SARS has taken great strides to improve its online and offline facilities to make filing tax returns easier and more convenient than ever. In 2021, the government allocated an additional R3 billion to SARS to improve its efficiency and effectiveness.

SARS are expanding specialised audits and investigations of return claims as part of their improvements. Audits and investigations are vital for SARS to identify to ensure that fraudulent claims are stamped out and taxpayers’ money is used correctly.

What is the Difference Between SARS Audit And Verification?

Let’s take a closer look at these terms and the processes involved:

SARS Verification

A verification status means that SARS needs to compare the information declared on their return to the taxpayer’s actual financial and accounting records and other supporting documents.

The purpose of this verification is for SARS to make sure that the declaration or return fairly and accurately represents a taxpayer’s tax position.

SARS Audit

The SARS audit goes a step further than the verification to determine if the taxpayer’s position has been correctly declared. If a taxpayer made no declaration or did not file a return, the audit will serve as an investigation into the taxpayer’s compliance with the provisions of the relevant tax legislation.

An audit is more in-depth and intrusive than verification, and the scope is generally more extensive.

How long does SARS take to refund after verification?

The introduction of eFiling has made transactions with SARS easier and faster than ever. Following your final tax assessment, if there is a refund due to you, it will automatically be logged and paid out to you. You will not have to manually request it.

A refund takes between 48 – 72 hours (2 to 3 business days) from the date it was issued to you through eFiling. There are certain instances where it may take a little longer, but SARS will notify you of this accordingly.

It is vital that all your information with SARS, especially your banking details, are accurate as possible to minimise the chances of further delays.

What happens if SARS audits you?

Here’s what you can expect in the SARS audit process:

SARS Audit Process

- The process starts with a formal Notification of Audit being issued to the taxpayer, indicating the scope and auditor of the audit.

- The relevant supporting documents will then be requested and must be submitted to SARS within 21 business days.

- The documents requested can be uploaded via eFiling, collected, or delivered.

- Throughout the process, SARS can request additional information. If these are not provided by the taxpayer, SARS will use the information available from third parties.

- Progress reports should be issued at 90-day intervals from the date of the Notification of Audit.

- SARS aims to conclude each audit within 90 business days; however, an audit can take between 30 days to 12 months to conclude, depending on the complexity of the audit and the taxpayer’s willingness to cooperate.

- SARS will issue an Audit Finding Letter, which the taxpayer will need to respond to, indicating their agreement or disagreement with the findings.

- If SARS believe that a revised assessment is still required or the taxpayer fails to respond, understatement penalties may be imposed.

- SARS will then provide a Finalisation of Audit Letter if the tax position is found to be incorrect. This letter will detail the grounds for the assessment or will conclude the audit if there were no findings made.

- Taxpayers are allowed to dispute the assessment by logging an objection.

No refunds will be paid out while the verification or audit processes are in progress.

What is the purpose of verification?

A verification status means that SARS needs to compare the information declared on their return to the taxpayers’ actual financial and accounting records and other supporting documents.

The purpose of this verification is for SARS to make sure that the declaration or return fairly and accurately represents a taxpayer’s tax position.

SARS Verification Process

- SARS will send a notification via an official letter on eFiling or your preferred method

- The letter will request that you either submit supporting documents or a Request For Correction (RFC) within 21 days. The letter will also explain if this should be done via eFiling or at a SARS branch.

- If the letter is not responded to within the 21-day period, SARS will issue a second letter. Following a further 21 days, they will make telephonic contact with you and request that you provide the information required within five days. If you still do not comply with the request, SARS will raise an assessment based on information they can access from a third party.

- Another letter requesting relevant information may be issued if the information SARS were able to access is not sufficient to finalise the verification.

- SARS will conclude the verification process within 21 days from the date they access all the relevant information.

- An assessment will be raised if the tax position declared is found to be incorrect.

- A Notification of the finalisation for the verification will then be sent by SARSs if there were no further risks identified.

- If further risks are identified, then your return will be referred for an audit, and you will receive an Audit or Referral Letter.

- You are allowed to dispute the assessment within 30 days by lodging an objection with SARS.

Note: Once the verification process has been completed, your tax affairs may still be referred for audit as part of SARS’ compliance process.

How do I check my SARS verification status?

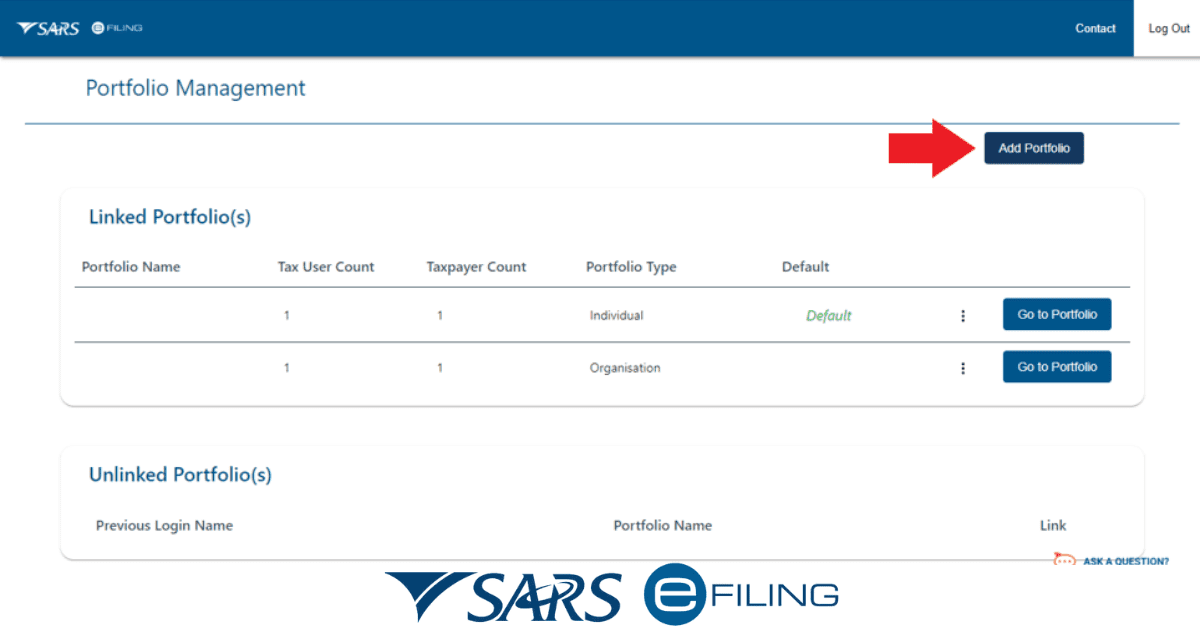

The My Compliance Profile (MCP) on eFiling allows taxpayers an online view of their compliance status as determined by SARS, and they can take the necessary steps to correct any non-compliance issues.

Here are the steps to view your “My Compliance Profile:”

- Log into eFiling – You must be registered for eFiling and have one tax product already activated on your profile to activate the Tax Compliance Status (TCS) service.

- Activate the Tax Compliance Status service – If you have not activated the TCS service, you will need to do so. Once activated, you will be granted access to your MCP.

- View your “My Compliance Profile” – Click on the menu option “My Compliance Profile”, and your status will be displayed as determined by SARS.

How long do taxes take after verification?

If you have been selected for verification by SARS, and you do not comply with the request made, SARS will raise an assessment based on information they can access from a third party.

SARS will then aim to conclude the verification process within 21 days from the date they access all the relevant information.

You are allowed to dispute the assessment within 30 days by lodging an objection with SARS.