For many South Africans, having a place to call their own resonates with financial stability and security. This journey often starts with a home loan application to purchase property that one could otherwise not afford to pay for in cash. The details of home loans in South Africa—the different types available, qualification criteria, and top providers—thus become essential information in prospecting for first-time house buyers. The article looks into details of home loans, thereby providing in-depth coverage to give the full view of the body of knowledge surrounding home loans in South Africa.

What is a Home Loan?

Through a home loan, a person can raise finances to buy a property. This is otherwise termed a mortgage and simply means the loan obtains value from the purchased property. The title of your home stays with the lender until you pay up for the loan. Interest or other fees are also part of the regular payments to be made in a period agreed upon by both parties—usually 10-30 years. Home loans offer a person the chance to purchase a house without raising the total purchase price upfront, granting one access to housing. In South Africa, home loans mean a lot because the prices of property are mostly beyond what many people can earn or save; therefore, loans are there as a pragmatic solution.

Types of Home Loans

Fixed-rate Home Loan

This product has an interest rate applicable in a lump sum for a predefined period, usually one or two years. This type of credit shields the borrower against lending fee fluctuations and stabilizes monthly repayments. At the same time, if the interest rates drop during the fixed period, the debtor will not benefit from such a drop in lending costs.

Variable Home Loan

The interest rates of the variable rate home loans fluctuate independently of the prime lending rate. The interest payments increase if the base rate goes up and decrease if it goes down. This would be to one’s advantage when interest rates fall, but there is also the possibility that payments may rise when interest rates go up.

Capped Rate Home Loan

Capped-rate home loans provide a mix of fixed and variable rates. While the interest rate may still enjoy or take some upward movement, it will never exceed the predetermined interest rate capped for borrowing. This protects the debtor against rising interest rates while allowing them to take advantage of the decrease in prime fees.

First-time Buyers Home Loan

They are designed for first-time home buyers. Such credits generally have more favourable terms, like lower interest rates or even allowing the borrower to lend more than 100% of the purchased price so that costs, including registration and transfer fees, can be covered within it.

Step-down Home Loan

They are specifically designed for people nearing retirement. The interest rate falls over time, reducing the monthly repayments. This type of loan can be pretty suitable in cases where the individual has retired and has a fixed income, making cash flow management more accessible.

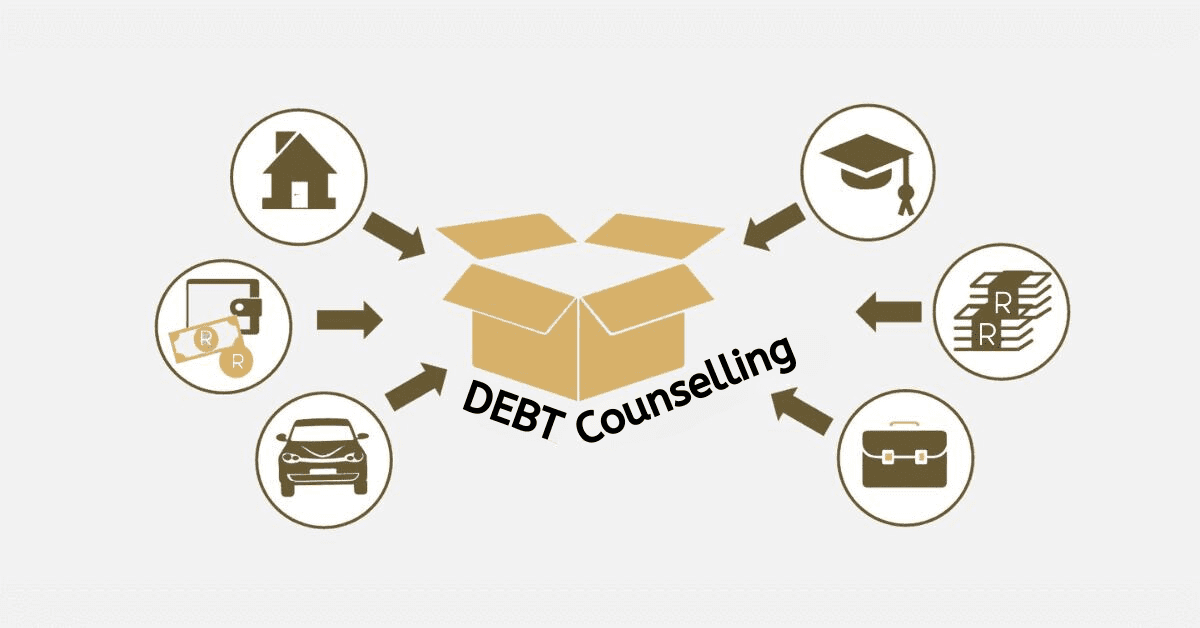

Meeting the Requirements for Home Loans in South Africa

Employed Applicants

There are several criteria one has to meet for you to get a home loan upon working full-time. Therefore, you must be older than 18 and have a good credit record. Having proof of income through the latest payslip and bank statements is also essential. You must attach a detailed statement of your monthly income and expenses, debt repayments, and a copy of the offer-to-purchase or sale agreement.

Self-employed Applicants

More documentation is required for self-employed individuals. In addition to the requirements of being above 18 years old and having a good credit record, they must provide personal as well as business bank statements for six months, a letter of drawing from an accountant in case there is no evidence of a monthly salary slip, statement of assets and liabilities as well as the offer to purchase or sale agreement.

Building Loan Applicants

Requirements for persons applying for a building loan are a bit more complex. Besides the basic requirements, applicants must provide provisional building or working drawings, signed building contracts or quotes, minimum specifications, builder’s all-risk insurance policy, and an engineer’s certificate in case structural reinforcement may be necessary. Another document required by the lending institution in this category will be the builder’s waiver of lien and original NHBRC enrolment fee certificate.

Top Home Loan Providers in South Africa 2025

Nedbank

Nedbank has very competitive home loan products. They attract a monthly service fee of R69 and an initiation fee of R6037. The early termination of the loan attracts three months’ interest, which is then pro-rated should the bond be cancelled within 90 days. The interest rates at Nedbank are usually variable and driven by the prime lending rate.

Standard Bank

Standard Bank charges a home loan with the same service charge of R69/m and about the same initiation fee of R 6037.50. The bank requires a ninety-day notice of bond cancellation; otherwise, an interest charge may be assessed pro rata. Their interest rates could rise due to economic influences and credit risk conditions.

Absa

Absa charges a monthly service fee of R69 and an initiation fee of R6037.50. A home loan that is prematurely terminated may attract up to 90 days of interest, which is reduced pro rata with any notice given. Like any other bank, Absa’s interest rates are pegged to the prime lending rate and move in tandem.

First National Bank (FNB)

Even at that, FNB stands out by dropping the early termination fee, though it still offers better value for customers who switch or settle their loans early. Their monthly service fee is R69, and an initiation fee is R6037.50. The FNB cash deposit fees are the lowest among central banks; hence, they are very cheap for borrowing customers.