Having a good credit score will unlock many financial doors for you. Even if you diligently try to live within your means and only make cash purchases, there will be times when you need a helping hand. In particular, most people will need to use financing to afford a mortgage for their home, and it will come in useful for many other things. It all starts with your credit score- but few of us even understand what that is! Luckily, you have us to help. Today we will be diving deeper into credit scores and how they are calculated in South Africa. It’s time to take control of your financial future.

How is Credit Score Calculated in South Africa?

Few things are as mysterious to the normal soul as how credit scores are calculated. In South Africa and globally! Sometimes it may seem like they just make everything up, but that isn’t the truth. We promise!

Credit score calculation seems muddy because no two people are the same, and a myriad of factors go into your score. So two people who seem alike can have vastly different credit scores. At the end of the day, however, it boils down to how well you handle the credit you have, how much in debt to that credit you are, and how well you pay. Remember that the credit bureaus don’t look just at the present, either. They will consider your behavior over time and what it says about your lending health.

Let’s reiterate the ‘lending’ part there. Credit scores only look at how well you behave with credit. They don’t consider external factors, like assets or cash in the bank. Someone could be very healthily positioned financially and still have a poor credit score if they haven’t used much credit over their lifetime. Why? Because there’s no proof they can use credit well. Those millions in the bank might disappear and leave the lender holding the bag. It’s not the fairest system in the world, but it is a facet of how we do business in the 21st century.

According to our most respected credit bureaus in South Africa, two factors impact the calculation of your credit score the most. That is payment history (35%) and credit use (30%). They want to see that you make timely, sufficient payments. That you have no record of late payments, defaults, or court judgments. And that you aren’t over-extended on the credit you already have. Typically, a utilization of about 50% or less of your available credit is seen positively.

Of less importance, there are three other factors. How long your history of using credit is (15%), the types of credit you use (10%), and when you last opened new credit (10%). Applying for a lot of credit in a short time makes it look like you have financial struggles, and so will count against you. Lenders like to see a mix of credit types, so having some short- and medium-term credit alongside maybe some long-term credit looks better than everything being a credit card. And the longer your (positive) credit history, the better. It shows you’ve been around a while and met all your obligations.

How Can I Improve my Credit Score in 30 days?

In reality, you won’t be able to improve your credit score in just 30 days. At least, not by much! While some people can make intensive changes in a short time, this is usually by addressing errors or fraudulent entries on their credit reports. Or by resolving real financial issues, like outstanding debt or judgments. It is certainly worth pulling your credit report from each bureau and checking them for things you can easily resolve. If you can do so, this will give you the biggest boost in the shortest time.

Otherwise, improving your credit score is a marathon, not a sprint. Look at our advice below, and start making changes to how responsibly you manage credit. Your score will improve over time, we promise!

How Do You Fix a Bad Credit Score?

Have you had the unpleasant discovery that your credit score is bad? Don’t despair! Your credit score is a constantly changing thing, and you can always fix it. It may not be a swift process, however, depending on where you are starting from and what is causing the issues. If you think you will need to apply for credit shortly, it pays to monitor your credit report so time can work on your side.

In general, these behaviors will slowly improve your credit score over time:

- Make payments on time and consistently: This is one of the biggest impacts on credit score, and regrettably, one you can only prove over time. So now is the time to start!

- Reduce your credit use (but use credit): This may sound counter-intuitive, but lenders don’t want to see you max out your existing credit. That suggests you are having financial difficulties or overspending, and makes you a poor credit risk. However, they don’t want to see a credit-clear report, either! There’s no point in following some of the bad internet advice to open and not use a line of credit. A healthy credit score is built from responsible credit use. If you use none at all, you still look like a poor risk. Aim to keep existing credit use under 50%, but do use and maintain your credit. Spending on a credit card and paying it off within 60 days, for example, will show you can responsibly use credit. If you pay it immediately, there will be no benefit to your credit score- although it isn’t a bad financial habit overall!

- Diversify your credit: While this has only a small impact on your score, having different credit types will help. So instead of two credit cards, try to build a variety of sources, like store cards, credit cards, installment loans, and longer-term lending.

- Don’t open credit in quick succession: Want to look like a poor credit risk? Then start making applications left and right. Lenders will take this as a sign you are having new financial difficulties, and having many hard inquiries on your report will reduce your credit score. Try to space out your loan applications over time to avoid this.

- Regularly check your report: Monitor your credit report for inaccuracies or discrepancies. Report any errors to the credit bureau for correction as soon as you spot them. Not only will this help keep your credit score strong, but it will help you avoid fraud in your name, too.

What Causes a Poor Credit Score?

In short, poor credit scores come from bad previous use of credit. If you have court judgments and defaults, fail to pay on time (or at all), and max out every line of credit you are given, you will severely impact your credit score. Luckily, positive behavior changes will fix it over time.

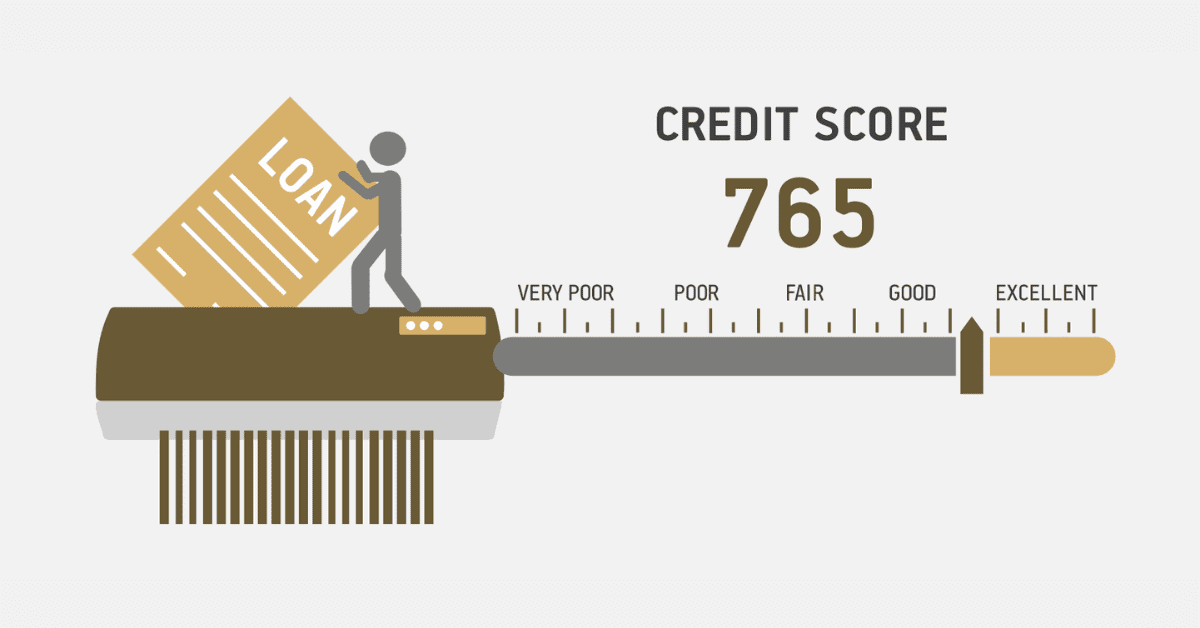

What is the Lowest Credit Score to Borrow?

Every lender is different. Additionally, the type and risk inherent in the loan will impact how willing a lender is to offer it. There are much more stringent criteria for mortgages than for store cards! However, in general, credit scores in the low 500s will struggle to access credit, and anything lower is more likely than not to be rejected. If you have a credit score in the 580 range, you will be able to access more credit. And once you are in the 600s, lenders will start looking at you favorably. Aim for a minimum of 670 for mortgage qualification.

What is the Minimum Credit Score to Buy a Car in South Africa?

If you have a credit score of 580 and over, you will qualify for some car loans in South Africa. In the 580-670 range, you will be a subprime borrower. This means they will consider you, but you aren’t their favorite. Aim for over 670 to access the best possible rates.