Modern plastic money, in the form of credit cards, simply prepares holders to shop immediately when they do not have money. Such convenience, however, could come at a price, particularly at the petrol pumps, where credit card users will get amounts above the rate at which the fuel is purchased. This is not just a simple bother but a big deal for most credit card users who depend on it daily. This paper further expounds on the reasons for levying such extra charges, the consequences of overcharging them, and the steps the consumer will likely take to handle the issue.

Why Does My Credit Card Charge Extra For The Petrol Pump?

Service stations may also charge an additional credit card or fuel surcharge. But there are reasons for that.

- Transaction Cost: The transaction cost could attract between 1% and 2.5% of the value of the petrol transaction to the credit card companies. Then, the petrol outlets would pass the cost down to the customers to preserve their profits.

- Fuel Surcharges: This is a surcharge put on every transaction done at the petrol pump as an adamant fee put up either as a percentage of the purchase or generally as a fixed fee.

- Pre-Authorization Holds: Every once in a while, an automated fuel dispenser requires performing a pre-authorization hold so the card works and has money. The actual charge goes through, and the hold is taken off afterward, which may have looked like an additional charge.

- Charging of Surcharges: Gas stations and others are poised to surcharge the credit card users to at least recover the transaction cost for the card. It puts restrictions on the value depending upon which region.

- Cash Incentives: Some merchants encourage cash-based payments by adding credit card surcharges to avoid transaction fees.

What Happens If Your Credit Cards Get Overcharged?

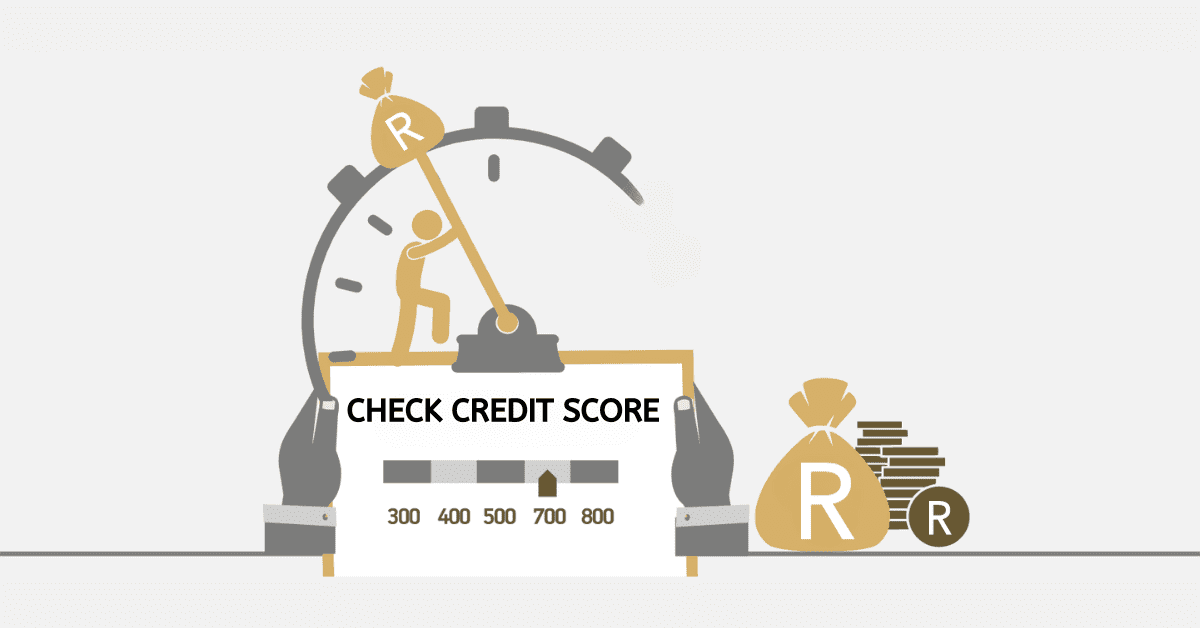

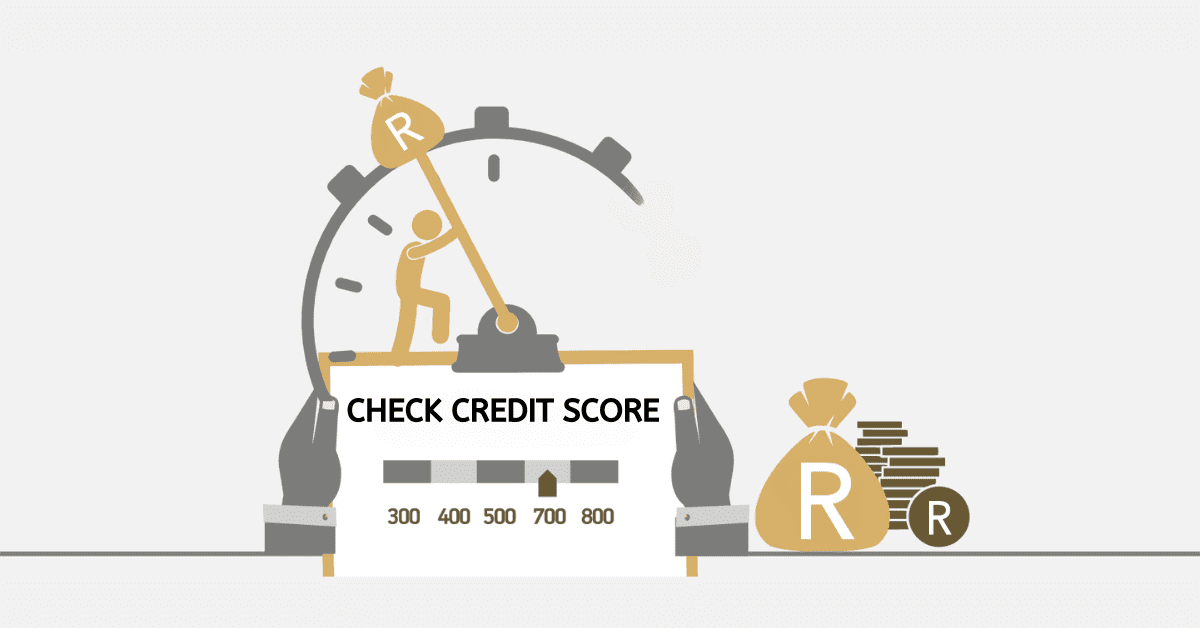

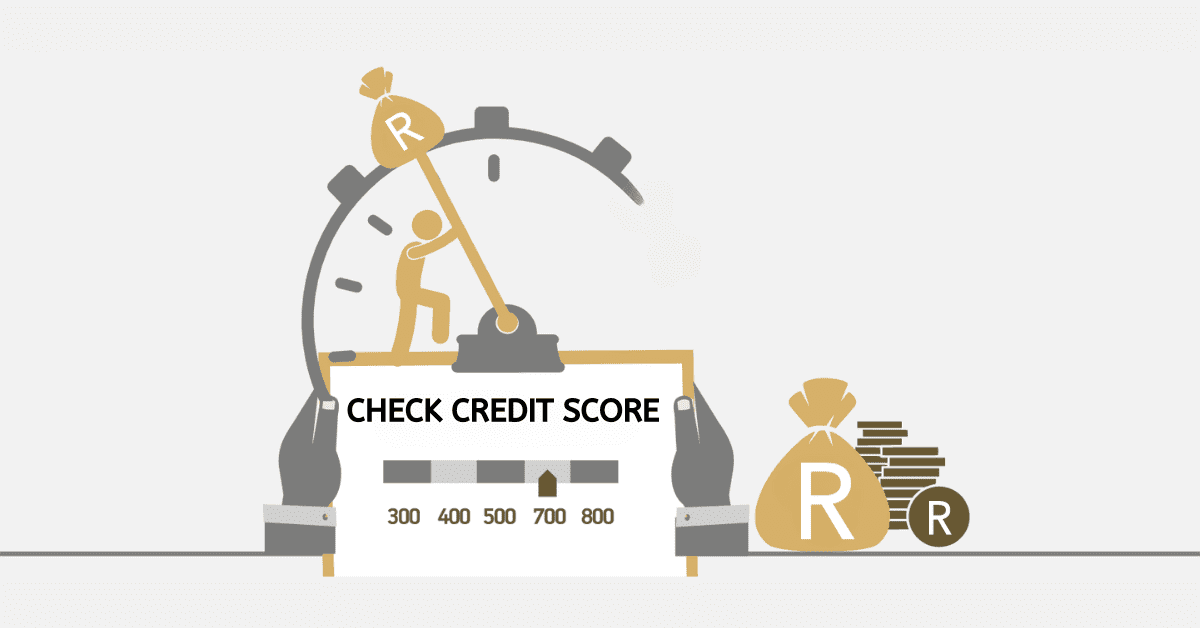

Nothing is depressing than being overcharged on your credit card, but you are protected. Examine your bills for additional charges. They might have been billed erroneously, there may have been double billing, or you were scammed. Delaying action in such events could hurt your credit rate.

Dispute for any billing inaccuracies with the issuer immediately. Be sure to approach the merchant in case of errors in the billing – most will correct the mistake immediately. Write your issuer at the billing inquiry address with information on the transaction within 60 days of the statement and the nature of the dispute.

Your issuer is to acknowledge your dispute within 30 days and make a decision within 2 billing cycles. During that period, you owe nothing regarding the disputed amount, and under no circumstance shall the amount be reflected in your record.

Overcharged payments require the issuer to correct the error and cancel the finance charges. They will need the payment plus the interest if the charge is legitimate. Overpayments require a seven-day refund by the issuer.

Should You Use A Credit Card At The Petrol Pump?

Using credit cards at petrol pumps will provide a convenient and secure payment. Consider this:

- Convenience: Credit cards allow quick transactions at the pump, saving you time.

- Tracking Expenses: They can help you easily track your spending on fuel.

- Rewards: Many credit cards offer prizes or cashback on fuel purchases.

- Security: Money with charge plates is safer from theft than cash or a debit card. In most circumstances, the issuer reverses the fraudulent transactions.

- Credit Score: Regular use and prompt payment can help build your credit score.

How Do I Complain About Credit Card Overcharging?

If you’ve been overcharged on your charge plate, here’s how to complain:

- Contact the Merchant: Contact the business overcharging you to seek a resolution.

- Contacting the credit card issuer: If all the above fail, always contact the credit card issuer. You can make contact via an online account or mail.

- Documentation: Provide any relevant receipts or docs to support your claim.

- Customer safety: you have every right to file a complaint with the Bureau of Consumer Financial Protection.

Why Do Gas Stations Charge Extra For Credit?

Many gas stations surcharge cards to recover interchange fees charged by payment networks such as Visa and Mastercard. The fees are a percentage of the transactions, and a gas station could easily pass on a fraction of that cost to the consumer to achieve its targeted profit margins. In some simple forms, some stations offer a cash discount instead of a credit surcharge, which tends to encourage payments in cash.

What Is The Best Credit Card To Use For Fuel?

A fuel card offers improved credit on fuel-related purchases. Annual fees, the nature of rewards, and the structure of rewards must always be checked to find a card that suits one’s profile of fuel spending. Always compare current offers online to be sure you get the best deal.