If you believe yourself to be fully tax compliant and have paid overall monies due to SARS, it can be a shock to find out they don’t agree! In many cases, this happens not because you do owe money but because an error on the payment reference or another simple error has caused your received payment to go unallocated on the SARS system. Today we break down unallocated payments further, so you can better understand and remedy them with SARS.

What do Unallocated Payments Mean?

Unallocated payments simply mean SARS have a record of a payment made into your account which they cannot trace/attach to the tax return or liability it was meant to address. This can occur when you pay into the incorrect SARS bank account accidentally or when you use the wrong reference number on the payment. It can also happen in cases where you double pay for a specific return, and the obligation is fulfilled twice, leaving you with ‘extra credit’ on your account.

Or if you made an error in their favour about the amount due. This often occurs when handling payroll and PAYE obligations. Being meticulous with accounts used and references will prevent unallocated credits from occurring for the most part. Try not to be rushed when calculating amounts like PAYE, UIF, and more, too, so silly mistakes or small errors do not occur.

How Does SARS Allocate Unallocated Payments?

Will SARS allocate unallocated payments without your input? In most cases, they simply don’t! Or rather, they can’t. This is because SARS can only work with the information you provide to them. If they cannot match up a received payment to the information provided on the reference, they will not be able to match it to the relevant return.

Don’t panic, however. They will not simply ‘lose’ your payment. Instead, it will be allocated to your account as an ‘unallocated credit’. These will usually show on your account statement, so it is worth regularly checking these. This does mean that the return or tax type it was meant to pay will still show as due on the system and may be attracting interest and penalties due to the payment not being allocated correctly. Luckily, in most cases where you make SARS aware of the error and assist in allocating the payment correctly, they will roll back penalties or interest to the date the payment was made- if it was made in time, they will often be obliterated altogether.

You may feel like it is silly for them to not automatically allocate ‘obvious’ issues. If you have a R250 return to pay and R250 credit in your account, it should be obvious, right? Why continue to show R250 outstanding with a R250 credit? However, we wouldn’t want them to do that, as it would introduce considerably more mistakes and errors to the system and even potentially allow for fraudulent behaviour on their side. Remember, too, that people will pay certain tax duties in increments- like paying provisional tax

So they can’t just assume what an amount is meant to do on your account. While the process can be annoying, it is better to wait for you to give clear instructions on where the payment is meant to reflect. This lets you retain control of your financial affairs all the way.

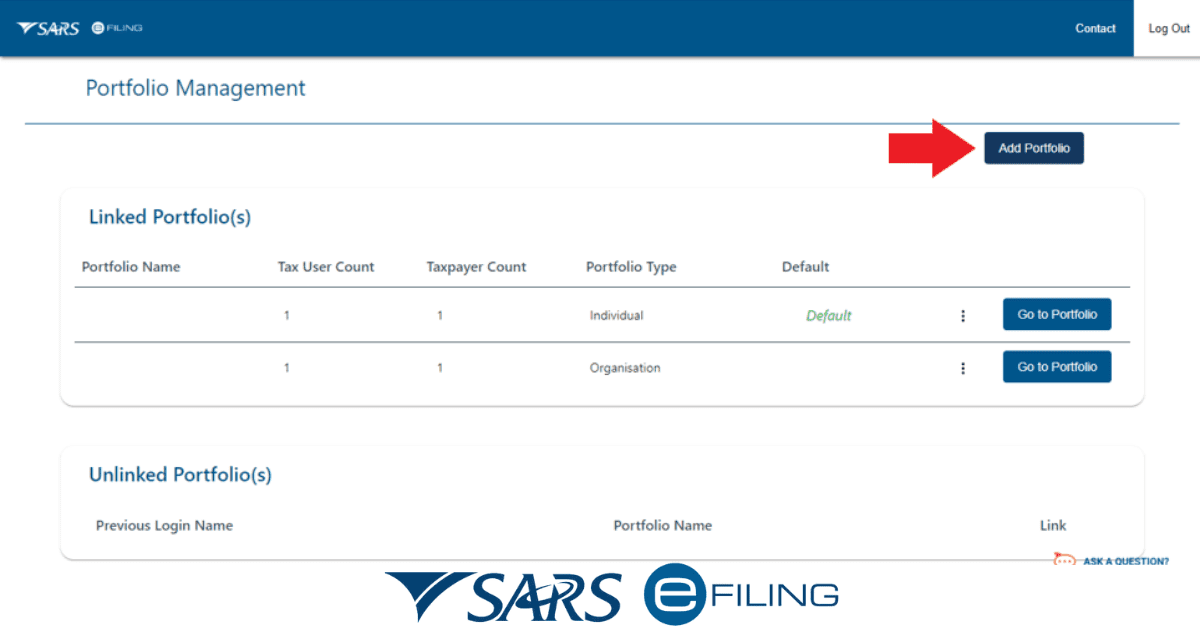

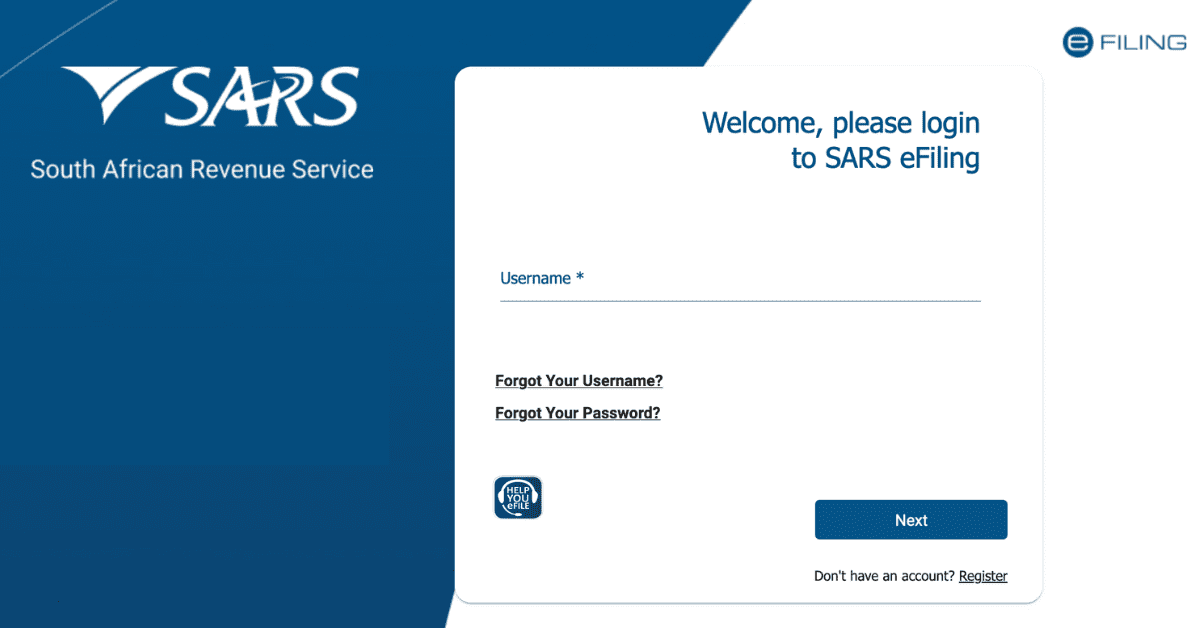

How do I Allocate Credits on eFiling?

You can allocate many unallocated credit balances via the eFiling platform. Should you not have any luck with this, you can also contact the SARS Call Center and give them instructions on what to do with the unallocated balance.

From your eFiling account, most individual taxpayers will find their unallocated credit under the ‘Tax Credits’ tab on the system. This can look different for Tax Practitioner and Organization profiles and may also depend on the version of eFiling you are using.

To allocate a credit, click on the credit you would like to allocate. This will take you to a screen where you can select the tax type and tax period to which you would like to assign the credit. Once you have selected the tax type and tax period, click on the “Allocate” button to confirm the allocation. The credit will then be applied to your account and reflected on your tax returns.

Of course, you can only allocate credits to tax types and periods for which you have an outstanding tax liability. Mostly this is logical, as most unallocated payments refer to a specific tax type that has been missed. In the event you have accidentally overpaid; however, this may give you credit you can assign to newer tax liabilities, either in full or part payment of the new amount due.

How do I Arrange Payments with SARS?

If you cannot meet your financial obligation for a tax type all at once, you can request a payment arrangement from SARS. You can propose payment arrangements online using the SARS eFiling platform. Apply for a payment arrangement with them through the offered tab, giving amounts, months, and dates you intend to pay. They will then deny or approve the arrangement.

When you make payments to SARS, ensure that you have the correct tax reference number and that your payment is for the correct tax type and period. Also, ensure you understand what bank account to pay into. This will significantly reduce your chances of creating an unallocated payment and having to reassign it later.