eFiling by SARS allows registered users to perform several tasks and roles online and securely from the comfort of your home or office.

The Portfolio Management feature on eFiling allows eFilers the ability to use a single login to transact between their existing Portfolios. Once a portfolio is verified and linked to a Primary User

Completing eFiling processes for several portfolios at once can be tricky, but by understanding the process, you can get it done in no time. Here’s everything you need to know on how to manage your portfolios of eFiling:

How do I change my portfolio type on eFiling?

To change your portfolio type on eFiling, here’s what you need to do:

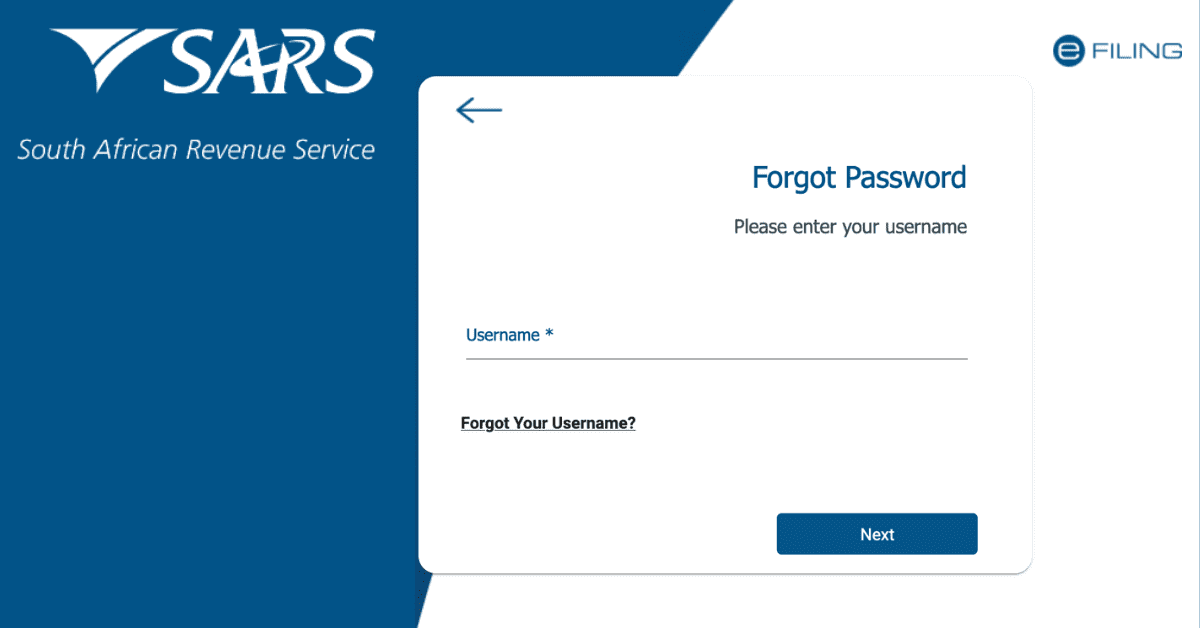

- Login to your SARS eFiling profile using your username and password.

- Click on ‘My Profile’ on the menu on the left pane.

- A drop-down list will appear.

- Click on ‘Portfolio Management.’

This will take you to your Portfolio Management page. You will be able to view all the linked and unlinked portfolios related to your profile.

- Click on the 3 dots (ellipses) and click on ‘Change Portfolio Type’ from the drop-down list.

- Select the option you want to change your portfolio type to (organisation, individual, etc.)

- Click ‘Save’ to submit your change and continue.

Note: You will be allowed to have multiple Organisation and Tax Practitioner portfolios; however, you can only have one individual portfolio linked to your name.

How do I make my portfolio more tax efficient?

Taxes reduce the return on investment in the same way that transaction costs and other fees do. Very few taxpayers understand exactly what they are paying different types of taxes for and how to maximize applicable allowances and incentives to positively affect their investment return.

While efficient tax strategies should be custom built according to personal circumstances, here are a few basic tips for almost any type of portfolio:

- Understand the different types of accounts that are available

There are 3 main types of accounts: taxable, tax-deferred, and tax-exempt accounts. Understanding the difference and benefits between these accounts can have a major impact on your bottom-line return when used correctly. Typically, it is advisable to place tax-efficient investments in a taxable account, while tax-inefficient investments are better off in a tax-deferred account. By holding all or most of your income in a taxable account with a relatively high tax rate, your net return on income may be significantly reduced.

- Understand Tax Brackets and Types

Income tax, which is more commonly known as Pay As You Earn (PAYE), is calculated on a sliding scale, meaning that the more you earn, the more tax you will pay. By understanding your tax bracket, you are able to calculate the rate of tax you will be liable for on any additional income that you generate or earn. This will help you make better investment decisions to minimize tax when investing additional funds.

Dividend Withholding Tax and Capital Gains Tax can also be made tax efficient when understood properly. For example, the first R40,000 of capital gains is completely exempt from tax, but any amount above that R40,000 is liable for Capital Gains Tax at a 40% inclusion rate and is taxed at your marginal tax rate.

- Favor Tax-Efficient Options over Tax-Inefficient

The final tip is fairly obvious. Your aim should always be to capitalize on tax-efficient investments such as common stocks, which are considered to be one of the most tax-efficient investments available. High-dividend stocks that are held in tax-deffered accounts are subject to minimal taxes, meaning that your net return will be higher than on other investments.

How do I get rid of tax practitioner access?

Individuals that want to remove or deactivate tax roles on their portfolio can do so by following these steps:

- Login to your eFiling account at www.sars.gov.za.

- Click on ‘User’ on the menu pane on the left.

- Click on ‘Tax Types.’

- Click on ‘Manage Tax Type.’

- Select the tax practitioner that you want to remove.

- Click on ‘Submit’. A list of actions will display.

- Click on ‘Remove Tax Practitioner Access.’

- Click on ‘Continue’ to confirm the removal of the selected tax practitioner’s access.

How do I unlink a portfolio from SARS eFiling?

If you no longer want to be linked to an existing portfolio on eFiling, you can unlink it using the following steps:

- Login to your SARS eFiling profile at www.sars.gov.za.

- Click on ‘My Profile.’

- Click on ‘Portfolio Management.’

You will see a list of the portfolios that are linked to your profile.

To unlink an existing portfolio:

- Click on the portfolio that you want to unlink.

- Click on ‘Remove.’

You will need to confirm your selection by clicking ‘OK. The portfolio should then move to the unlinked portfolios section of Portfolio Management.