According to the credit bureau TransUnion, when someone gets married, it does not necessarily mean that their credit score is automatically combined with their partner. If you have poor credit and marry someone with a good score, your joint loan application can be affected somehow. Therefore, there are certain aspects about credit score that you should know before tying the knot. This article explains everything you want to know about how credit scores work for married couples.

How Do Credit Scores Work for Married Couples?

When you marry someone, your credit score remains yours. Credit scores are not merged upon the consummation of your marriage. If one has a high credit score and the other has a low score, their scores remain separate. However, when you decide to apply for a joint credit card or loan, the aspect of credit score comes into play.

The lender will consider each partner’s credit score and income. If one of the partners has a bad credit history and a lower credit score, your loan application might be declined. If you are lucky to get approval, you may not get favorable terms. For example, you may be charged a high-interest rate because the other partner is regarded as a high-risk borrower due to their negative credit history.

If you want to apply for a loan as an individual, your marriage contract will not affect your credit score rating and the outcome of the loan. However, the responsibility for the loan is shared equally between the partners married in a community or property. The lender can legally recover the money from your spouse even when you applied for the loan alone. The primary loan holder will be responsible for repaying the debts if you have an ante-nuptial contract. Therefore, make sure you understand the effects of credit scores before applying for a joint loan.

Can I Buy a House if My Spouse Has Bad Credit in South Africa?

While your partner’s negative credit history does not affect your credit score, the lender considers both scores if you want to obtain a joint loan to buy a house in South Africa. Couples married in a community of property can apply for a joint bond to purchase a home, but if one has a bad credit score, the application may not be approved. If you get approval, you are likely to get high-interest rates. In case of default on your loan repayment, the lender will recover the money from the other partner.

How Is Credit Score Calculated for Married Couples?

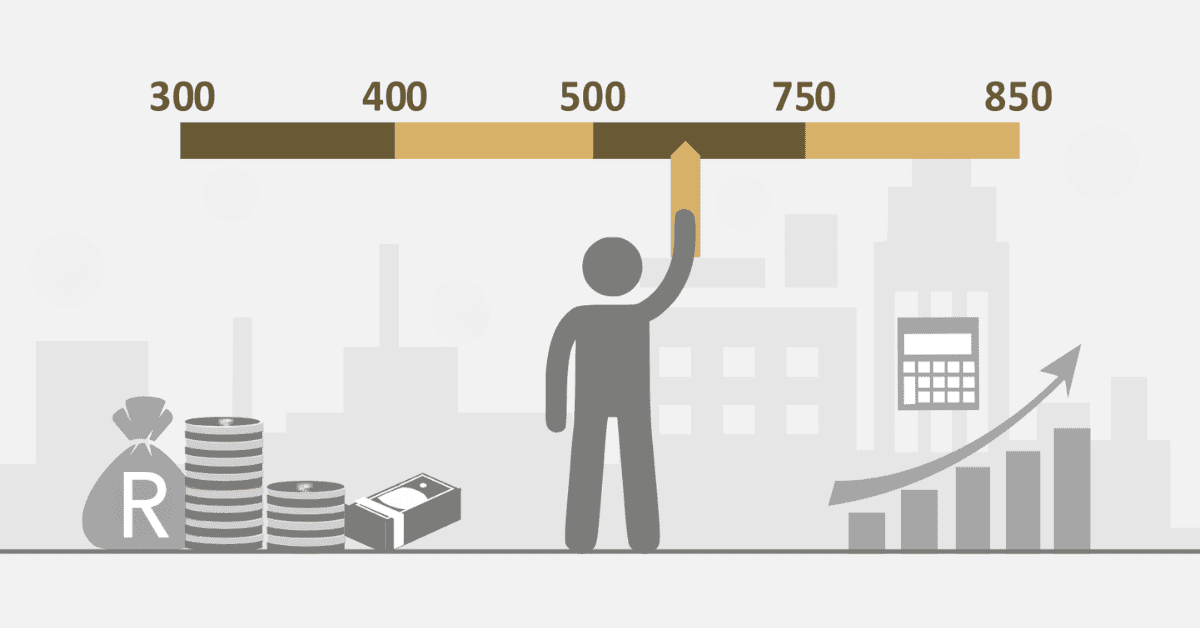

A credit score is a figure that reflects your credit history in the past. The credit bureau uses your credit report to calculate your score. There is no joint credit score for partners since each individual has their own. Your credit score is used to determine your creditworthiness as an individual, not as a couple.

A registered credit bureau calculates your credit score by compiling your credit transactions and considering the following transactions.

- Your credit history and amount owed.

- Duration of your credit accounts.

- The number and types of credits you have applied for.

- Your current credit utilization.

- Details about bankruptcy, default in loan repayment, or judgment.

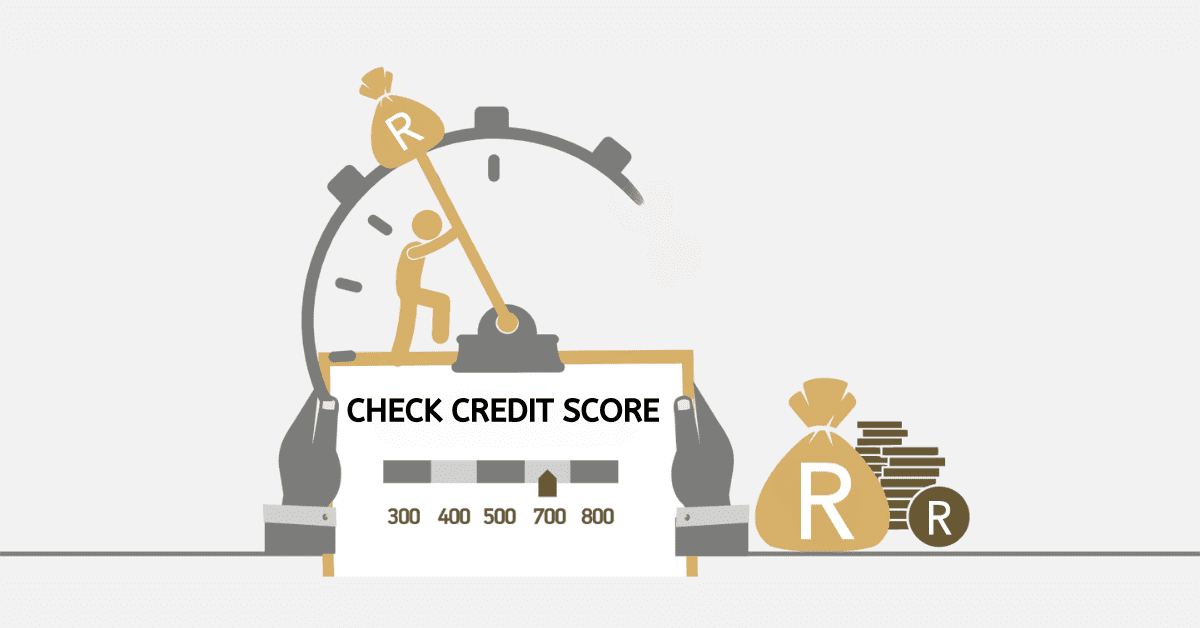

Having good credit scores as a married couple is good, especially when you want to apply for a joint loan to purchase a home. A good score will help you save money in the long run due to the favorable interest rate you will receive from the lender.

Do Married Couples Have Their Own Credit Score?

Yes, married couples have their credit scores. Your scores are not merged when you get married. You can apply for a loan as an individual, and your marriage contract will not affect the application. However, for partners married in a community, the other one will be responsible for the debt if the primary account holder fails to meet their obligations to repay it.

When your partner has a low credit score, it will not impact negatively on yours. However, if you intend to apply for a joint loan, the lender will consider both credit scores. The negative credit score owned by the other partner is likely to affect the outcome of the application or the interest rate charged.

Will My Bad Credit Affect My Partner if We Get Married?

No, your marriage has nothing to do with your bad credit, and it does not affect your partner’s bad credit score. Your bad credit can only affect your partner when you decide to apply for a joint credit card or loan to buy a home or a car. The lender will consider both of your credit scores to see if you are a reliable couple capable of repaying their loan.

There is a chance of the loan application being rejected if one of you has a negative credit history. You may also be charged higher interest as a result of the risk posed by the other partner. If you default on repayment of a joint loan, the judgment will show on both credit scores. In such a scenario, your good credit score will be negatively impacted by the judgment. Before you apply for a joint loan, it is essential to consider the consequences of your credit scores on the outcome.

In South Africa, when two people enter into a community or property marriage contract, their union will not impact the other partner’s credit score. The only time your credit scores are checked together is when you apply for a joint loan. You also need to know that you will be responsible for a loan applied by your partner when you are in a community marriage contract. If you are in a different partnership, the primary account holder will be responsible for repaying their debts.