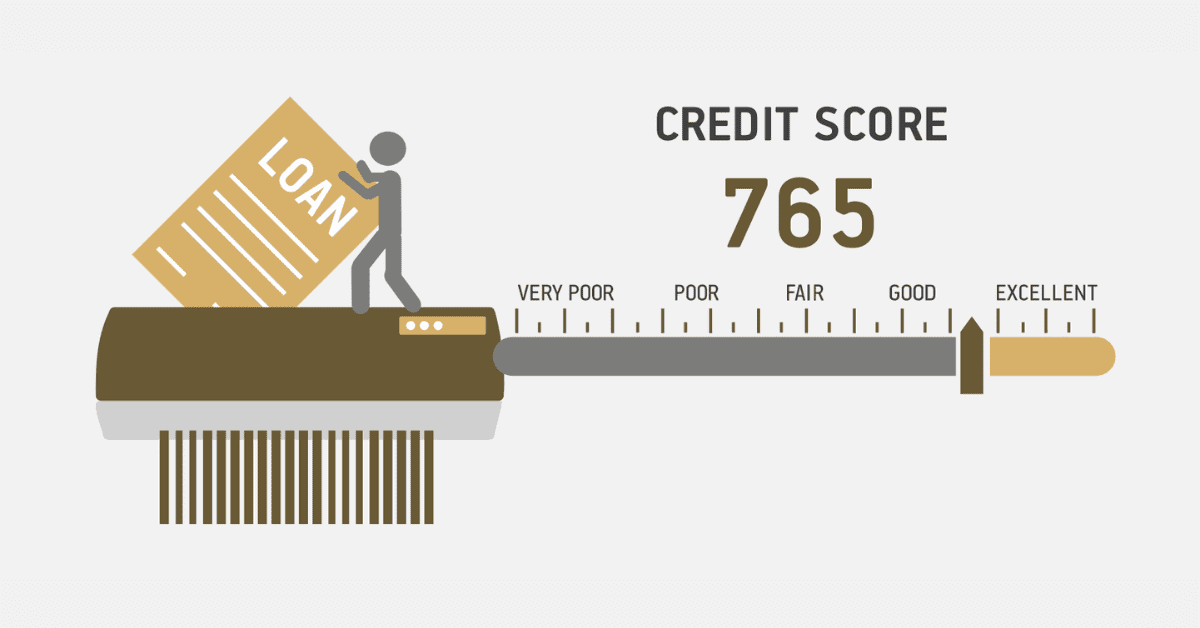

How is business credit score calculated?

A business credit score tells lenders how likely it is that a company will pay back its loans on time and not miss payments. Lenders use business credit scores to decide who can get loans and how much interest to charge. Scores for businesses range from 1 to 100. The bigger the number, the better a business is seen regarding credit.

Different credit reporting companies use slightly different methods to figure out a business’s credit score, but in general, they look at the following things. These things form the percentage value of your credit over a period of time.

- Payment History (35%): This shows how much you have paid for things on trade accounts. Making payments on time can help your credit score, but missing payments or defaulting on your loans can hurt it.

- Use of Credit (25%): This factor looks at how much of your available credit you are actually using. In general, a lower loan utilisation ratio is a good thing.

- Credit History Length (15%): Your score can be affected by how long your business has had lines of credit open. In general, having a longer credit background is a good thing.

- Bad publicity (10%): bankruptcies, unpaid taxes, fines, and other public records are all part of the public records and collections. Bad public records can have a big effect on your credit score.

- Credit Mix (10%): Lenders may look at the different types of credit accounts your business has, like company loans, business loans etc.

- New Credit (5%): Getting a lot of new credit in a short amount of time might be seen as a huge risk. Checking your credit and starting a new account at different times is usually a good idea.

How to build a business credit score in South Africa?

Building a business credit score in South Africa is not a straightforward process. Some of these steps are supplementary and can be complementary.

It is crucial to understand the rationale behind every action towards building your business credit. These steps, when done right, can provide you with immersive opportunities when it comes to building a good credit score.

Here are some tips to help you build your credit score in South Africa.

Monitor your credit score.

Many banks first offer firms money based on owners’ credit scores. Practice by paying bills on time and following payment terms to build credit. This prevents your credit score from implicating the company.

- Apply for credit shortly after starting your firm to start developing credit. A bank usually requires two years of business history before issuing a large credit line. You can avoid that by getting a small bank loan.

- Not having all your financial eggs in one basket can assist because banks can change lending rules overnight and decrease your credit limit. Try smaller banks instead. In smaller banks, you can talk to the individual who will put your loan package together and go to the board.

- Remember that traditional banks are not your only credit option. More possibilities are emerging, such as finding investors. Using other methods may indirectly boost your credit prospects.

- Business credit scores are calculated by numerous credit bureaus. Different lenders provide different data, and each business credit agency calculates scores differently.

- You should update your credit because you never know which credit bureau merchants, creditors, or new customers may check. You can submit financial statements and change business details like years in operation and personnel. More detailed profiles are preferable.

- All credit bureaus evaluate your history of paying creditors when calculating company credit scores, however their methodologies vary. Pay on time or early to improve your score.

- Banks report to credit bureaus, but negative credit usually precludes bank loans. Many online business lenders that lend to bad-credit applicants report to credit bureaus.

- Your company credit report will include bankruptcies, judgments, and your business’s payment history. Court judgments are rulings. A debt collection lawsuit loss will hurt your credit score. Negative ratings on your company credit report can harm you for years.

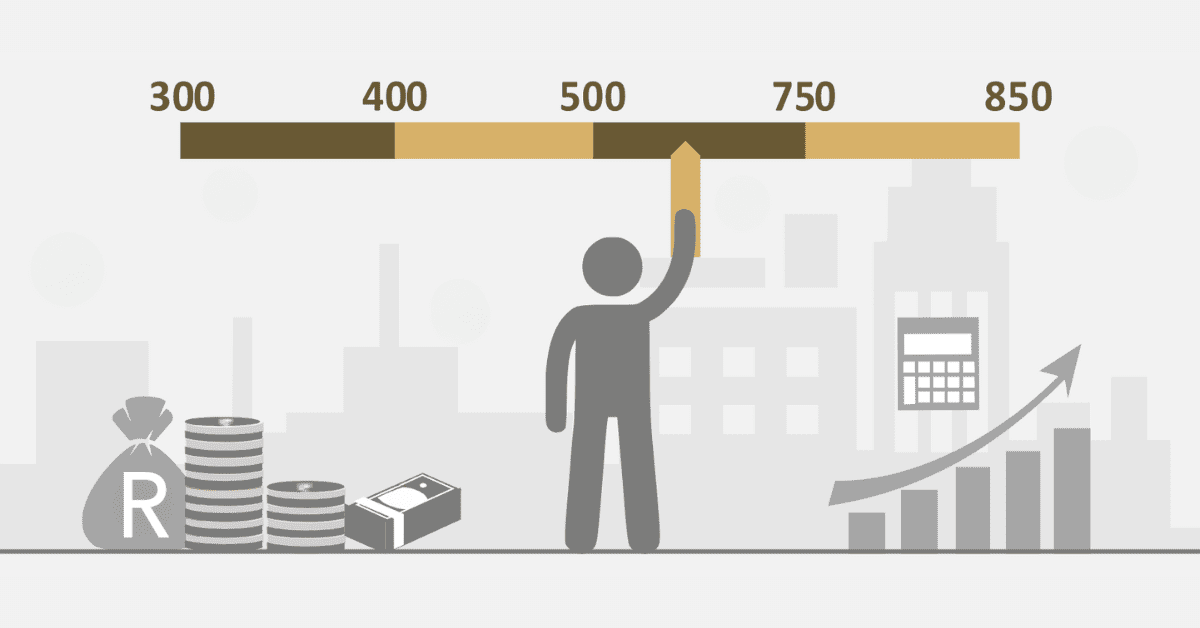

How long does it take to get a business credit score?

Getting a business credit score does not mean once you have a credit account, you are automatically in there. You need to get the information right from the initial stage to get your business credit score.

Once the discipline acts are applied, it could take a year or two to build a credit score.