Due to its nature and accessibility, the SAP system can be complicated. This platform is designed to provide an exclusive process for credit checks, credit blocks, sales checks, credit limits, and more.

Many industries that are familiar with ERP and have customer control are always looking for ways to improve their SAP usage.

Individuals who are enthusiasts about the highly esteemed work of SAP tend to learn new things.

If you are here, we are going to take you through some cumbersome process on the SAP. This can only be done when you are already on the SAP platform or have some sort of orientation.

The focus will be on credit checks, credit check blocks in sales orders, and credit limits; all in SAP.

How to Check Credit Block On A Sales Order In SAP

Here are the steps you need to take to look at credit blocks in SAP sales orders.

- To begin, go to transaction code FD32 and enter the customer number and payment control area.

- Enter the amount of your card limit and save it.

- Change how credit is managed with the IMG path Credit Management and Risk Management are part of S&D’s basic functions.

- Set up account groups and type the credit group 01 into your sales document.

- Use the transaction code OVA8 to set up automatic credit control.

- After that, make a sales order in VA01.

- The system will show a warning message if the credit limit is reached.

- Use VKM1 to see sales papers that have been blocked and VKM3 to unlock the sales order document.

How do I see credit limits in SAP?

When you need to check a credit limit and are new to SAP, it is a simple process. This easy-to-follow guide will help you handle SAP credit limits more efficiently.

- Start by going to the “Maintain Business Partner” app.

- From the dropdown menu in this app, choose the job “SAP Credit Management.”

- Then, go to the part called “Credit Segment Data.”

- This is where you can learn useful things about a customer’s credit matter.

- Find the number that says “Credit Exposure.”

- This number shows how much credit the customer used.

- On the “I” information button, you can see a breakdown of the credit risk that gives you more information.

How do I release a credit block order in SAP?

Releasing a credit block order in SAP is an important step in ensuring that the business runs smoothly. To do this, you can use the tool RVKRED06 to simplify the process. This program automatically checks the customer’s credit and releases sales orders, ensuring that orders are filled on time and within the customer’s credit limits.

First, make sure that the RVKRED06 tool is set to run every day in the background. This program usually looks at sales orders that have not been processed yet or have only been partly processed. You will need to make an implicit change to the program, though, if you want to include orders that have been fully handled as well.

After this improvement is made, the program will choose sales orders instantly based on their status (A, B, or C). Orders with status C have been fully processed. Once the program is done running, it will check the credit state of the orders again. The function module SD_ORDER_CREDIT_RELEASE can be used to change the credit state of any orders that still have a credit block to “Released.”

By doing these steps, you can quickly and easily release credit block orders in SAP without having to do anything by hand. This will make sure that the order handling goes smoothly and the customer is happy.

Where is a delivery block in the sales order in SAP?

The many features of SAP can be difficult for new users to understand, especially when handling sales orders. Knowing where to find the delivery block is important. The SAP Manage Sales Orders—Version 2 app makes it possible to find delivery blocks.

To begin, users can easily see and set shipping blocks at the header level of the sales order list. This shows a big picture of all the orders and the blocks that go with them. When looking at a single sales order, there is also a tab just for progress and blocks that make things even easier.

For even more precise management, delivery blocks can be set at the item level within each sales order item. This level of detail makes it possible to keep track of each item’s delivery progress very precisely.

How does credit block work in SAP?

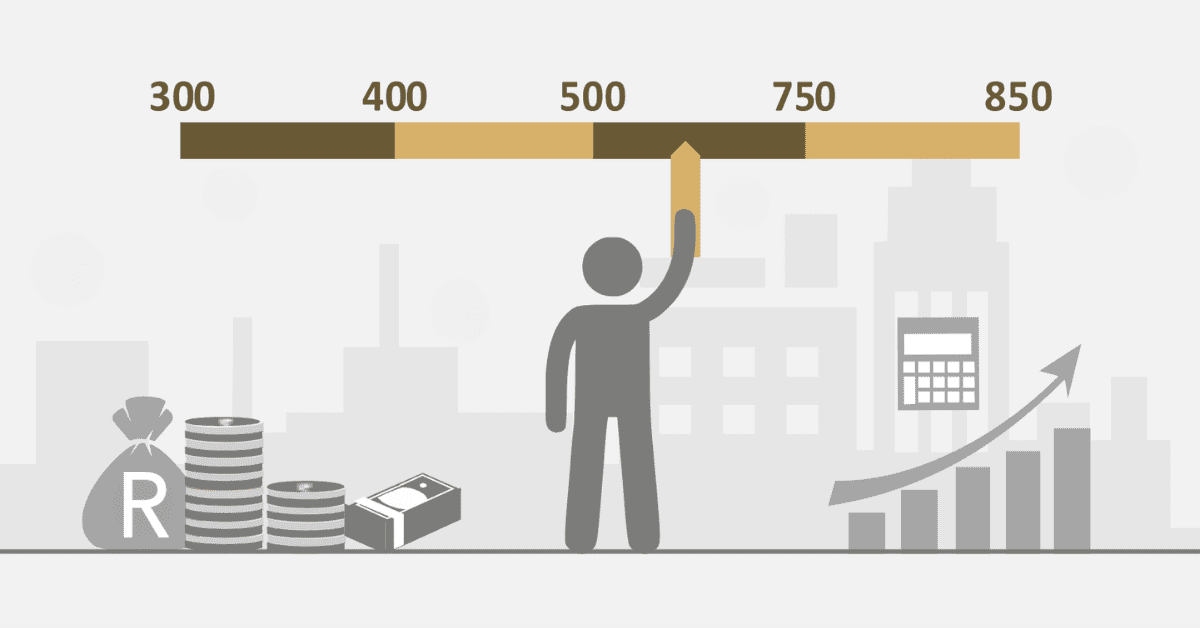

The word “credit block” in SAP refers to a method that helps companies keep track of the credit limits they give to their customers. SAP is the largest company that makes business software. It offers a full range of solutions for companies in many different fields.

A credit block is an important part of SAP that makes sure customers do not go over their credit limits. This block stops people from borrowing more than they can afford.

When a customer places an order with the company, SAP will check to see how much cash they have available.

SAP will immediately put a credit block on the order if the amount is more than this limit. This will stop the purchase from going through again until the problem is fixed. This keeps customers from getting into too much debt and helps businesses better handle their money.

Most of the time, either the customer or the sales team needs to do something to clear a credit block. In this case, you might need to call the finance department to raise the credit limit or make a partial payment to lower the amount that is still due. Once the problem has been fixed and the payment limit has been set correctly, the order can be processed.

In conclusion, SAP’s credit block feature is an important tool for businesses that want to control their credit risk and keep their funds stable. This helps businesses run smoothly and people handle their money well by ensuring that customers stick to the credit amounts that have been set for them.