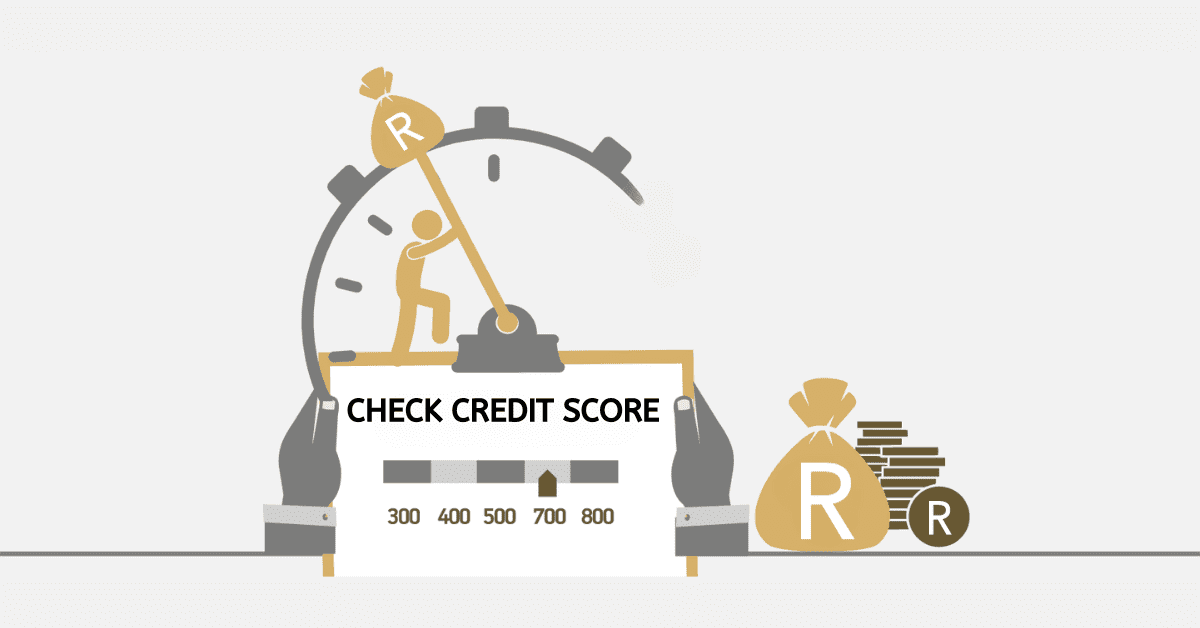

Securing a loan with a credit score comes at an easy pace and becomes better with a good credit score. But what happens if you want a loan but with no credit score?

Loans are offered based on your overall income, assets and ability to pay. While these are important, your ability to pay a loan can be determined by your credit score.

It is always important to take note of your credit score to boost your chances of securing loans.

In the case where one wants to get a loan without a credit score, he or she may have to find other means to inform lenders about his creditworthiness.

In this blog post, we will take you through how a loan can be obtained without a credit score. We will delve into more topics on the absence of credit scores and its effect on securing a loan.

How Do I get a loan Without A Credit Score?

It can be quite challenging to find a lender who is willing to lend money if you have little or no credit history.

Not having a credit history can pose a challenge when trying to qualify for a loan. If you lack a credit history, it indicates that you have not engaged in any borrowing or credit card activities, resulting in a lack of information that can be reported to the three major credit bureaus: Equifax, Experian, and TransUnion.

In this situation, it is important to locate a lender who considers factors other than just your credit score when determining your eligibility for a loan. These factors may include your income and employment history.

Obtaining a personal loan without a credit history can be challenging, but it is still within reach. Here are a few ways to secure a loan with no credit score.

- Research lenders: It is important to compare multiple lenders to find the loan that best suits your needs. Begin your search for lenders who do not impose a minimum credit score requirement or who are open to the option of having a cosigner. Having a cosigner can greatly increase your chances of getting approved for a loan. A cosigner is an individual with good credit who takes on the responsibility of repaying the loan if you are unable to do so.

- Prequalify: Take the first step to find out if you qualify with lenders by prequalifying with them. Prequalification provides an estimate of your eligibility without negatively impacting your credit score (if applicable). However, it is important to note that this is not a credit offer, and not all lenders provide the option to prequalify before applying.

- Compare lenders: Compare the annual percentage rates offered by different lenders to determine which one offers the most affordable borrowing options. It is necessary to take into account the repayment terms and loan amounts you may be eligible for, along with the funding times, fees, and potential discounts. Keep in mind that if a lender imposes an origination fee, the loan proceeds will be reduced accordingly, resulting in a lower amount than what you initially requested.

- Select your loan option: After evaluating different lenders, opt for the loan that aligns with your specific requirements.

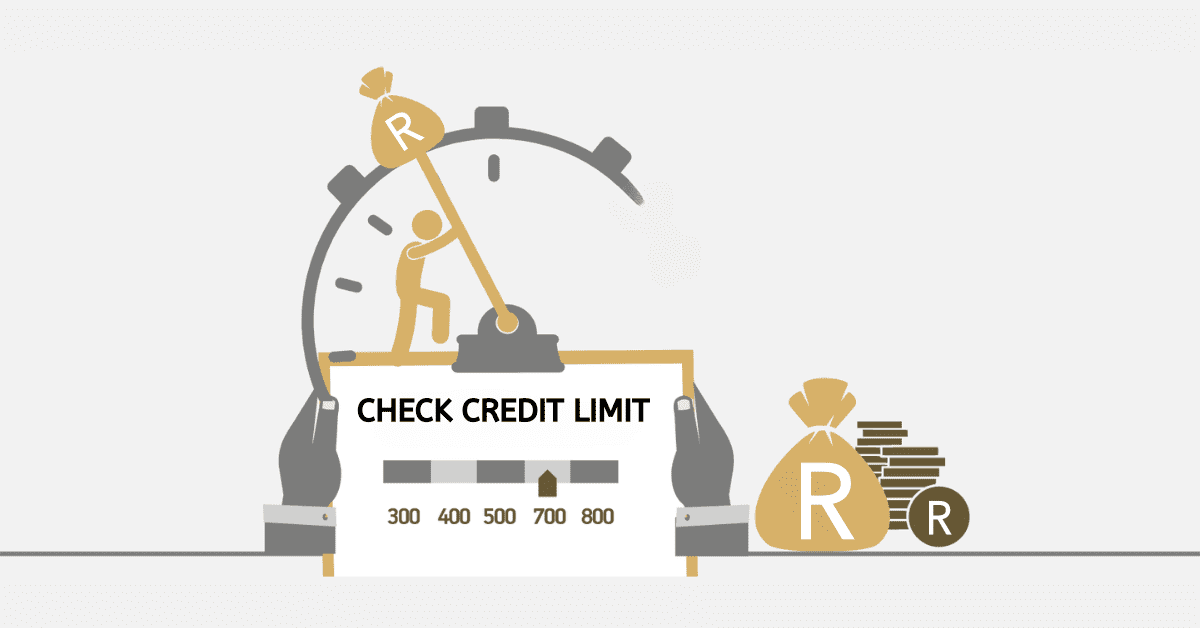

How big of a loan can I get with no credit score?

What is considered a big loan in the first place? Big loans can be very relative considering the income levels and loan application criteria for each individual.

A big loan could be personal for an individual and having a fair amount in mind could help you prepare.

Securing a big loan with no credit card is a big risk for lenders and can be extremely difficult. With a well-valued item or property, one can get a big loan from a lender. That item or property will serve as collateral in processing and securing the loan.

Why is no one approving me for a loan?

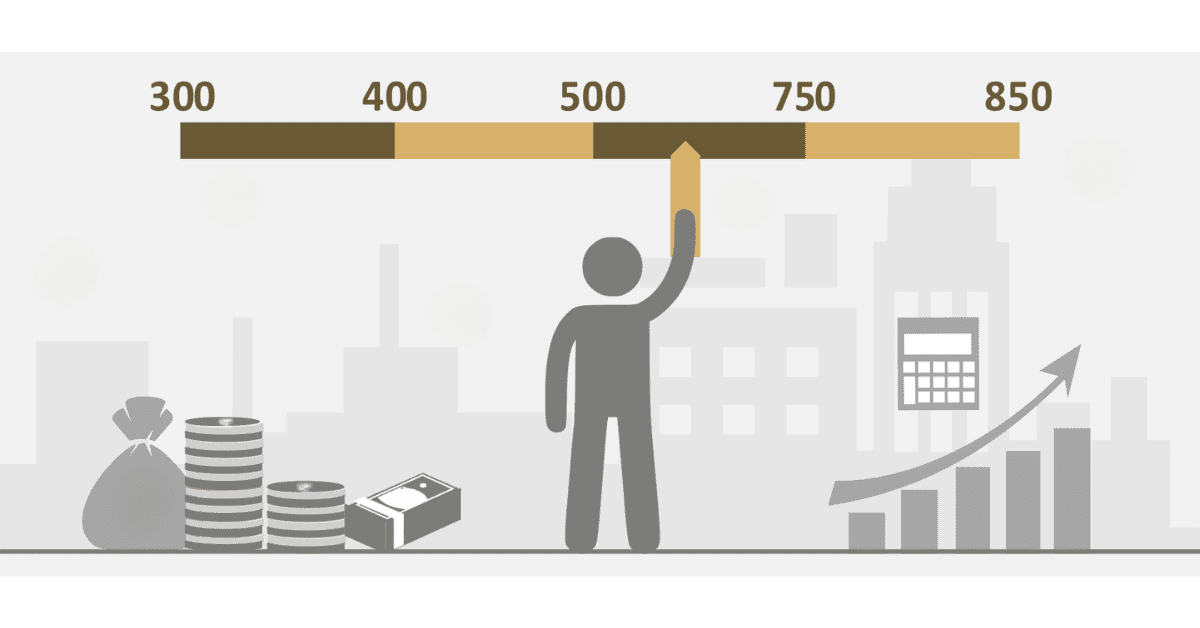

Various factors may delay the approval of a loan, including a low credit score, inadequate income, a high debt-to-income ratio, and the absence of collateral.

Additional factors could be a track record of delayed payments, a short credit history, or recent instances of bankruptcy.

In addition, factors such as inconsistent job history, insufficient paperwork, or requesting a loan amount that exceeds one’s ability to repay can lead to loan rejection. Every lender has their own set of criteria, and various factors or even just one significant issue could lead to the rejection of a loan application.

What is the easiest government loan to get?

There are a lot of government loans in the system but one of the easiest to get is a business loan. In every economy, the government finds it deemed fit to secure businesses by supporting them with loans. And as such, the process, although may be cumbersome, it is a matter of providing the needed documents for the funds.

The easiest loan one can get is a business start-up or business growth loan from the government.