Credit scores hold a lot of information that can help you get ahead financially. Your financial situation could get better if you understand how your credit score works. Many people are worried, and a hot question comes to mind: How quickly can your credit score go up after paying off your debts? When you look deeper into this financial puzzle, you might find answers that will change the way you build your credit. Come with us on a journey where understanding meets action as we explore the complexities of improving your credit score and finding the fastest way to a better financial future.

Our focus in this blog post will give an insight into how fast credit scores increase after settling debt.

How fast does a credit score increase after paying debt

Clearing your debt has the potential to boost your credit score, although the rate at which it improves is influenced by several factors. Typically, you can expect to see some progress within a few weeks as credit bureaus receive updated information. However, it may take a few months for significant increases to occur.

Several factors can impact the rate at which you see improvements in your credit. These factors include the nature of your debt, the amount you pay, and your credit history as a whole. Settling high-interest credit card debt could potentially yield faster results compared to paying off a mortgage.

Other factors that credit scoring models take into account include your payment history, credit utilization, and the length of your credit history. Making payments on time and keeping credit card balances low is important for maintaining a strong credit profile.

Although it is important to repay debt, it is crucial to develop responsible financial habits in the long run to achieve a lasting improvement in your credit score. It is important to regularly monitor your credit report and promptly address any inaccuracies to maintain an accurate representation of your financial status. Being patient and consistently maintaining positive financial habits are crucial for improving your credit score in the long run.

Why does my credit score keep drop after paying off debt?

Paying off debt is a significant accomplishment, but it’s important to note that it can decrease your credit score. Although it can be disheartening to witness a decline in your credit score, gaining insight into the reasons behind it can empower you to develop a strategy for improving your score.

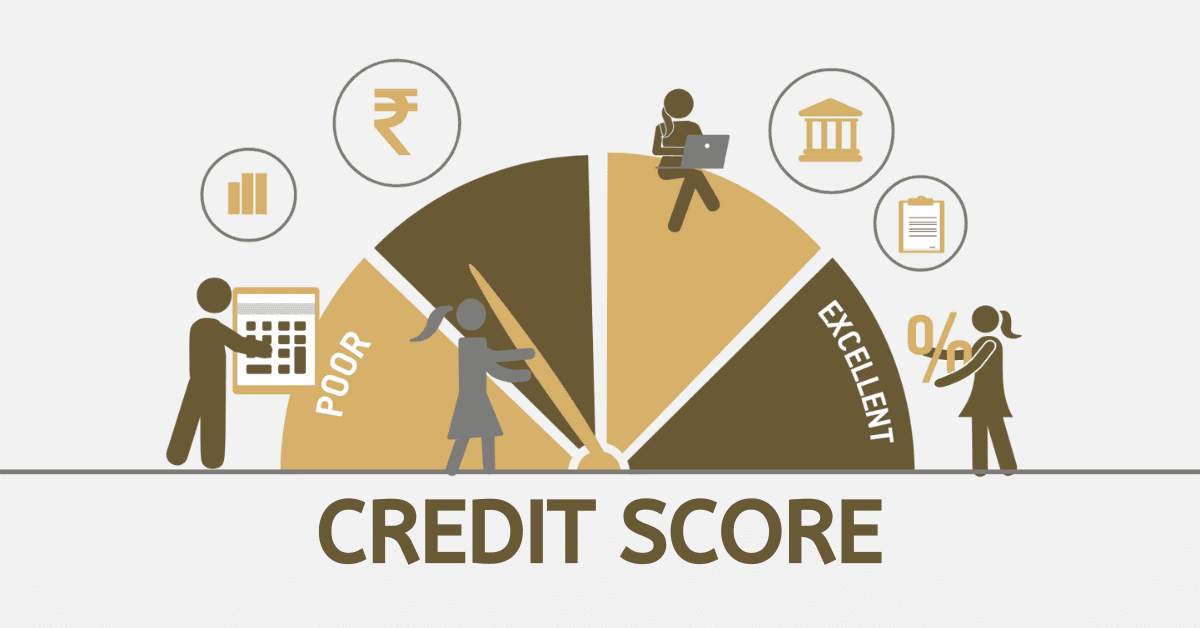

Various factors contribute to your credit score, extending beyond just your debt. Several factors, including your credit utilization ratio and average age of debt, play a role in determining your credit score. Gain insight into the various elements that influence your credit score and learn effective strategies to maintain a favourable score even after settling your debts.

Credit scores are determined by a specific formula and serve as an indicator of your likelihood to repay a loan promptly. However, it’s important to note that even though paying off debt is generally a positive step, it could potentially have a negative impact on your credit score if it alters your credit mix, credit utilization, or average account age.

There is a common misconception about credit scoring that suggests closing an account will not affect your credit scores. It’s possible that’s not always true.

If you successfully clear your loan and maintain a good payment record, your positive account history will continue to have a favourable influence on your credit scores.

However, if you fail to make payments before fully repaying the loan, those missed payments can still negatively impact your credit scores.

Will Paying Off Debt Impact My Credit Score?

Your credit scores may decrease even after you have fulfilled your payment obligations on a loan or credit card debt. Clearing your debt could potentially impact your credit scores if it influences factors such as your credit mix, credit history length, or credit utilization ratio.

It may take some time, but paying off your debt can lead to an improvement in your credit score over time.

What happens if I pay off all my debt at once?

Clearing all your debt in one go can offer instant financial relief as it eliminates interest payments and boosts your credit score. It helps to alleviate stress and allows for more financial flexibility to save or invest.

However, it’s important to keep in mind any potential prepayment penalties and make sure you have a sufficient emergency fund.

Consider the potential benefits of assessing long-term financial goals and determining if investing the lump sum could result in greater returns.