One can have multiple bank accounts with the same bank or different financial institutions. Although checking accounts and savings accounts are the most common, you can consider other types of accounts, such as fixed-rate, regular savers, and others depending on your needs. Opening a bank account is easier in South Africa because it does not require a credit score nor does it affect it. If you’re one of the people wondering if multiple bank accounts affect credit

Do Multiple Bank Accounts Affect Your Credit Score?

Having multiple bank accounts does not necessarily impact your credit score as long as you use them for normal day-to-day transactions. A bank account is commonly used for depositing money, withdrawing funds, transferring cash to different accounts, and making different purchases. For any bank transaction you conduct, you will be spending your own money, so there is no way it will affect your credit score. As long as you are not spending money obtained via credit, your credit score will be safe.

However, the moment you start having multiple overdrafts from your accounts, your credit score is likely to suffer. If you apply for overdraft protection, you enter into a short-term loan agreement with your financial institution. As a result, the bank will conduct a hard inquiry on your credit history to see your spending behavior. A hard inquiry is different from a soft inquiry, so it will affect your credit score and appear on your credit report for about 12 months. A hard inquiry on your credit can lead to a loss of about five points from your credit score. The situation can be compounded by a short credit history.

Once you sign for overdraft protection, your credit score is likely to be affected if you overdraw your accounts and take time to repay the money. Your bank might be forced to refer you to a collection agency to recover the money you owe. Once you are referred to debt collectors, you will be blacklisted by credit bureaus which affect your score.

Applying for multiple bank accounts within a short period can affect your credit score due to several hard inquiries. Once you have bad credit, it might be difficult to open a checking account that comes with overdraft facilities. To maintain a good credit score, it is recommended that you desist from abusing the overdraft service offered by banks.

Does the Amount of Bank Account Affect Credit Score?

A bank account does not usually affect a credit score and it does not appear on your credit report. Normal day-to-day uses of your bank account like withdrawal of money, writing checks, depositing cash, or transferring money do not constitute loans. Therefore, the amount in your bank account does not affect your credit score since you will be using your money.

The only exception is that when your account has an unpaid overdraft, your bank can take appropriate measures to recover the money you owe. For instance, the bank can enlist the services of a collection agent if you fail to repay your overdraft within the agreed period. This kind of situation will lead to blacklisting of your account, which negatively affects your credit score.

Closing a bank account with a negative balance is another factor that can impact your credit score. The bank involved is likely to report you to credit bureaus for fraud. Whenever you apply for new credit, the negative details will appear on your credit report. If you maintain the required balance in your account, your credit score will not be affected in any way.

How Many Accounts Is Too Many for a Credit Score?

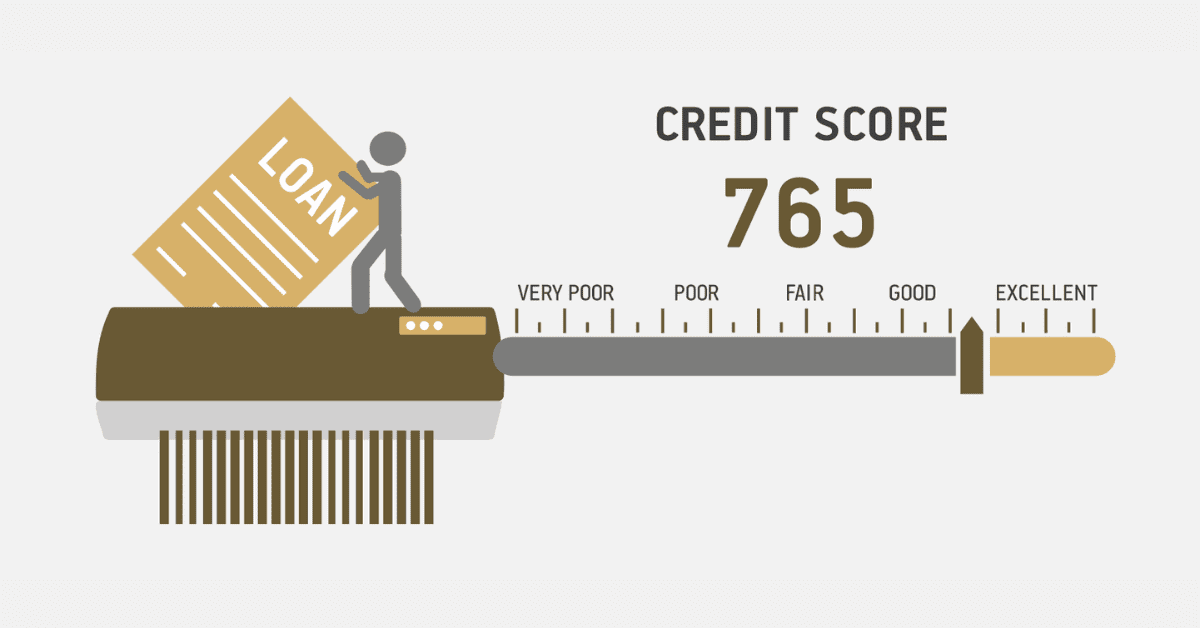

You can have two or more bank accounts, and they’ll not impact your credit score as long as you use them in a normal way. However, this is not the case when it comes to other accounts related to credit lines. For instance, it is important to have at least one credit card account when you are still new to the world of credit. One account is manageable, but you can add one or two cards to improve your credit score. It is recommended that you have a maximum of two or three credit cards at a time to maintain a good credit score.

Your total debt to ratio and available credit can impact your credit score. You may be forced to overspend when you have several credit cards. Maintaining your credit ratio below 30% is critical if you want to attain a good credit score. Once you exceed your limit, you may find it difficult to repay the money, which attracts interest and leads to late payments. Additionally, keeping track of monthly payments can be difficult if you have more than three credit cards. Several credit cards that are not in use can hurt your credit score since you will appear risky to lenders. They will regard you as someone desperate for money due to the number of credit cards you have.

However, you can boost your credit score by getting new credit cards if they lower your credit card utilization ratio. New credit cards often come with travel-related benefits and rewards, but you need to add them gradually. Paying your credit card balance in full every month is the most effective remedy for building a good credit score.

Do They Check Your Credit When You Open a Bank Account?

No, when you apply for a new account, banks do not check your credit score. If you want a special type of account, that’s when the financial institution may check your banking history not necessarily your credit score. When opening a savings or checking account, banks normally ask for proof of address, and identification details, one must be above 18 years. You need to be legally resident in South Africa to qualify for a bank account.

Opening multiple bank accounts in South Africa does not affect your credit score. When you open a bank account, you’re not applying for a loan, so your credit will be safe. However, multiple overdrafts can harm your credit score if they are not paid off over an extended period.