There are facts and there are opinions. Some opinions have an iota of truth which confirms quantitative information. Why this?

Many will tell you about their debt, how they go about it, how they pay and what they pay first. But at the end of the day, what do we seek, the truth, opinion or both?

Everyone has their way of dealing with his financials, what may work for you may certainly not work for the other. The fundamentals may be the same, but the process and procedures may differ.

When you find yourself using credit for all payments, it is always important to seek the right information to help your financial life.

Payment timelines differ as well as the amount. Also, the negotiations and discipline differ among others. So how then can you deal with your debt to improve your credit score?

Many people ask many questions about which debt they need to pay first when they have a lot on this list.

In this blog post, we are going to take you through a journey of debt payment, credit score improvement and many more.

Does paying off debt early improve your credit score?

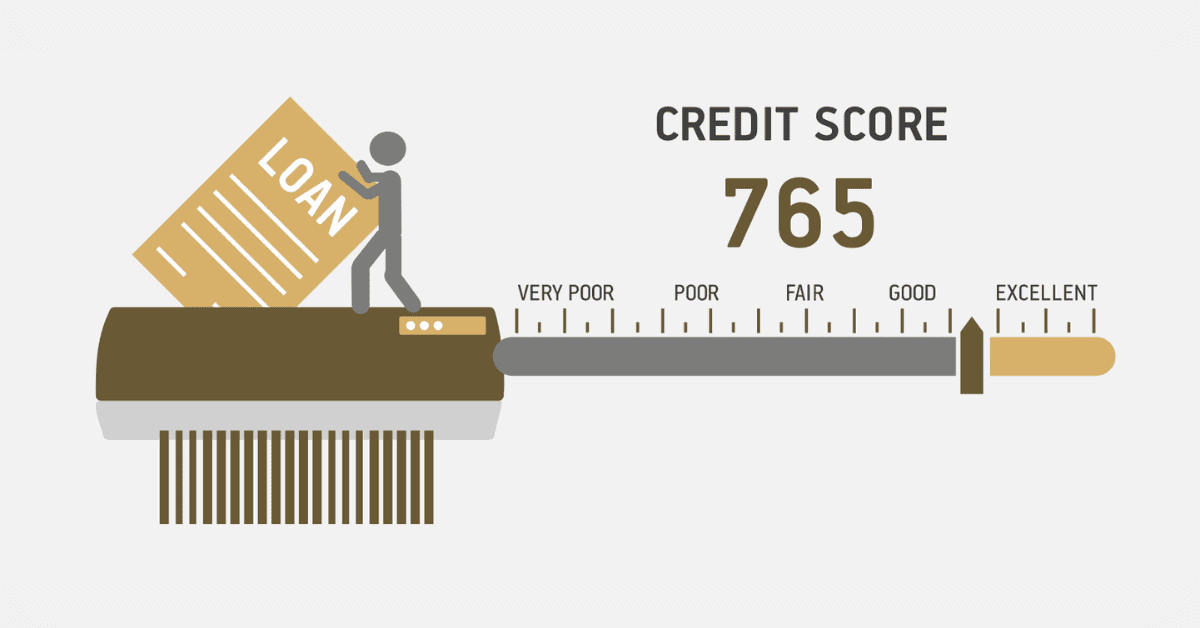

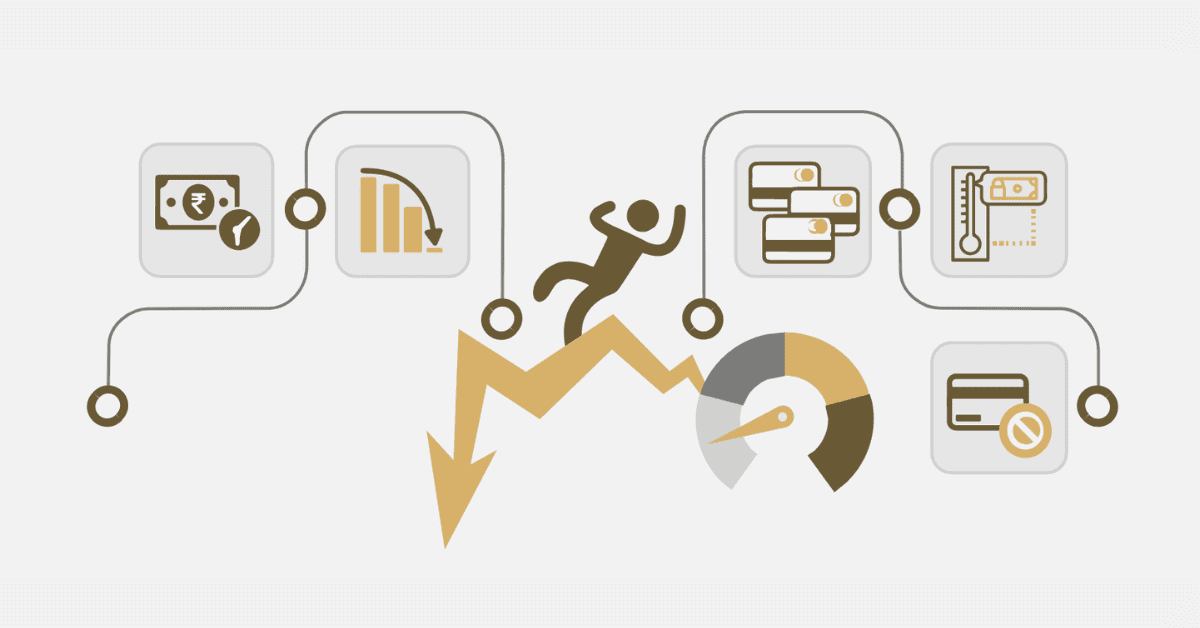

There could be a negative or positive impact on your credit score when you pay off your loan. However, this outcome depends on the account balance, credit mix and certain factors.

There are cases where when one pays off his debt, he or she may lose some credit even though it is always ideal to pay off your debt.

Paying off your loan early does not improve your credit score but rather can have a negative impact. This is because the scoring algorithm works in a way where loans that are not due are supposed to stay on your credit until they are due.

Which debt should I pay off first to improve credit score?

The point of paying off debt is to get rid of high-interest rates and also avoid losing credit score. Whether it is a small debt or a huge debt, a debt is meant to be paid. But the truth is that not all debt can have a real impact on your credit score.

In the financial space where credit applies everywhere not every debt paid off can increase your credit score.

Debts with high-interest rates are meant to be paid off first to see a positive impact on your credit. When your interest rates for a debt accumulate they tend to affect your payment history which indicates you are not diligent when it comes to your debt.

However, once you pay off these debts with huge interest, you close the overall debt gap and improve your credit score.

How long does it take to rebuild credit after paying off debt?

If you have decided to deal with your debt, you may be wondering how long it will take to rebuild your credit and what will happen to your score after you settle your debt.

Understanding that the credit repair process takes time is important, as a settlement can have an effect on your credit record for two to seven years. There is still hope for you to improve your credit, even though those bills will stay on your report for a long time.

Your credit past is the main thing that determines how long it takes for your credit to start getting better.

If you have paid off several debts in the past, those settled debts will show up on your credit report as an exception and help it improve. Showing lenders that you can regularly meet your financial obligations is important.

Also, it will help if you are paying off other bills at the same time, like a mortgage, car loan, or other credit accounts. People with a pretty good credit background may be able to raise their credit score in as little as six months, or even less than half that time.

If you do not have a long credit background, it could take a lot longer.

For example, if you have never paid off debt before and are not meeting the due dates for your mortgage, loan, or other credit cards right now. It could hurt your credit score if the accounts you settled were ones you have had for a long time.

This is because credit history takes about 15% of your entire credit score calculation. This means you need to have an old credit score history before seeing much improvement after paying off the debt.

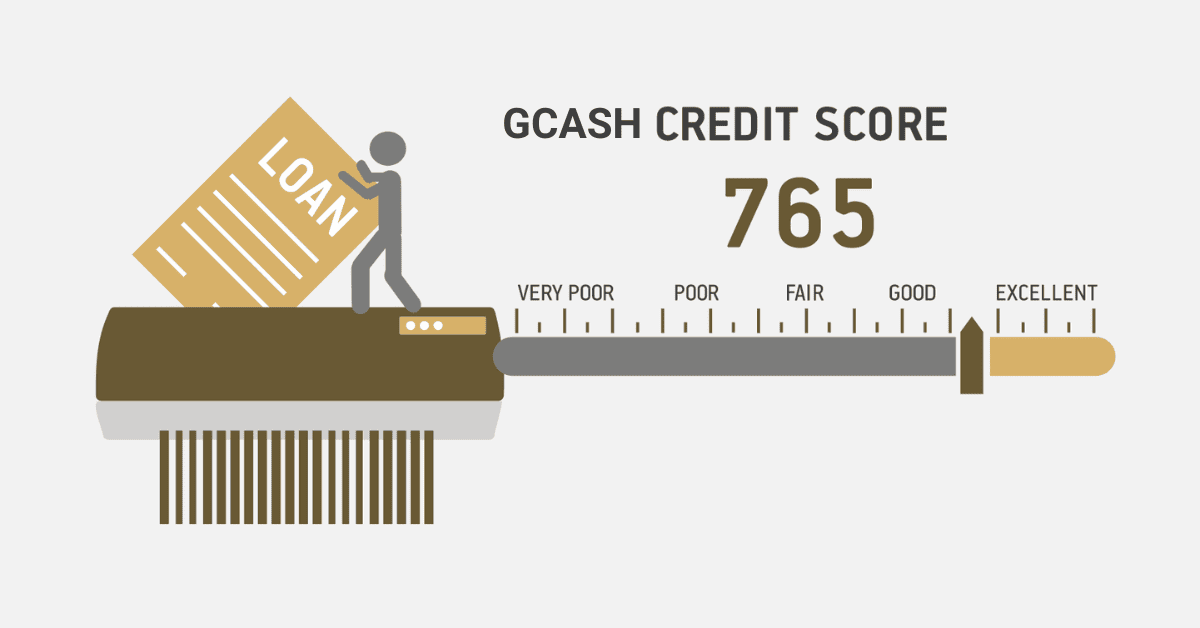

What is the fastest way to raise your credit score in South Africa?

If you are seeking ways to improve your credit score, it is normal to look out for the fastest possible ways. But here is the deal about raising your credit score.

The credit system works almost the same everywhere; what changes it is the fiscal and monetary policies of the nation.

In South Africa, when you want to raise your credit score in a fast way you may end up causing a lot of issues. This is to tell you that there is no “fast” way to raise your credit.

But there are certain simple methods you can apply in your daily credit life. These ways are considered to be ideal to help you raise your credit score when done well and on time.

The ultimate first step to raising your credit score in a fast manner is to keep monitoring it. Studying the pattern and trend of your credit score can give you a clue on how to approach the other ways.

Making payments on time, paying off your debt without accruing more interest, spending over your credit limit, reducing the credit request, and avoiding credit mix are all part of the fastest way to raise your credit score in South Africa.