Your credit score, a three-digit number, is the key to your financial freedom in this growing world. Your credit score is an essential indicator that lenders consider when assessing your ability to repay loans and it significantly influences your financial prospects. Your credit score serves as a gauge of your financial responsibility. It gives lenders insights into your debt management, loan repayment frequency, and overall financial responsibility.

The primary objective of credit scores is to assess the level of risk associated with lending money to specific individuals.

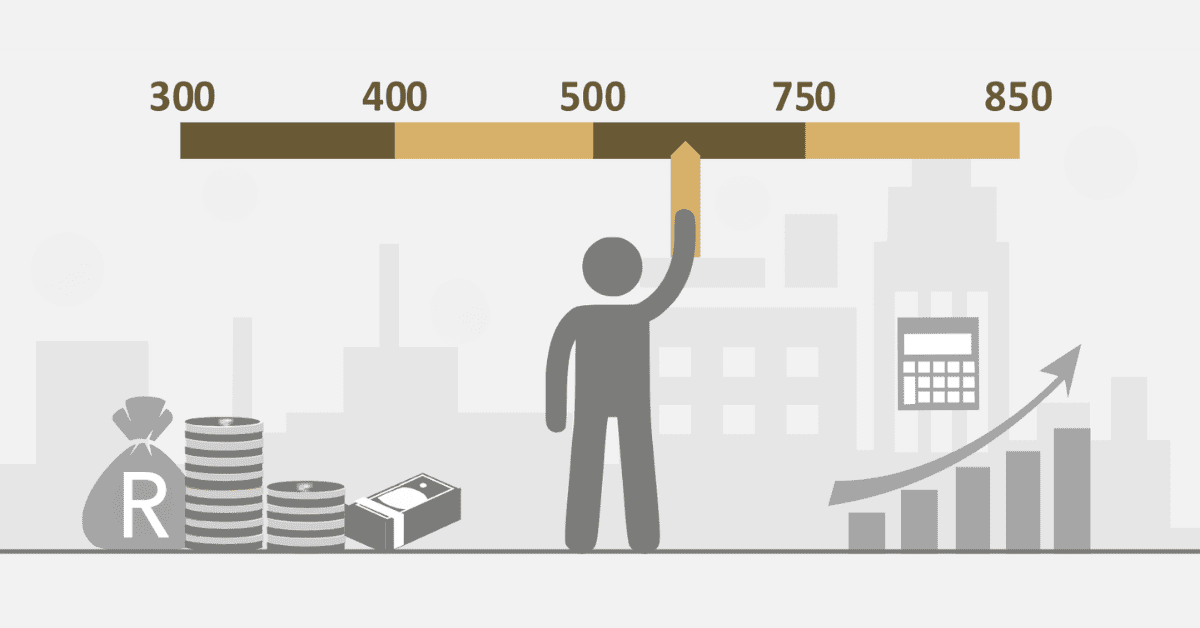

People are categorised into different risk levels based on their credit scores, which can range from 300 to 850. A higher score can improve your chances of obtaining loans and credit cards with favourable interest rates, as it indicates that you are at a lower risk.

Understanding the factors that impact your credit score, such as your payment history, credit utilisation, and credit history duration, empowers you to make wise financial decisions.

Your credit score ratings tell a lot about an individual and therefore we are going to share with you what they mean.

Credit score ratings and what they mean

It is essential to have a clear understanding of your credit score when navigating the financial landscape. This three-digit number is typically calculated using a formula that takes into account various factors and usually falls between 300 and 850.

Several factors contribute to your credit score, such as your payment history, the length of your credit history, outstanding balances, overall debt levels, and the number of credit accounts you have. Lenders rely on credit reports, which are compiled by credit bureaus, to evaluate your creditworthiness. Your credit score has a significant impact on the interest rates you’re offered and the approval or denial of your loan applications. Lenders use your credit score to assess the risk of lending you money.

- Payment history (35%): This includes how often you’ve paid your bills on time in the past. If you’re late on payments, fail, or go bankrupt, it can hurt your score.

- Credit utilisation (30%): This is the amount of money you owe on your credit cards compared to the amount of credit you have available. Generally, it’s good for your credit score to keep this number low.

- Credit history duration is (15%): This is how long your credit accounts have been open. Most of the time, having a longer credit background is good for your score.

- Credit types used (10%): The different types of credit you have, like mortgages, credit cards, and monthly loans.

- New Credit (10%): You may see a short-term drop in your score if you have recently applied for a new credit.

Here are the credit score ratings and what they mean.

- Credit score under 300: No credit will be given for scores under 300. If you have not opened any credit accounts, you have no credit history. This offers a fresh start, giving you the chance to establish a strong credit history.

- 301-579: Below Average: Having a poor credit score is usually the outcome of a credit history that has been marred by numerous defaults on different credit products and lenders. Bankruptcy can have a significant impact on your credit score, remaining on your credit report for a duration of up to seven years. Rebuilding your credit can be quite challenging, so it’s a good idea to seek guidance from a financial advisor.

- 580-669: Acceptable: A credit score that is considered “fair” may be the result of some minor negative impacts on your credit history, without any significant problems. Although the options for interest rates may be somewhat limited, they are still accessible.

- 670-739: Satisfactory: An average credit score, which is considered good, makes you eligible for competitive interest rates. However, it may be more difficult to obtain certain types of credit at favourable rates. It is advisable to compare different loan options to find the terms that best suit your circumstances.

- 740-799: Excellent: A high credit score demonstrates responsible financial management and presents a lower risk to lenders. Timely payments and avoiding loan defaults are crucial for maintaining a good credit score.

- 800-850: Outstanding: Making timely repayments and managing credit effectively can lead to a strong credit score. People who have a strong credit history may be eligible for reduced interest rates on credit cards, loans, or mortgages, as they are seen as highly reliable in terms of making payments on time and avoiding defaults.

What credit score ratings mean?

A credit rating is commonly used as a measurement within a broader credit rating system. This system covers a wide range of credit portfolios and uses various methods to measure and assess credit risk. It also considers the potential for a credit rating. Typically, a credit rating is determined using a restricted rating scale.

What is a good credit rating in South Africa?

In South Africa, a good credit rating confirms the creditworthiness of an individual. One’s ability to repay loans can be explained through their credit score rating.

Although there are 5 levels of credit scores, a good credit score rating allows you to request for mortgage, car loan, business loan or any other loan. Once you have a good rating, your qualification to secure loans becomes easy and simple.

What are the 5 levels of credit scores?

The 5 levels of credit score represent numbers and indicate the performance indicators of individuals. Each level explains itself and can be denoted with the remarks attached to them.

Below are the 5 levels of credit scores and their remarks.

Poor: 300 – 580

Fair: 581 – 669

Good: 670 – 739

Very Good: 740 – 799

Excellent: 800 and above

How to read credit score South Africa?

Credit score reading could be simple and complicated at the same time. The readings involved a numerical understanding of your ability to repay loans on time and diligently.

When you plan to read credit score you must first understand the dynamics of a credit score and what constitutes it.

There are credit bureau support systems that can thoroughly explain the credit score system. If you wish to read credit score you must be well versed with credit bureaus and your financial transactions.

The scores could be self-explanatory as their remarks associated with the numbers indicate how well you have performed. In this instance, you can read and indicate whether a score is bad or good.