In South Africa, a strong loan rating is a key to financial freedom, especially for independent workers. It is not just a number but an epitome of your financial discipline and credibility. A high or low score increases one’s appeal for competitive interest rates and attractive loan offers targeted at freelancers, small business owners, or independent contractors. This could, after all, pave the way into a home, aid in a financial emergency, or maybe even dictate the terms of a credit card. Though the way to earn credit for salaried people is often structured, it may seem not so for the self-employed. However, self-employed individuals can build a solid credit score

How Can I Build My Credit As A Self-Employer?

A good rating gives one as an independent worker the best bargaining power while accessing better deals from financial institutions—such as lower interest rates, higher loan limits, better interest terms on savings, and more favorable overdraft terms. Here are the basics on how to get your credit score up in South Africa:

- Keeping records: These are the sources of income and all the expenses involved—from invoices to tax returns. This will also assist in proving your financial stability and reliability to the credit provider.

- One should always keep personal and business finance apart. That would mean opening a separate bank account and having a separate credit card for all business transactions. This way, one would not get the personal credit score hampered for business activities and vice versa.

- Register your business in a manner that is legally possible. This may be a sole proprietor, partnership, or private limited company. This stage has an advantage in that it gives your business more credibility and also a different credit profile from your business.

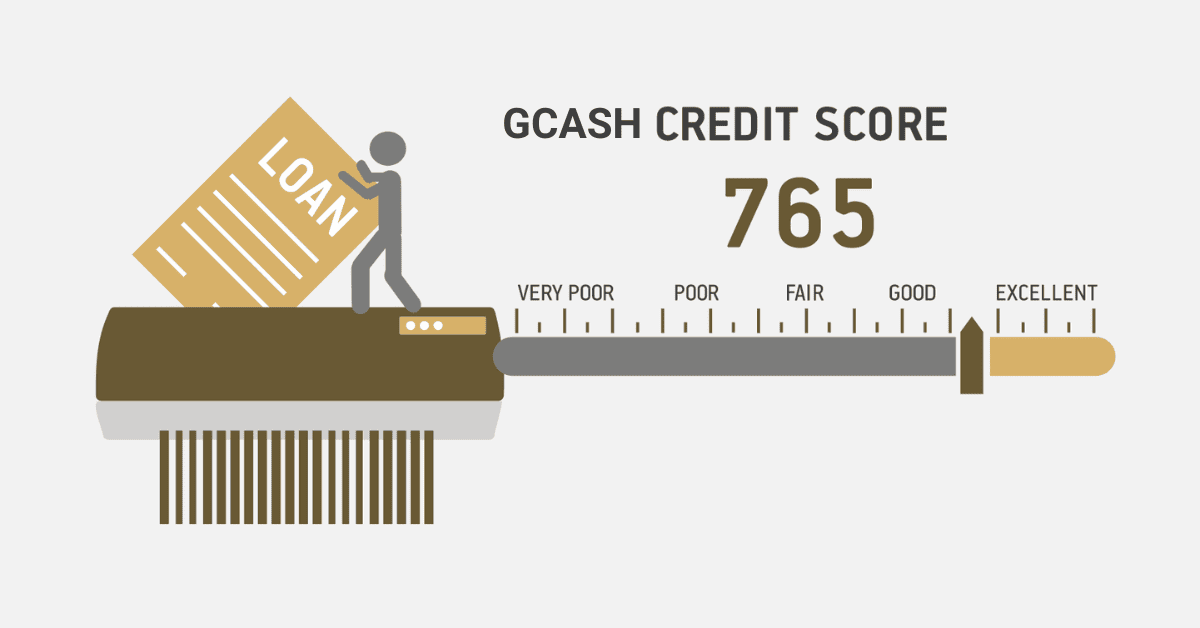

- Pay your bills on time. This is your most influential account factor. Ensure your loans, credit cards, and every other financial obligation you incur are met in full on time every month.

- Always regularly check your credit report. Get your free copy of the credit report from TransUnion, ClearScore, or Investec. Review your report for any errors or incorrect information and dispute if any.

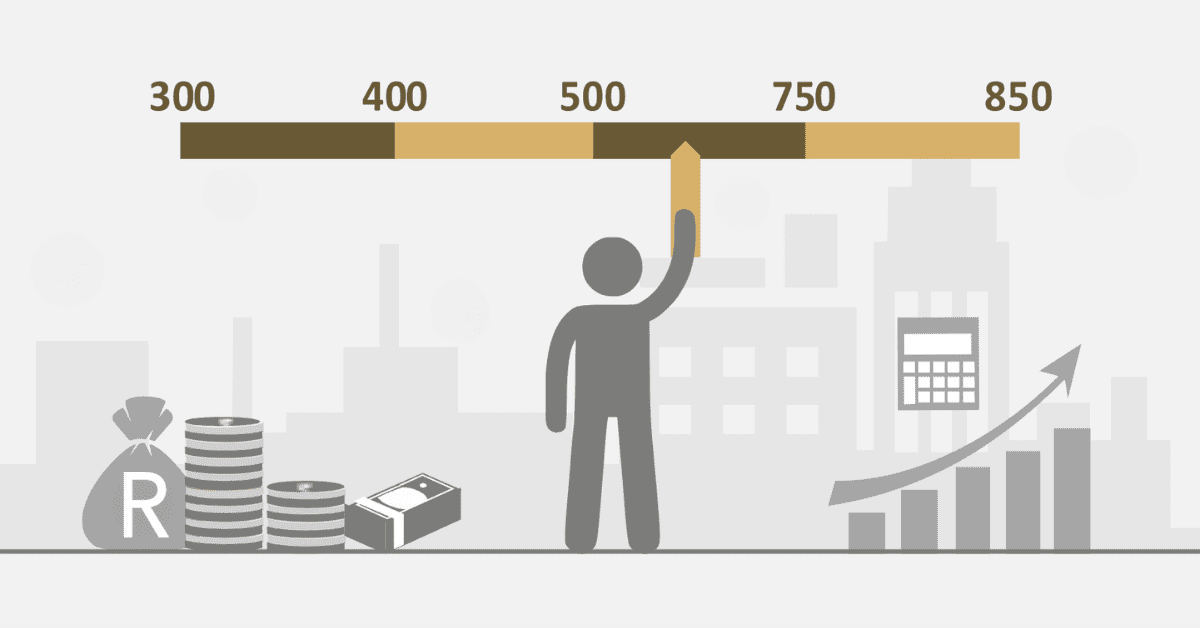

- Keep credit utilization low. This means the ratio of how much of your available credit you are using. A helpful figure is to keep it at less than 35%—for example, if your credit limit is R1000, don’t spend more than R370 on your card.

- Diversify your credit mix. A mix of secured and unsecured credit products will better show your ability to handle various types of loans to a lender.

- Engage with the lenders. Engage the lenders who have created products explicitly for the self-employed or those with experience dealing with the self-employed. Better terms and conditions for the loan you apply for will be guaranteed through such engagement.

- Avoid applying for too many credit products. Inquiring about too many credit products in a short period makes it look like you’re desperate, lowers the score, and implies poor financial management skills. Only apply for those that are really needed and carefully compare the options.- ADVERTISEMENT -

- Seek professional help. Contact a financial advisor or a debt counselor to help you with financial management, raising your credit score, or dealing with outstanding debt. They may even plan for your improvement and develop the most suitable budget.

Does Being Self-Employed Impact My Credit?

Being an independent worker does not in itself have a direct bearing on the loan rating in South Africa. However, irregular cash flow usually affects one’s credit score through missed bills and loan repayments. Under it, lenders sometimes regard self-employed people as having a higher credit risk, which may reflect the same in the terms applied to the credit provided. Accordingly, financial discipline by self-employed people is key to developing and maintaining a good credit score.

Can Self-Employed People Apply For Credit Card?

Yes, independent workers in South Africa can apply for a charge plate. An original ID doc, the latest income slip, and a three-month bank report are required when filling out the form. Minimum salary required: R5,000 for salaried persons or R10,000 for self-employed clients. And it is in a credit card where money could instantly be available to access on the spot, something valuable to the whole spectrum of people, from salaried to the self-employed.

Do You Need To Be An Employer To Receive Credits?

In South Africa, employment is not the only measure to get credit. Lenders are more interested in your constant income and being able to pay back. Even when you are an independent worker or unemployed, you could also be eligible for advances so long as you show constant earnings. Nevertheless, employment surely provides some sort of stability in life hence, it has an impact on credit terms. Thus, it is not a strict prerequisite but influences your credit qualification.

Which Bank Offers Loan For Self-Employed?

There are several banks in SA where one can apply for a loan, whether one is self-employed or not. Some institutions that give overdrafts to self-employed individuals are FNB, Absa, Standard, Nedbank, and Capitec. Various advances usually support such, from personal credits to business overdrafts to revolving loan facilities. The amounts of loans, terms, and interest rates can differ from one bank to another and surely will depend on one’s credit profile. As per the criteria, age and certain minimum salary details will also be considered. Generally speaking, you should be about 18 years old, earning between R2,000 and R3,500 monthly, and must have a good credit score.