In the developed world, where financial discipline is attributed to credit score, it is common for a lot to seek how to make things better for them.

Financial discipline does not just happen overnight and as such your credit score speaks a lot about your financial decision.

A lot of people ask certain questions about credit scores to ensure they are doing the right thing and at the right time. You need to get it right from the onset to keep your credit in good standing.

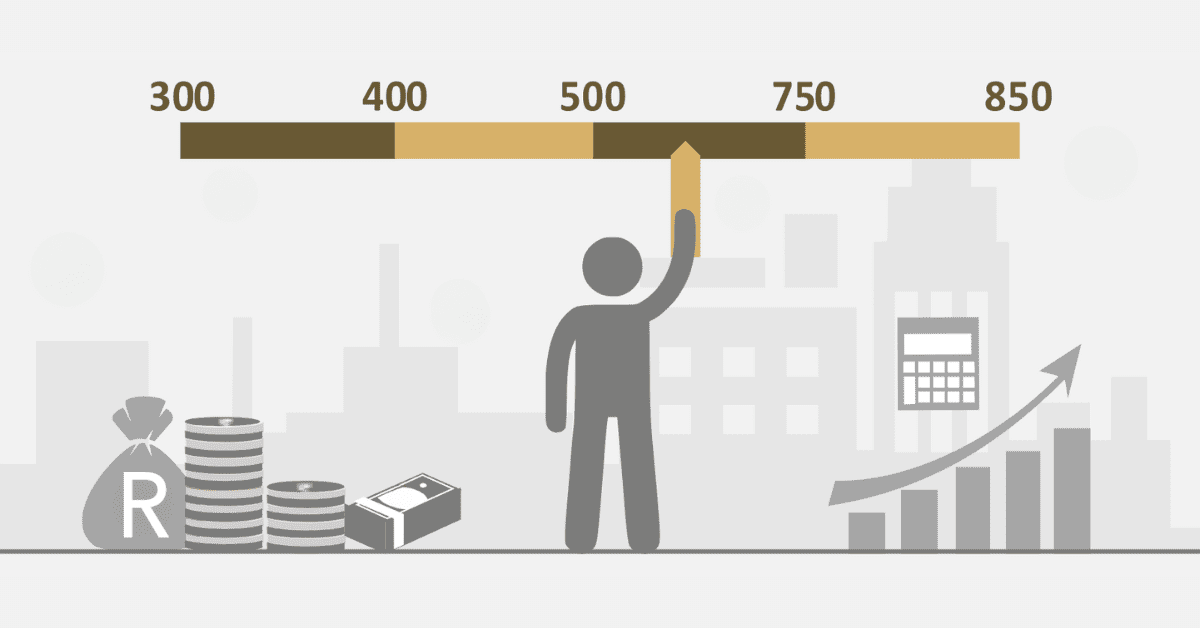

The credit score is all about numbers; speaking about how your finances have been over some time. And as this period elapses, your credit history keeps building.

These credit score ranges are calculated and developed using formulas. These formulas have constant variables. This means whatever decision is taken, these constant variables do not change but have a great influence on how your credit score may look.

Our focus is to enlighten, educate and inform our readers about positivity. And this includes ways to improve your credit score; it is all about making your credit score look good.

How fast can credit score improve

Your credit score is a crucial indicator of your financial well-being. It provides lenders with a quick overview of your credit usage and responsibility.

Having a higher score will increase your chances of getting approved for new loans or lines of credit. A higher credit score can also give you access to the lowest available interest rates when you borrow.

Keep in mind that establishing credit requires patience, as credit scoring models analyse your actions and account history over a period of time.

If you are looking to improve your credit score, there are several easy and effective steps you can take.

Although it may require a few months to witness an enhancement in your credit score, you can initiate the process of improving your score within a matter of hours.

- Avoid taking huge loans from the onset as this may push lenders to do a hard inquiry on your credit. Once there is a hard inquiry on your credit history, it affects your credit score. you may lose some previous points and should this be a continuous act, you may have your credit score looking bad.

- Having a significant amount of outstanding debt can have a negative impact on your credit score, but making timely payments to reduce it can help improve your score. Showing consistent debt repayments demonstrates your ability to effectively handle your financial obligations. It is advisable to pay more than the minimum instalments each month, even though it is not mandatory.

- Having a lower credit score reduces your risk. Consider closing any accounts that are not currently in use. Creditors evaluate the complete extent of your credit agreements, even if they are not currently being utilised.

- Instead of requesting creditors to decrease your credit limits, focus on reducing the difference between your outstanding balance and your credit limit. This is viewed favourably by the creditors.

How much can your credit score go up in a month?

Credit score increase does not happen overnight. There has to be a continuous conscious effort to improve your credit score.

Many people who are in despair and desperation are looking for ways to increase their credit in the shortest possible time. Well, even if it is a month, you can never push your credit score up the way you desire.

Realistically, there is no specific amount an individual credit score can go up in a month. Your credit score could increase by 50 or less in a month, and this depends on how you work towards improving your credit score.

How do you fix bad credit?

Although certain measures may not apply similarly to everyone the information shared covers the majority. This will give you an insight into how you can fix bad credit.

- To improve your bad credit, begin by acquiring your credit report from major credit bureaus. Check it for mistakes and challenge any incorrect information. Develop a practical budget to effectively handle your finances, with a focus on paying off debt. Discuss payment plans or settlements with creditors, and think about consolidating debts with high-interest rates.

- Make sure to make your payments on time for your existing accounts in order to establish a positive payment history. Ensure you never miss a due date by setting up automatic payments or reminders. It is important to keep your credit card balances below 30% of the credit limit in order to have a positive impact on your credit score.

- If you want to establish positive credit, you might consider opening a secured credit card or becoming an authorised user on someone else’s account. It is needed to exercise caution when applying for new credit, as multiple inquiries can have a negative impact on your credit score. Consult with credit counselling agencies for personalised guidance from experts.

- Enhancing your credit score requires patience, self-control, and steadfastness. Make sure to keep a close eye on your credit report, stay on top of your progress, and remain dedicated to maintaining good financial habits. With time, practising responsible financial behaviour can help you rebuild your credit score.

Will my credit score increase if I pay off a loan?

The credit score does not automatically increase after paying off a loan. First of all, we have to understand the type of loan, the payment period and the amount involved in this.

These are key indicators towards your credit score.

Ideally, your credit score will not go up after paying off a loan. Your total debt, credit mix and all these influence whether your credit score will increase after paying off the loan.

If you are concerned about this, remember, that it may take a couple of weeks to months before your credit score could increase after paying off a loan.