Choosing the appropriate automobile loan can be daunting since the process involves several things. Before applying for a car loan, you must do your research first and set a realistic budget to safeguard your credit score. If you approach several car dealerships within a short period, they are likely to make hard credit checks on your credit score, which will harm it. Like other lenders or providers of credit lines, a car dealership will check your credit to ascertain if you can afford to pay off your debt. Getting a credit extension in South Africa solely depends on your credit score.

How Does a Car Dealership Check Your Credit?

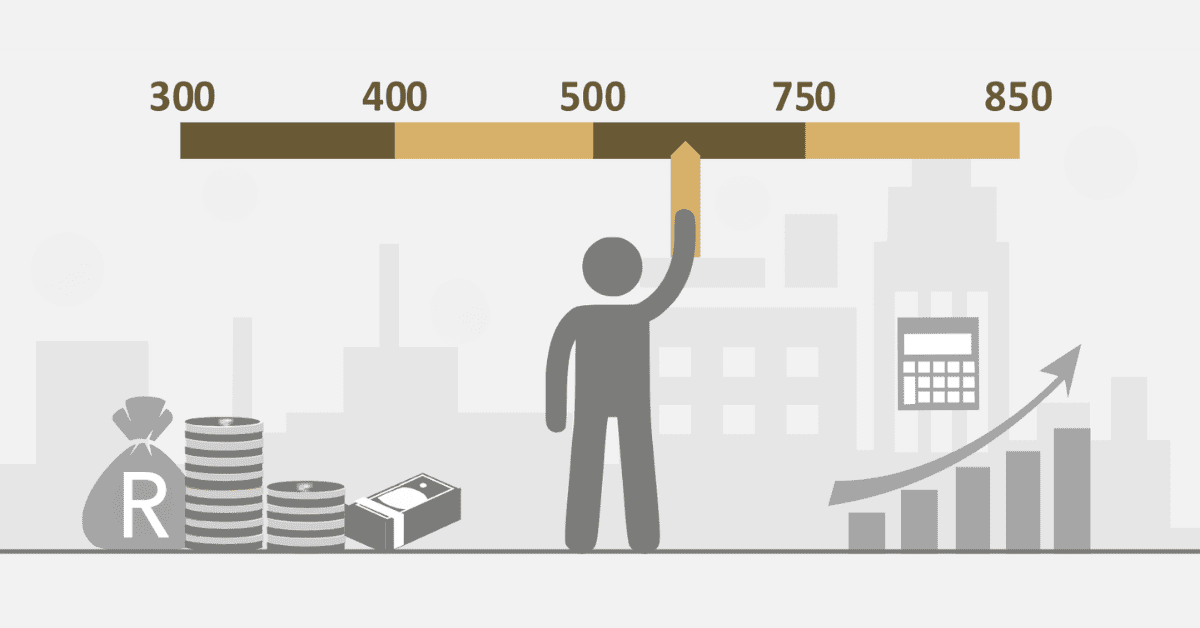

Car dealerships work with different credit bureaus to assess a potential client’s creditworthiness. Credit bureaus use different scoring methods and this is why the credit score for one individual may vary from one bureau to the other. Most car dealerships prefer the FICO scoring model because it is believed to be comprehensive. FICO scores are believed to be accurate, and they can be used to predict if the potential borrower is capable of repaying the money. A FICO score of between 580 and 669 is believed to be fair for obtaining an auto loan.

On the other hand, the VantageScore model is another popular model used by car dealerships to determine if the potential customer is capable of paying back the loan. To calculate a VantageScore, credit bureaus consider variables of payment history, like late payments, missed payments, credit utilization, duration of credit, and amount owed. A VantageScore of about 670 is acceptable for a car loan.

What Is the Lowest Credit Score to Buy a Car?

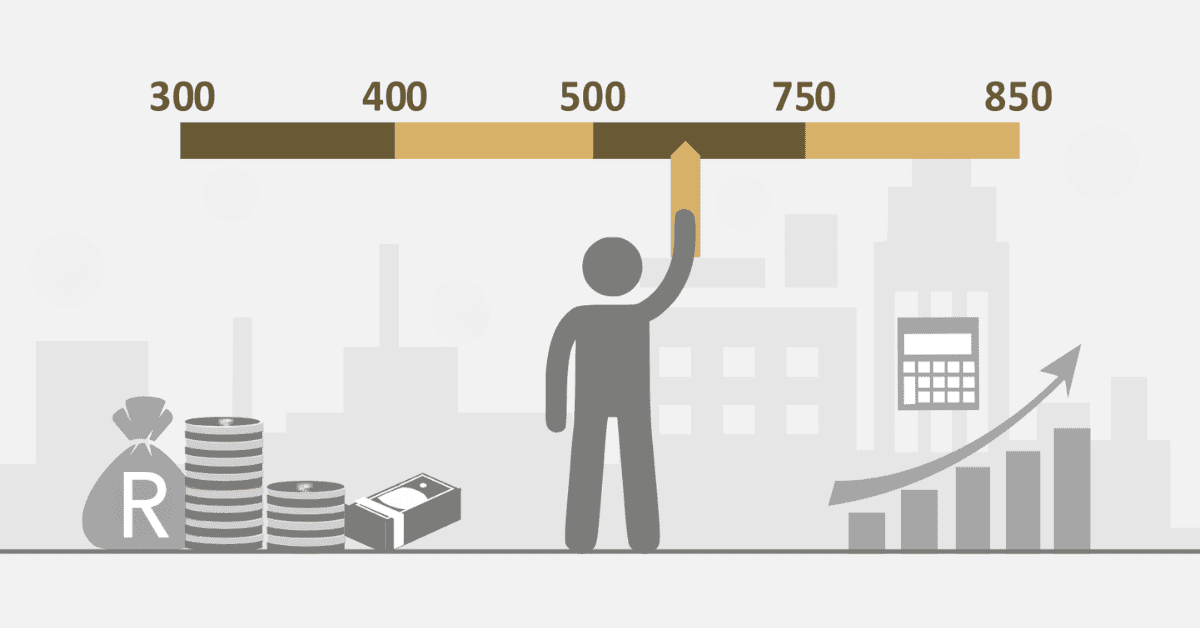

The lowest credit score to buy a car is determined by the credit scoring model used. A FICO credit score ranging from 580 to 669 is believed to be fair, and a car dealership is likely to consider your application. With a credit score above 670, you will automatically qualify for an auto loan. The lender will see you as less likely to default on your payment. Credit bureaus use different credit scores including the following:

- 800 +: Exceptional

- 740 – 799: Excellent

- 670 – 739: Very good

- 580 – 669: Good

- 579 & below: Poor

If your credit score is above 580, the car dealership is likely to consider you for a loan. Therefore, strive to improve your credit score so that it can be above 670 to qualify for any auto loan you may need.

How Many Points Does Your Credit Drop When Applying for a Car?

When you apply for a car loan, the lender will make a hard inquiry to check your credit score. Although a hard inquiry can affect your credit score, the impact is insignificant. Your score may drop by one to five points. This minor change does not severely impact your credit score, so no need to worry.

How Long Does It Take To Get a 600-Credit Score?

Building credit from scratch may be daunting since the process involves several things. A credit score of 600 in South Africa is believed to be good, but a higher score is better since it comes with several benefits. If you are new to the world of credit, it can take you a minimum of six months to build a credit score of 600.

First and foremost, you need to open an account with a shop like Edgars to begin your journey of building your credit score. Make sure you pay up your account every month and avoid late payments. The next move you can consider is to get a credit card. Remember, a credit card requires discipline, so it is important to start small, and then gradually increase your credit balance. Make timely payments and pay your balance in full to boost your credit score.

The following are the factors that contribute to your credit score you should know.

- Payment history involving consistent and on-time payments contributes 35% to your score.

- The amount owed contributes 30%.

- Duration of credit score (15%).

- New credit contributes (10%).

- Credit mix (10%).

As long as you have proof of making timely contributions, lenders will regard you as less risky. People who demonstrate responsible behavior when it comes to the management of credit quickly gain the trust of lenders. As a result, your credit score will gain a significant boost if you maintain the momentum of keeping your account up to date.

When you are in the process of building your credit score, you should maintain a lower debt-to-income ratio. Instead, it is recommended to avoid having several debts when you are still a novice in the world of credit. No matter you are still building your credit score, missed payments will go on your credit report. Be sure to make informed decisions and avoid activities that can derail your progress in building your credit score.

To obtain a car loan, you should fulfill certain conditions. Most car dealerships are guided by your credit score to determine your eligibility to get a loan. Knowing the appropriate credit score to buy a car can go a long way in helping you plan to get the best deal. Improving your credit score can give you an added advantage when you decide to apply for a car loan.