When you look at some of the things that can hurt your credit score, some items may seem unharmful. This is an ignorance part of every individual and it is important to stay updated on the issues at hand.

Hurting your credit score can go a long way to affect it and not knowing what could hurt your credit score can be worse than you can imagine.

There are unimaginable things that could negatively affect your credit score. There is a concern about whether consolidation loans can hurt your credit score or not.

As we continue to educate our readers, we will be sharing with you a couple of narratives concerning consolidation hurting your credit score and the aftermath of debt consolidation.

Do consolidation loans hurt your credit score

Before we look into the possibility of consolidation loans hurting your credit score, let us first share some insight on consolidation loans. What exactly is a consolidation loan?

A consolidation loan simplifies the process of managing multiple bills by combining them into a single, more manageable loan. This feature assists borrowers in making payments more conveniently and potentially reducing their interest rates.

Individuals have the option to streamline their accounts and reduce their monthly payments by consolidating multiple debts with high-interest rates, such as credit cards or personal loans, into a single loan with a more favourable overall interest rate. This method can assist you in regaining control of your finances, avoiding late fees, and ultimately saving money in the long term.

Prior to considering a consolidation loan, it is crucial to thoroughly evaluate the terms, fees, and long-term consequences to ensure that it aligns with your individual financial objectives and requirements.

Debt consolidation loans may have a temporary impact on your credit score. When you apply for a debt consolidation loan, the lender will conduct a credit check; and this is considered to be a hard inquiry. These inquiries can take away some points from your credit score.

When you consolidate your debt, it may have an impact on your credit score. However, if you handle your debt responsibly, any negative consequences will only be temporary. Having a clear understanding of the available options and their impact on your credit score can assist you in making informed decisions.

Do consolidation loans show up on the credit report?

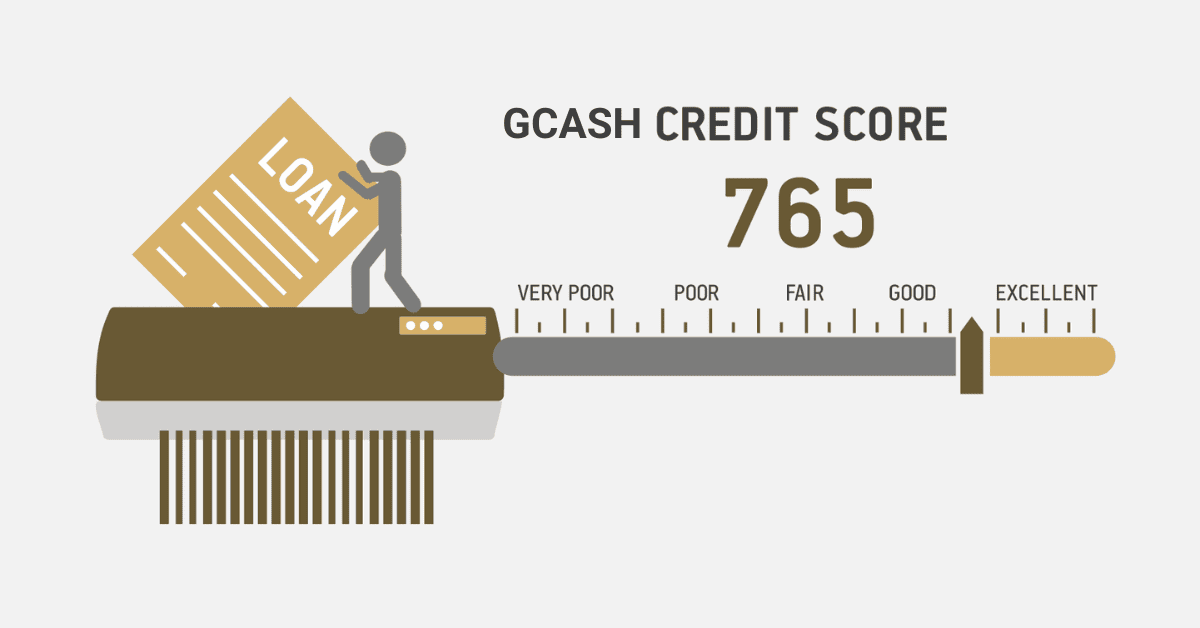

Consolidation loans can negatively impact your credit score. Once your loan repayment is ongoing, the details of the consolidation loan will be on your credit report.

The request for the consolidation loan is tight to your credit report in the sense that any alteration has an influence on your credit history.

Once you have been approved and received a consolidation loan, it will show on your credit report.

Are there any disadvantages to consolidating debt?

Opting for a debt consolidation loan might seem like a wise move to expedite the debt repayment process. Nevertheless, it is crucial to acknowledge that this approach comes with its fair share of possible challenges and hazards.

Here are some of the disadvantages of debt consolidation.

- Debt consolidation loans can come with various fees, such as origination, balance shift, closing, and yearly fees. Prior to selecting a lender, it is crucial to have a clear understanding of the precise expenses associated with each debt consolidation loan.

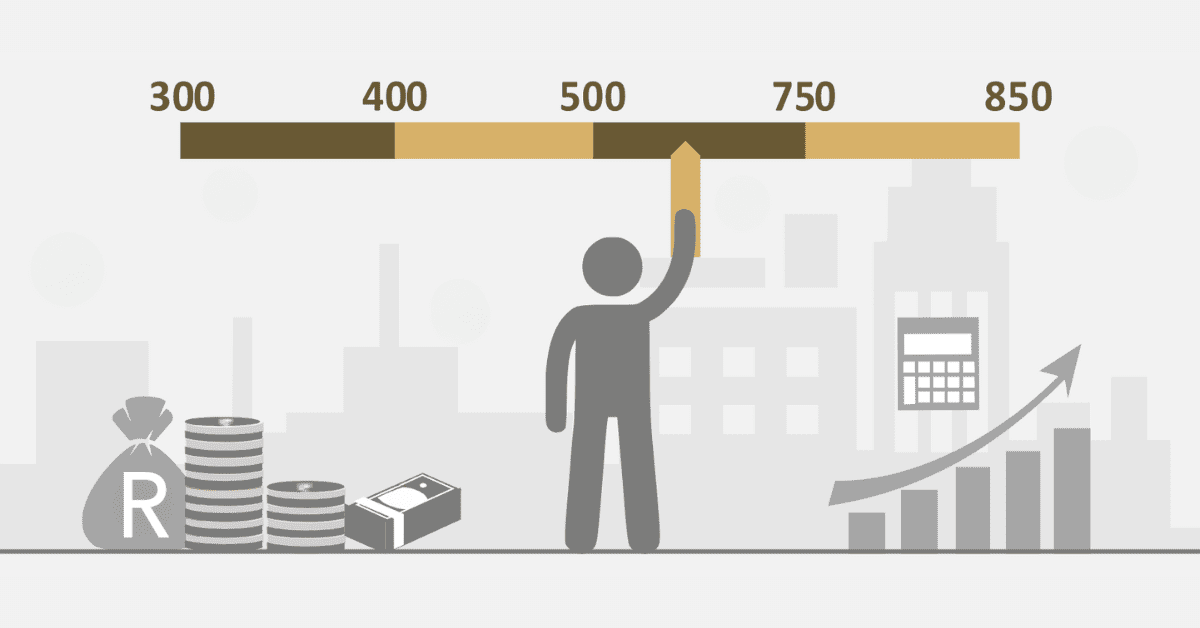

- Consolidating debt can be a wise decision if you can secure a lower interest rate. If your credit score is low, you might end up with a higher interest rate compared to your current loans. There may be a need for upfront payments and ongoing interest.

- Failure to make payments on a debt reduction loan or any loan can have a negative impact on your credit score. There may be extra charges. To prevent this, it is important to review your budget and ensure that the new payment is manageable. Once you have merged your accounts, make sure to utilise autopay or other methods to prevent any late payments. If you are unable to make a payment, please inform your lender right away.

- Consolidating debt streamlines payments, yet it does not alter the financial habits that led to the loans. It is worth noting that a significant number of debt consolidation customers end up accumulating more debt due to their failure to reduce their spending. Consolidating your debt can be a useful strategy to pay off multiple maxed-out credit cards. However, it is essential to develop sound financial habits.

- Using a debt reduction loan to pay off credit cards and other lines of credit can create the illusion of having more money. It is incredibly frustrating how individuals can accumulate debt and then discover that their balances have actually increased when they make payments to reduce them.

How long does a consolidation loan stay on your credit report?

With a very good standing on your credit report, your debt consolidation could stay on the report for about 8 to 10 years. Debt is indirectly seen as a way

The clock begins ticking from the date when the first delinquency occurred on the original debts that were consolidated. Nevertheless, repaying the loan can gradually enhance your credit score, leading to a positive outcome.

How long does it take to rebuild credit after debt consolidation?

There are a couple of factors that could alter debt consolidation rebuild. Rebuilding debt consolidation simply means putting measures to put your credit score or credit report in good standing. Although there could be a time target on how long it will take to rebuild credit the factors are influenced by other components.

Rebuilding credit after debt consolidation can vary, usually taking anywhere from 6 months to 2 years to see initial improvements. Consistently making payments on time and decreasing debt can have a positive impact on your credit history. Nevertheless, it may take several years to fully recover, as the extent of the impact relies on personal financial habits and the seriousness of previous credit problems. It is essential to maintain consistent and responsible financial behaviour in order to achieve long-term improvement. Keeping a close eye on credit reports and scores can be beneficial in keeping track of progress and pinpointing areas for improvement.