These are generally tangible assets. They include metals, energy resources, and agricultural products. In SA, commodities investing runs deep, buoyed by the country’s mineral-rich land and agricultural produce. The commodities market usually avails a stable investment avenue against market fluctuations in world markets for diversification and protection against economic downturns. It is paramount that both amateur and professional investors have deep knowledge of the local commodities market to realize opportunities and mitigate risks.

How to invest in commodities in SA

Options to invest in commodities in South Africa, besides being different in core respects, also depend on one’s experience, risk tolerance, and capital. Therefore, the following are the main options available:

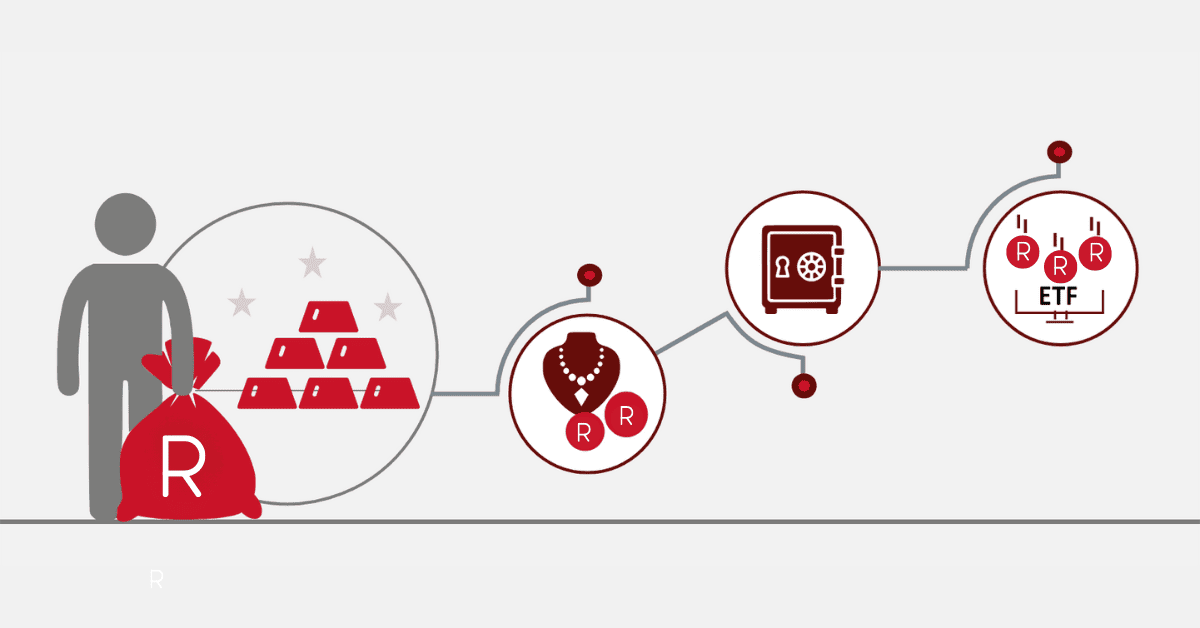

- Physical Commodities

Buying physical commodities, such as gold bullion or agricultural products, is straightforward. One can buy gold from dealers or institutions like the South African Mint. Besides this, there is an added cost of holding them and keeping them safe.

- Commodity Futures

It allows you to speculate on the price of a tangible asset at a future date. The JSE offers quite a few different future contracts in tangible assets, including maize, sunflower seeds, and crude oil.

- Exchange-Traded Funds

ETFs are an easy way to be exposed to tangible assets. They track the performance of a particular commodity or a basket of tangible assets. An example is the NewGold ETF. This one tracks the price of gold and trades it on the JSE.

- Commodity Companies’ Shares

One can also purchase shares in companies that deal with producing or mining these commodities. These include AngloGold Ashanti for gold exposure and Sasol for exposure to energy.

- Online Trade Platforms

Access to commodities and commodity-related assets has been made relatively easy online for South Africans through EasyEquities or GT247.

What are the Five Key Commodities in South Africa?

South Africa is known throughout the world for possessing many natural resources. The following are the top five commodities headlining in the market:

- Gold

South Africa has a rich gold production history and is still among the leading world producers. Gold will also be in massive demand since it possesses excellent investment potential and is a hedge against inflation. Locally, capitalists may expose themselves to gold via ETFs or futures or directly from dealers.

- PGMs

It is the world leader in platinum. It’s the second largest in palladium and the third-ranked in rhodium. All three are in heavy demand by the automobile industry in catalytic converters to reduce harmful emissions. These metals are also seen to have increased applications in green techs.

- Coal

Currently, coal is South Africa’s major mineral commodity export, its chief source of mining employment, and its leading mineral energy source.

- Iron Ore

The more significant part of the exports is iron ore, a key raw material for steel production and, therefore, investment opportunities under the dominance of companies like Kumba Iron Ore.

- Maize

It’s one of the staple commodity crops of SA, whose trade is carried out both in international & local markets.

Can I Make Cash Trading Commodities?

Commodity trading may promise a good return, but how the process goes will depend on knowing the market, timing, and what strategy is taken up. Here’s how one can make a profit:

- Price Speculation

Capitalists stand to benefit from the changing values of commodities such as gold, oil, or maize. For instance, when the economy is in turmoil, the value of gold always appreciates, offering fantastic opportunities for astute capitalists.

- Demand Trends of Commodities

It gives one a sense of the trends in the world that helps one try to forecast which will be the most robust commodity. For example, with increased renewable energy, there is an increased demand for platinum and lithium.

- Leverage in Futures Trading

This allows traders to have more of the commodity given a smaller capital outlay. While this can mean more significant potential profit, it also amplifies risk.

- Passive Income via Dividends

It is another mode of investment different from speculation or direct commodity trading, and one can earn regular returns through dividends by investing in the shares of commodity-producing companies.

- Diversification and Risk Management

Commodities act like a hedge in your portfolio. Rising oil prices would decrease the losses in energy-intensive sectors like manufacturing.

Which is Better: Stock or Commodity?

Investing in either of the two-commodity or stock-would depend on one’s financial goals, tolerance for risk, and investment horizon. Here is a quick comparison to help:

- Potential for Growth

This is because stocks have a better potential to grow in the long run, their values being most influenced by the business profits and market growth. Generally speaking, commodity prices are affected by supply and demand. Usually, this will develop cyclic patterns in price.

- Volatility

Commodities tend to be more volatile due to good or bad weather conditions, geopolitical turmoil, or a change in foreign demand. Stocks bounce around a little, but their base is company performance and general economic performance.

- Hedging Against Inflation

Commodities, particularly gold and oil, make for fantastic inflationary hedges, as they retain purchasing power when the values of currencies fall. Stocks are less efficient at this.

- Liquidity

Both commodity and stock markets represent liquid markets; however, the former shows higher trade volumes and better accessibility. For the beginning investor, stocks may be more easily traded.

- Dividends

In addition, stocks come with dividends on top of their long-term return possibilities. This is not true of commodities, which give no income unless held indirectly through an ETF or shares.

- Risk Profile

Commodities are more volatile in the short run and might provide stability during economic turbulence. Stocks are more stable for longer-term growth, although they underperform during certain market conditions.

Closing Thoughts

The investment in commodities in South Africa ranges from gold and platinum to agricultural commodities. Nonetheless, it requires knowledge of market dynamics, global trends, and handling risks associated with such investments. Moving ahead, locals use diversification and hedge against local economic risks using ETFs, futures, and direct share investments. Always consult a financial advisor to ensure these investments align with your goals. If well planned, this would turn commodities into a vital constituent of your investment journey.

![Internal Rate of Return [IRR] – Calculation](https://www.searche.co.za/wp-content/uploads/internal-rate-of-return.webp)