At some point in life, we all need to access credit or loans to make major purchases or cover different things. Most lenders are financial institutions, and they use credit scores to determine if one qualifies for a loan. Therefore, it is important to understand how the credit scoring system functions and affects interest rates before applying for credit. Read on to learn how your credit score affects your interest rate.

How Does Your Credit Score Affect Your Interest Rate?

First and foremost, it is crucial to understand that lenders are in business, and they charge interest on money borrowed to generate profits. When you borrow money, the interest you will pay varies depending on factors such as your creditworthiness and the type of credit or loan you intend to get. This is when credit scores come in handy to help lenders determine the interest they can charge on any amount borrowed.

The lender will consider you a high-risk borrower if you have a low credit score, and they will charge you a high interest rate. In contrast, individuals with high credit scores could get lower interest rates because they are viewed as low-risk borrowers. The business of lending money is risky, so financial institutions charge interests to protect their interests.

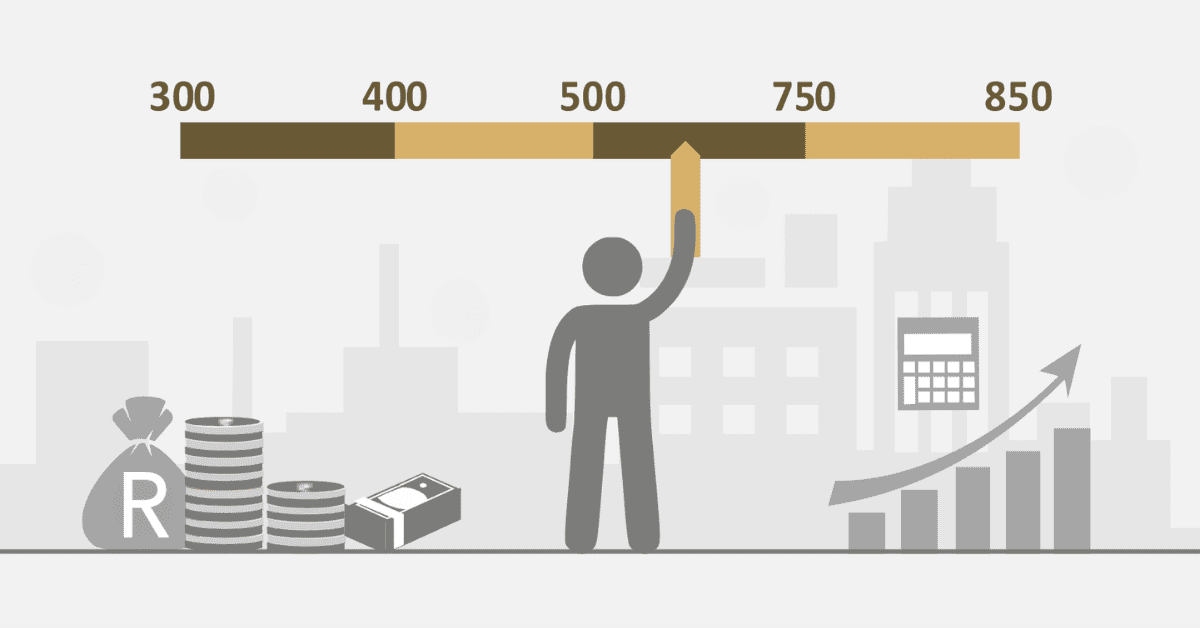

Some people have a habit of not paying back even when they borrow from their friends and relatives. Borrowers are strangers to lenders, and this is where the aspect of credit score comes into play. A credit score is a numerical value that represents your previous credit behavior, and it is shown in figures ranging from zero to 900 in South Africa. A lower credit score denotes that the borrower poses high risks and is likely to be charged a high-interest rate if their loan application is approved. A higher score shows that one is creditworthy and they will receive a favorable interest rate.

Since borrowers are strangers, lenders set interest rates based on the applicant’s credit score to determine the total amount they will repay once the loan application is approved. If your credit score is bad, you need to improve it first before you apply for a loan. Other factors that can also determine interest rates include the borrower’s income-to-debt ratio, income earned by the applicant, and stable employment.

Why Your Credit Score Is So Important as Interest Rates Rise?

If your credit score is low, you are likely to be charged higher interest because you pose high risks to the lender. To ensure they will recover their money, the lender will levy a high-interest rate on approved loans. Boosting your credit score can significantly lower the interest rate you are charged when you borrow money from different lenders. As a result, you can save a lot of money if you are charged a lower interest rate based on your credit score.

How Your Credit Score Impacts Your Financial Future

Your credit score affects almost all facets of your life and financial future. To make a big purchase like buying a home or a car, you will need financing in the form of a loan. Financial institutions like banks are responsible for offering loans to applicants. You may also need a personal loan to cover different things, and you can get it from small lenders.

Whether you want an auto loan, business loan, or personal loan, the chances of approval of your application are determined by your credit score. It is easier to get a loan with a high credit score. Conversely, your loan application is likely to be rejected when you have a poor credit score. Furthermore, a bad credit score also attracts high-interest rates.

A good credit score can open new job opportunities. Some employers view a good credit score as a symbol of responsibility. Other job tasks come with a lot of responsibilities, and a high credit score is used to measure your level of financial discipline. A good credit score can help you get a promotion at your workplace.

When looking for property to rent, potential landlords will check your credit score to see if you are reliable and capable of paying your rentals. A poor score can make it difficult for you to get property to rent.

Most service providers offer quotes for different packages commensurate with one’s credit score. For instance, cellphone providers first conduct credit checks before approving your account. If you have a good borrowing history, you’re likely to get a fair deal with a reduced deposit for a new account, lower prices, and other incentives. Insurance companies also offer lower insurance premiums to clients with good credit scores since they pose less risk. With a bad credit score, an insurer may charge a high premium for fear that the client can make a costly claim to the company.

What Interest Rate Is Considered Bad Debt?

The South African Reserve Bank (SARB) pegged the interest rate at 8.5%, and it has remained unchanged for some years now. However, due to inflationary forces experienced in the economy, some financial institutions have increased their interest rates. However, this has affected many debtors. As a result, most lenders have recorded a significant increase in bad debts. Therefore, any interest that exceeds the current rate mentioned above can be considered bad debt.

What Happens to Interest Rates When Your Credit Score Is High?

When your credit score is high, you qualify for lower interest rates. Individuals with high credit scores have consistently shown that they are capable of repaying their debts, so they do not pose any risk to lenders. Lenders are concerned about minimizing risk in their operations, so they prioritize someone with a good credit history. To continue enjoying lower interest rates, you need to maintain your high credit score. You can achieve this by paying your debts and bills on time and disputing errors on your credit report.

Your credit score shapes your financial future in several ways. With a good score, you will receive lower interest rates from lenders. A poor credit score attracts high-interest rates due to the risk posed by the borrower. To achieve financial success, you need to maintain a high credit score by paying your bills on time, avoiding unnecessary debt, and checking your credit reports.