As an international student, your liberty to earn and spend can be very limited. These limitations are already set during the application process. Your documentation submitted informs the embassy and the school about your income and expenditures.

This means international students are capable of fending for themselves without needing credit. But what happens when an international student wants to buy anything expensive? Well, that could certainly raise a flag.

In most developed countries, individuals need credit to purchase expensive items. These expensive items are put on your credit for monthly payments. These things restrain many students as they need help to acquire credit. But what if an international student acquires credit; what are the needs? How can an international student check his or her credit score?

This topic can be devious as the requirements and the geography also matter. But what if you find yourself in South Africa?

This is why our blog will focus on the South African context, taking our audience through how to check credit scores for international students.

Do I have a credit score as an international student?

Credit score is not an automated system offered to international students. The point of credit score is to provide credit support for individuals looking to purchase items.

As an international student, you do not have a credit score. You need to apply but must meet the minimum requirement.

The credit score application process requires an identification card. So, imagine you have moved from Ghana to South Africa to study. You need to have a citizenship ID, residence, or work permit before you can apply for credit as an international student.

How can I check my credit score as an international student?

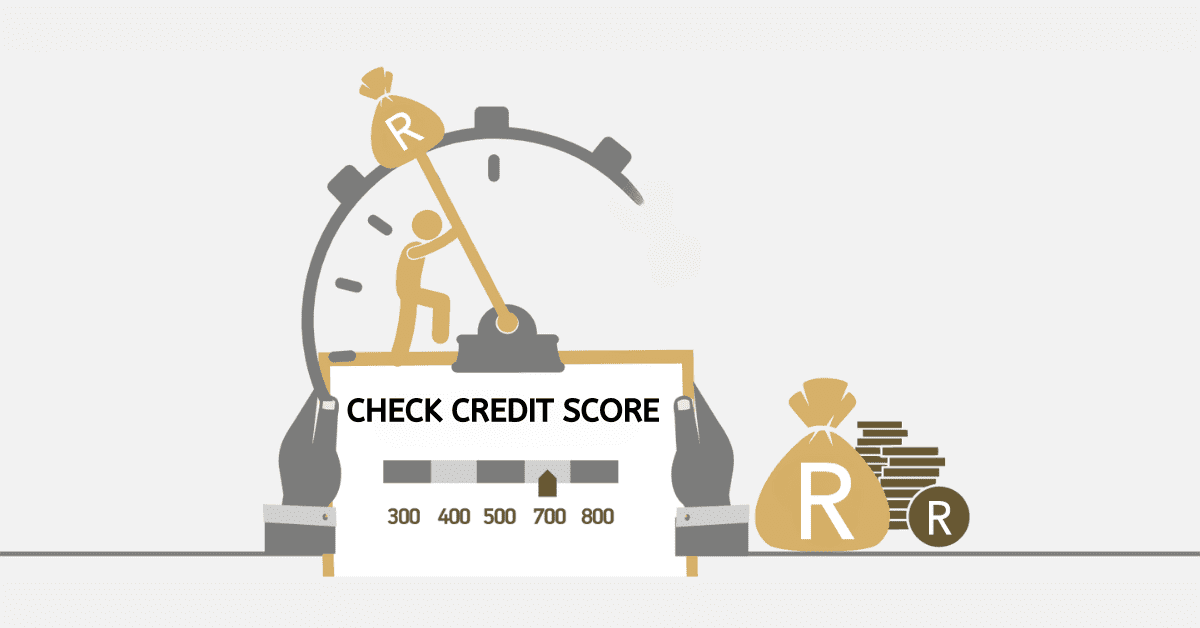

It is very important for international students living in South Africa to know how to handle their credit. Keeping an eye on your credit score is important if you want to keep track of your money. Your credit score, which shows how trustworthy you are, has a big effect on your ability to get loans, rent an apartment, or even get a job. How does a student from another country who is learning in South Africa check their credit report?

Credit reporting agencies in South Africa get information about their customers’ credit from many places to create credit reports and scores. There are three important credit reporting agencies in South Africa: TransUnion, Experian, and Compuscan. Credit bureaus

For most credit applications in South Africa, you need to have a valid residency card and also a work permit as well. These papers show that you are legally in the country, so you will need to show them when you apply for a credit card or start a bank account.

Once you have a bank account and all the necessary permits, you can start the loan application process. You should never borrow more money than you can pay back, whether it’s for school or a store account. To keep a good credit score, you need to take money responsibly and pay it back on time.

For good credit, you need to keep an eye on your record with one of the three main credit bureaus. Each of South Africa’s three main credit companies will give you one free report a year. By going over your credit report again, you can quickly find and fix any mistakes or inconsistencies.

In South Africa, there are several places where you can get services to keep an eye on your credit score. These sites not only make it easy to see and understand your credit score, they also give you tools and knowledge to help you do it. Keep an eye on your credit score with these tools.

If you know which credit company your account is linked to, you can go to their website. Sign in to get a copy of your credit report. This is where your credit score will show up.

How to build a credit history as an international student?

As an international student, there is one key thing that can help you build your credit quickly and better. Certainly, the offers and payment may not be the same for someone who is already a citizen of South Africa as compared to an international student.

But should you have credit rolling, here is the number one key factor that can build your credit history.

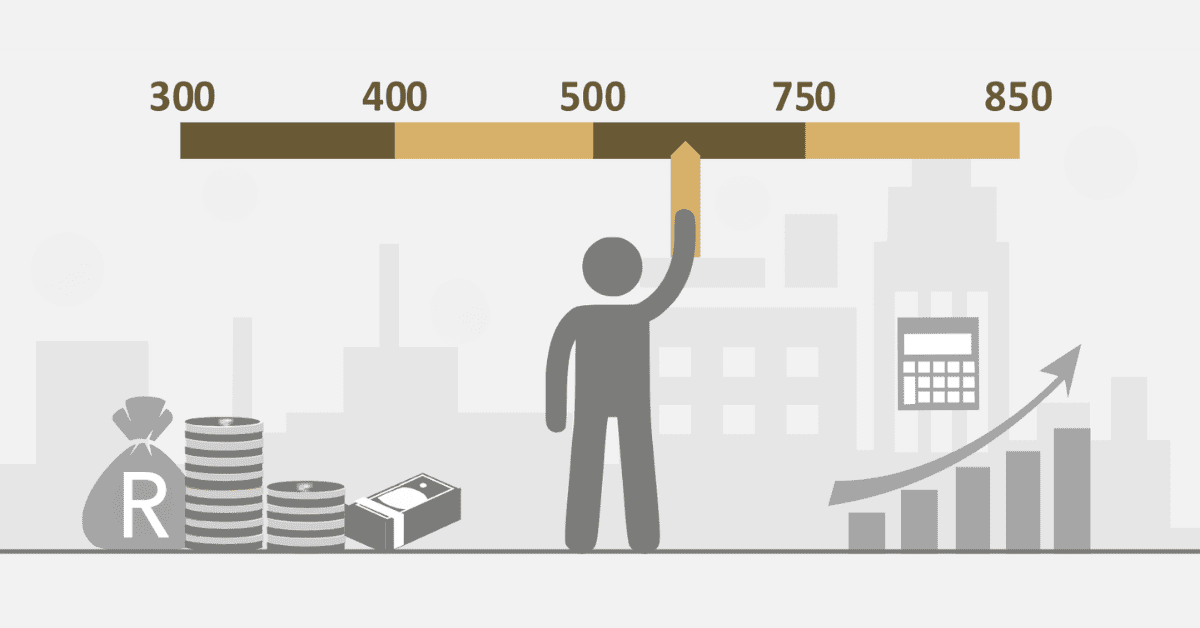

Always ensure to apply for minor credit so you can pay them on time and diligently. Doing this for 6 months can shoot your credit score from 350 as a fresher to 800.

However, there are other things that can influence your credit history building as an international student.

You can also open a bank account (like a savings account) and show that you know how to handle money by making deposits into it over time. This won’t show up on your credit record, but it does connect you with that bank. If you have been a good customer for a while, ask for a credit card at the same bank. They may be more likely to give you a card when other people wouldn’t because they know more about you.

Certainly, there are other ways one can build a credit history as an international student. Paying bills on time, borrowing within your means, checking your credit score, and working on errors are all ways to help an international student build credit.

How many credits can an international student take?

In South Africa, international students can get any amount of credit they wish to have, but here is what you need to know first.

Although there is no discrimination against international students taking credit, they are seen as huge risks.

In a nutshell, an international student can be advised not to take more than two credits. This can easily be managed and monitored for credit building.