Credit push payments are one of the methods for paying for returns due to SARS. They are initiated from eFiling, but still allow you a lot of control over the payment, as you have to approve them via your banking app or online banking. Here’s everything you need to know to utilize this SARS payment method for yourself.

What is a Credit Push Payment?

Credit push payments for SARS are initiated by you, the taxpayer. You begin the payment on the eFiling site yourself. They then present this instruction to your bank for payment. You have to confirm the transaction through your banking app; then, the payment will go through. They are irreversible once done. This allows you to stay in full control of the payment process, and there will be no subsequent transactions unless you authorize another payment.

eFiling Payments (Credit Push): How to Set up Credit Push on eFiling

Anyone with access to a specific eFiling profile can initiate a credit push- so that could be the taxpayer themselves, their tax practitioner, or an authorized representative of a company. Remember, even if your tax practitioner or another party initiates the push, the bank account holder will still have to verify the transaction, so you are always in control.

Your first step should be ensuring your bank allows these credit push transactions. In South Africa, all of the major banks have this set up with SARS, but it can vary by product type (many savings accounts outside of Capitec will not allow transactions).

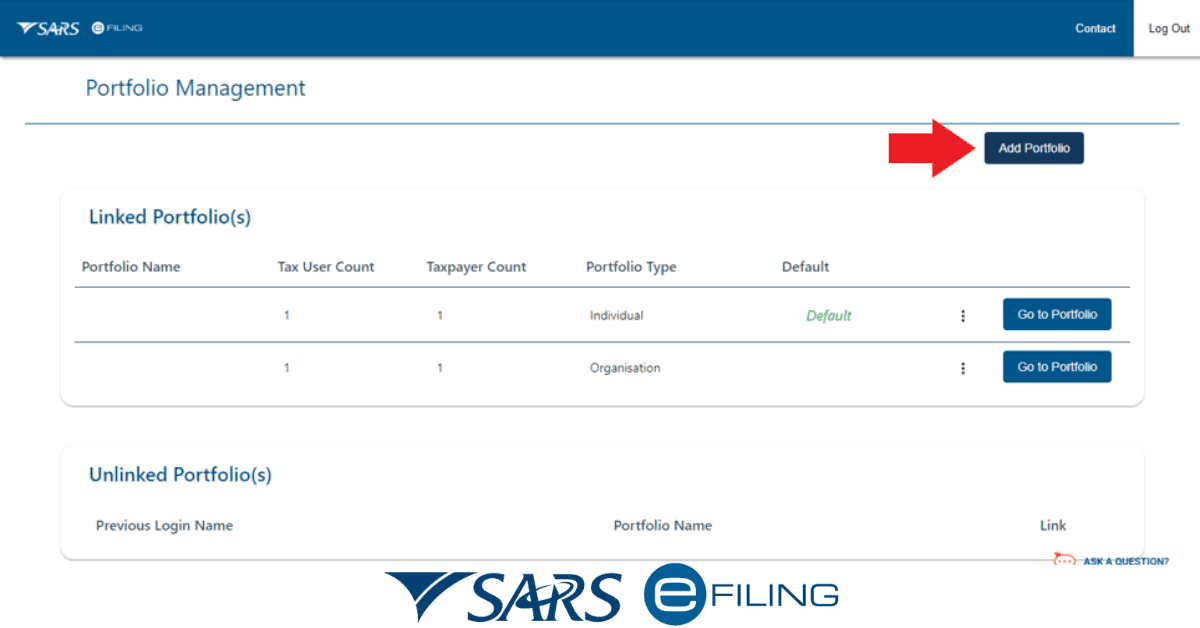

Access your user profile on eFiling, and head to banking details. This will be under Home>User>Banking details for individuals and Organizations>Organization>Banking details for companies and other profiles. You may need to set up a new account. Credit pushes can also be initiated from the returns page via Payments>Bank Details Setup.

On the banking information screen, credit push is automatically selected by default. Ensure your current bank account details are correctly set up by following the onscreen prompts. They will then be saved on eFiling. You can subsequently see the banking information via the ‘open’ hyperlink. You can also delete old or unwanted bank accounts from this screen.

Next, initiate the payment. Then log in to your banking product to authorize the payment, the same as with other push-style payments. Authorize the payment with your bank, and you’re done!

What are the Three Payment Types?

This is, of course, not the only way you can pay SARS. In addition to the credit push method, you can pay in the following ways:

- Directly at a bank: This is available for Capitec and the ‘Big 4’ banks (ABSA, Standard Bank, Nedbank, and FNB). You will need to make sure you use the correct SARS account and the right payment reference number (PRN) to ensure the payment reflects seamlessly.

- EFT: This works exactly like any other EFT payment. Most South African banks have various SARS accounts as preloaded beneficiaries. Ensure you select the correct SARS account- for example, SARS ITA for income tax assessments or SARS PAYE for PAYE/SDL/UIF payments.

- SARS MobiApp: You can pay based on a statement or received ITA34 on the SARS MobiApp. Be aware that you cannot make part payments this way. You will either pay a predetermined amount set by SARS or the full amount.

You can also pay customs duty at SARS branches in ports of entry and exit or perform a foreign payment if you live outside of South Africa.

How Long Do Payments Take to Reflect at SARS?

How long a payment will take to reflect can vary depending on the payment method used. Typically, it will take at least 72 hours to reflect on the SARS system. This can be delayed further by bank processing times. Typically, the credit push method is the fastest to reflect. If you still don’t see a payment after 10 working days, you may want to enquire directly with SARS to see if there has been a misallocation or error.

How do I Make SARS Payment Arrangements?

You can apply for SARS payment arrangements directly through eFiling. Payment arrangements allow you to pay down a set amount over time to bring your account back into compliance.

You can make payment arrangements from any return where you see the ‘payment arrangement’ button or from your My Compliance page on the site. You will only be able to load a payment arrangement for specific tax types one at a time.

Access the My Compliance page from Tax Status>Tax Compliance Status>My Compliance Profile. Then click Debt>Tax Type> Tax Reference Number, and hover over the ‘Non-compliant’ indicator. This will take you to the payment arrangement page.

Similarly, you can go to Returns>SARS Correspondence>Search Correspondance and view the relevant demand letter.

Once you have arrived at the payment arrangement page, select the tax type you want to make an arrangement for. The default plan will be a 6-month plan. You can accept and save or propose a different plan.

Once you are happy with the presented plan, you can ‘save’ it to postpone finalizing it or proceed. Once you click ‘accept terms’ and indicate you understand the agreement, you can click on OK for SARS to proceed. You will then have submitted the request to SARS for approval. Occasionally, supporting documents may be needed, which can be loaded on the site.

You can also request payment arrangements telephonically or via email to SARS. They will expect very similar details to those outlined here- length, proposed amount, and payment details.

How do I Know if SARS Received my Payment?

You can access an ITSA or statement of account on the eFiling site to see if SARS has received a payment and correctly allocated it to the relevant return. This will also show interest charged, penalties due, and your overall transaction history for the year. If you are owed a refund from SARS, it will also show here. You can click on the ‘statement of account button on the top right of your screen while logged in to the correct profile on eFiling to access this.

Credit pushes can be a very convenient way to pay returns via eFiling, while still allowing you control over the payment process, so it is a method of paying SARS that is well worth considering.