Locating a South African property to rent may be pretty troublesome, especially if you have to go through several evaluations and references before being authorized to lease an apartment. One of the most usual and paramount assessments is the credit check, which is the tenant’s fiscal background record and creditworthiness. But what is a good credit score to rent an apartment? And how can you improve your credit score before renting the apartment? In this writing, we will answer both queries and share tricks and details for tenants and landlords.

What Credit Scoring Is Needed For Apartment Renting?

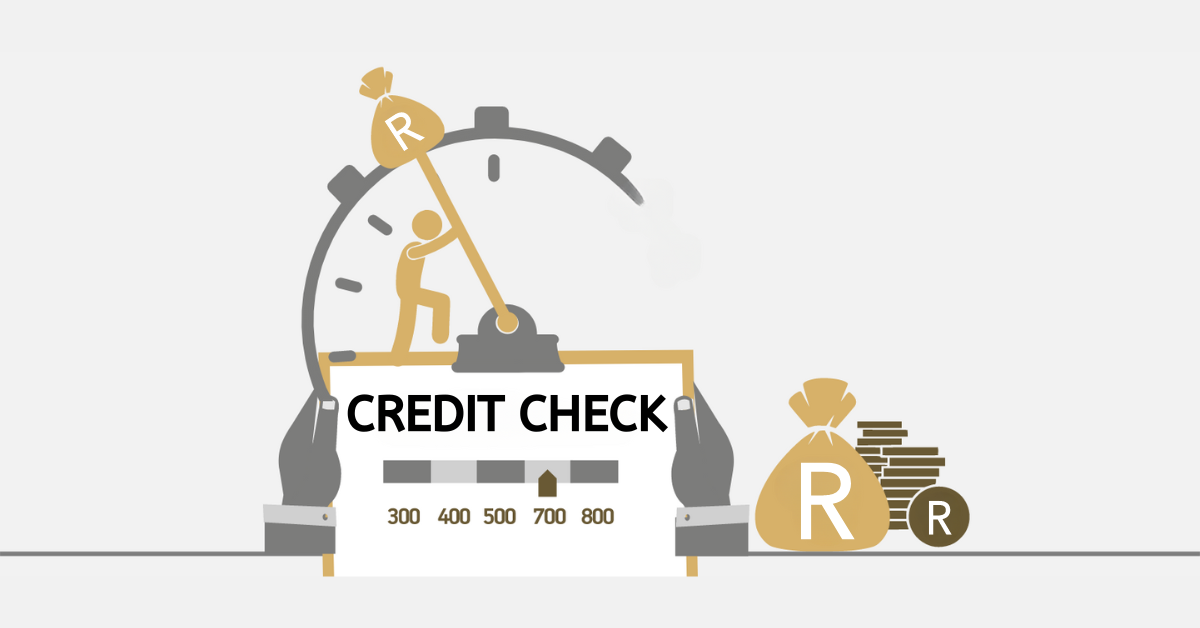

Credit assessments are allowed under the Rental Housing Act 50 of 1999 but only with the tenant’s written consent and may only be processed by the landlord/letting agent. A financial dossier, the credit score details the tenant’s capital score, payment history, and outstanding debts, amongst other associated material.

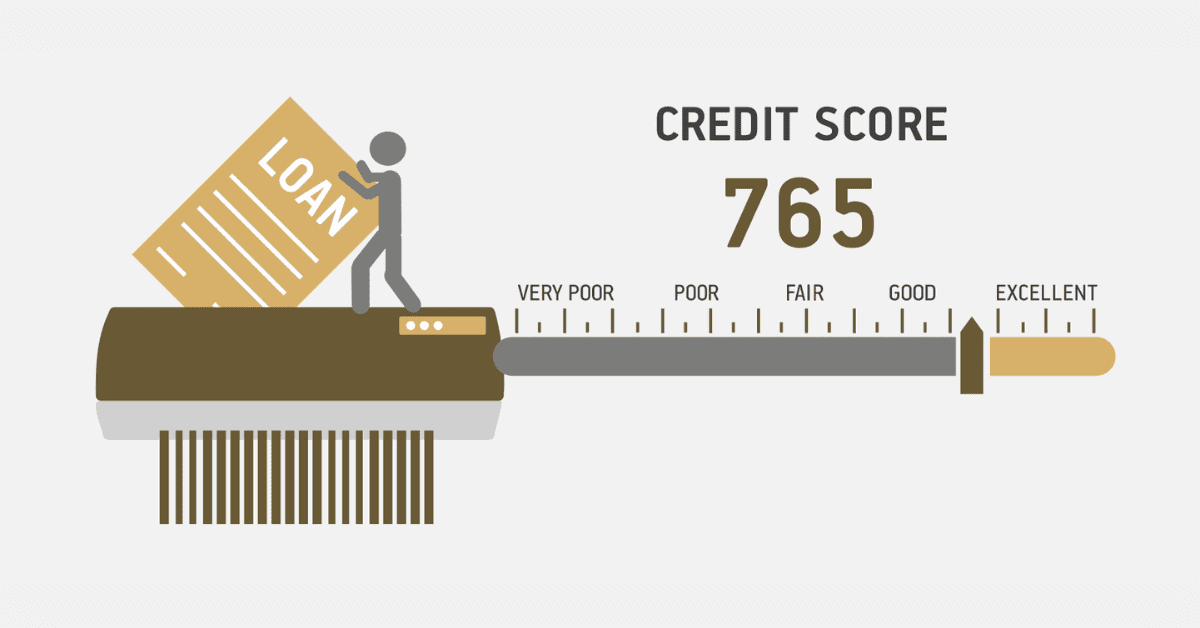

A credit score is a rating from 0 to 999 or 0 to 1200, showing your credibility of credit valued against your financial behavior. Generally, this can be considered good if it is above 650 and extra good if it is above 700. Scores that are this high influence rental approval odds, influence tenants to ask for lower deposits or rent based on their eligible eviction protection, and enjoy better terms, among other basic reasons.

However, it is not all about ratings. A string of positive credit information like long credit history, low credit utilization ratio, and different credit types can offset a low score. On the other hand, limited or negative credit history, high credit utilization ratio, and single credit type can hinder loan approval.

Does Paying Rent Build Credit?

Punctual rent payments can boost your credit score, but only if reported to credit bureaus. Not all landlords do this, leaving tenants unable to leverage their timely payments. However, there are solutions. Renting through a professional agency that reports to credit bureaus like TPN or PayProp ensures your payments are recorded. This data is shared with other bureaus, reflecting your creditworthiness. Alternatively, request your landlord or agent to report your payments or manually join a rental reporting program. This might require proof of payments and a fee, but the potential credit score boost and future benefits could make it worthwhile.

Steps To Using Bad Credit To Rent An Apartment

Poor credit may make house hunting difficult, but not impossible. Consider these alternatives:

- Boost your deposit: A larger deposit reduces the landlord’s risk and demonstrates your commitment, potentially improving your approval chances by lowering your rent-to-income ratio.

- Shop around: Landlords and agents vary in their requirements and rates. Use platforms like Property24, Private Property, or Gumtree to compare rental properties and prices. A credit score calculator can help estimate monthly rent and interest.

- Improve your credit grade: Clear arrears promptly, cut debts, dispute credit statement mistakes, and apply for fresh loans sparingly. Regularly examine your credit ratings and records to track progress and view improvement sections. Over time, this can qualify you for better deals and rent savings.

How To Increase Your Credit Score Before Renting An Apartment

Enhancing your credit grades before renting might be realized via these moves:

- Timely Arrear Payments: Clear all arrears, including utilities, cellphone fees, etc., on time and at 100%. This reflects your financial reliability.

- Exceed Minimum Payments: Pay more than the minimum on bills, especially credit cards and loans. This cuts your debt and credit usage percentage, improving your grades.

- Settle Credit Card Arrears: Clear credit card arrears quickly or maintain them below 30 percent of your curb. This frees up credit and improves your score.

- Keep Low Credit Usage: Keep your loan usage below 30 percent to display perfect credit control.

- Avoid Unnecessary Loans: Don’t process fresh loans unless required. It generates hard inquiries, lowering your score.

Is A Good Credit Score Needed To Rent?

This is not a query with a yes or no straightforward response but generally relies, going forward, on different aspects that enclose your rental case, such as the landlord, the letting agent, the rental field, and the rental apartment. However, having a good credit score could be needed to help the tenant rent an apartment as it indicates, to some degree, the financial condition or the creditworthiness of a tenant. The tenant can also be able to access better deals where, with a good credit score, they can reduce their deposit, the required rent, and interest.

However, apart from a good credit score, it is not the sole factor critical while renting an apartment. Landlords and letting agents consider the tenant’s income, employment history, rental history, landlord or agent references, guaranteed rent, and personal circumstances. So, while the potential tenant may possess a positive credit score, other requirements for documents and information to assure their suitability and compatibility status for the prospective rental property are crucial. Similarly, a tenant with a bad credit score may still be able to rent an apartment if they can present other evidence and assurances to pay for and take care of the property.