For many South Africans, owning a cell phone means taking out a contract with a cellular network. You will pay a fixed monthly fee covering the data/voice package you choose and the cost of your handset over a fixed period. Most cell phone contracts run for 24 months, or two years, and can then be canceled or renewed. This means that cellular companies work as credit providers, and means many of the same facets of credit history come into play when applying for a cell phone contract. Today we’ve assembled some things everyone needs to know about credit scores and cell phone contracts in South Africa.

What Credit Score Do You Need for a Cell Phone Contract?

Technically speaking, there is no minimum credit score to qualify for a cell phone contract in South Africa. However, that is only technically. In reality, as a postpaid service, especially one that lets you walk off with a rather valuable asset in hand, cell phone contracts need you to meet the same requirements as any other loan. And that means a strong credit score.

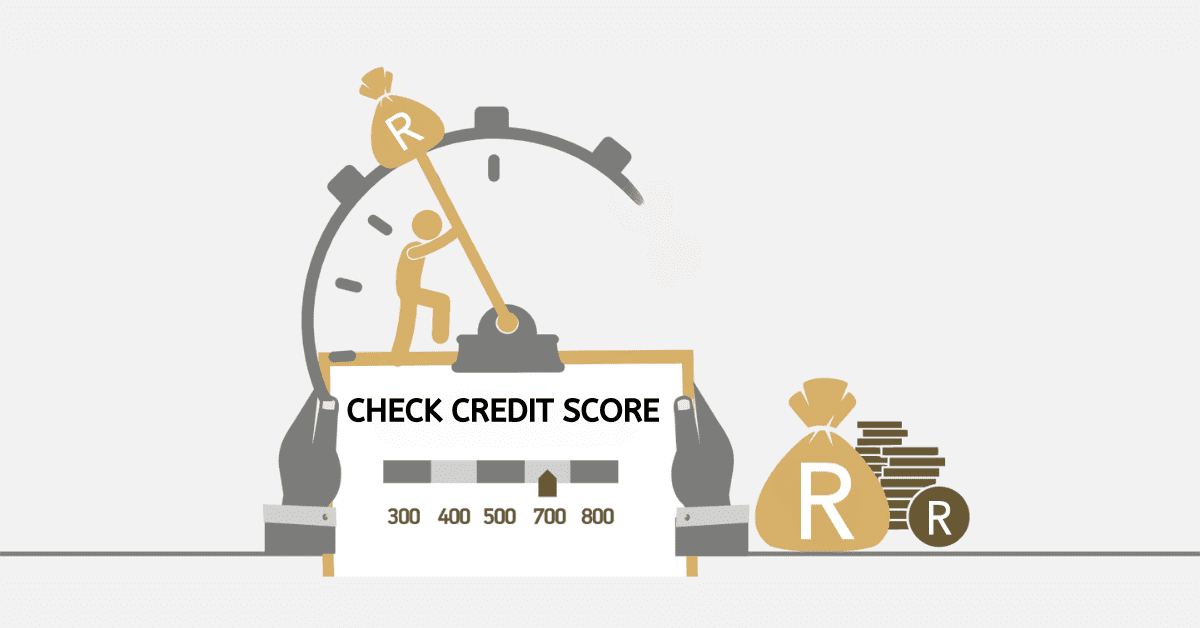

Additionally, more South Africans are being declined for new cell phone contacts than are receiving them. So it is clear our generally poor credit habits are turning cellular providers off. Bear in mind that the national average credit score, 560-580, is considered ‘poor’ by the credit bureaus! We strongly suggest that you get your credit score into the ‘good’ range (670 plus) before taking out a cell phone contract. Even though it technically doesn’t matter.

What is the Lowest Credit Score to Get a Phone?

What is the lowest credit score that will still get you a contract phone? Nobody knows! In addition to standard credit checks, the major 4 networks all use their own scorecards to assess your credit risk. And they are rather stringent, as the number of South Africans being turned down aptly demonstrates.

This shows that they are judging our credit scores rather harshly, but they aren’t very transparent about the criteria they are using. So while we can’t tell you exactly what credit score will look good to them, we highly suggest getting yours into the 600s at least before you apply.

If that seems impossible right now, know that non-major cell phone contract providers (i.e. not 8ta, Cell C, Vodacom, or MTN) are often more lenient. Some even advertise themselves as friendly to those with a low credit score. You may have better luck with them.

Do You Need a Credit Score for an MTN Contract?

Yes, you will need to undergo a credit check for an MTN contract, and they will assess your credit score as part of their wider scorecard to see if you qualify.

Who is the Easiest to Get a Phone Contract With?

The biggest cellular operators in South Africa, namely MTN, Vodacom, Cell C, and Telkom/8ta, all work on very similar credit history requirements, and none are particularly ‘easy’ to get a phone contract with. However, there is a burgeoning number of smaller cellular providers who are less stringent. Capitec, for example, now offers its own sim range, and they can draw from banking data they have for you. These would be your best bet for an easy phone contract. Alternatively, you can consider going through one of the existing third-party ‘mobile deals’ sites that offer contracts to people with poor credit history. They often over-promise and under-deliver, but you may get lucky.

Why Am I Being Declined for a Phone Contract?

This will be a frustrating answer for many South Africans, but no one is quite sure what goes into being declined for a phone contract. In recent years, the press has reported that up to 80% of South Africans trying to take out a new cell phone contract, rather than reissue an existing one, have been declined. However, the bulk of these come back to poor credit history that the applicants haven’t uncovered until after they have applied. It is no secret that many South Africans have poor credit and financial habits. While a few thousand for a data contract and handset are small fry next to credit card debt and other loans, they are still a loan and operate on many of the same criteria.

If that shoe doesn’t seem to fit, know that the cellular providers in SA each have their own ‘score card’ they use to assess creditworthiness alongside your credit history with the credit bureaus- and they play their cards very close to their chest. You may be pinging another facet of their scorecard without realizing it. As we don’t really know what those criteria are, it is tough to offer advice. All we can suggest is taking a step back, a deep breath, and getting a holistic picture of your financial circumstances. Make sure you are earning a good salary, have a lower debt-to-income ratio, pay your bills on time, and otherwise practice good credit habits. Consider pulling a credit report from the main credit bureaus to make sure no fraud or false information is impacting your credit profile. And try a different provider.

Cell phone contracts are becoming a frustrating thing indeed for many South Africans. You can best position yourself as a great choice by working on your credit score and ensuring you look like an excellent credit risk. While it carries no guarantees, you won’t lose anything by it- and it may be the secret ingredient to unlocking the phone of your dreams.