Capitec Bank has gained significant popularity in South Africa due to its user-friendly interface and innovative banking solutions. Many people in South Africa are fond of Capitec’s approach to credit scoring. Individuals with limited or no credit history have successfully established a positive credit score, ultimately leading to greater financial empowerment.

On the other hand, there has been some debate surrounding Capitec’s credit score limits as certain individuals have encountered difficulties in obtaining larger credit limits.

The bank’s commitment to transparency and educating individuals about finances has positioned it as a significant influencer in transforming South Africa’s banking industry. It successfully supports many individuals through various means and categorisation.

Understanding the credit score horizon can enhance your insight into how to manage your finances. Let us look at the Capitec credit score check and how to build your credit score.

How do I check my credit score at Capitec?

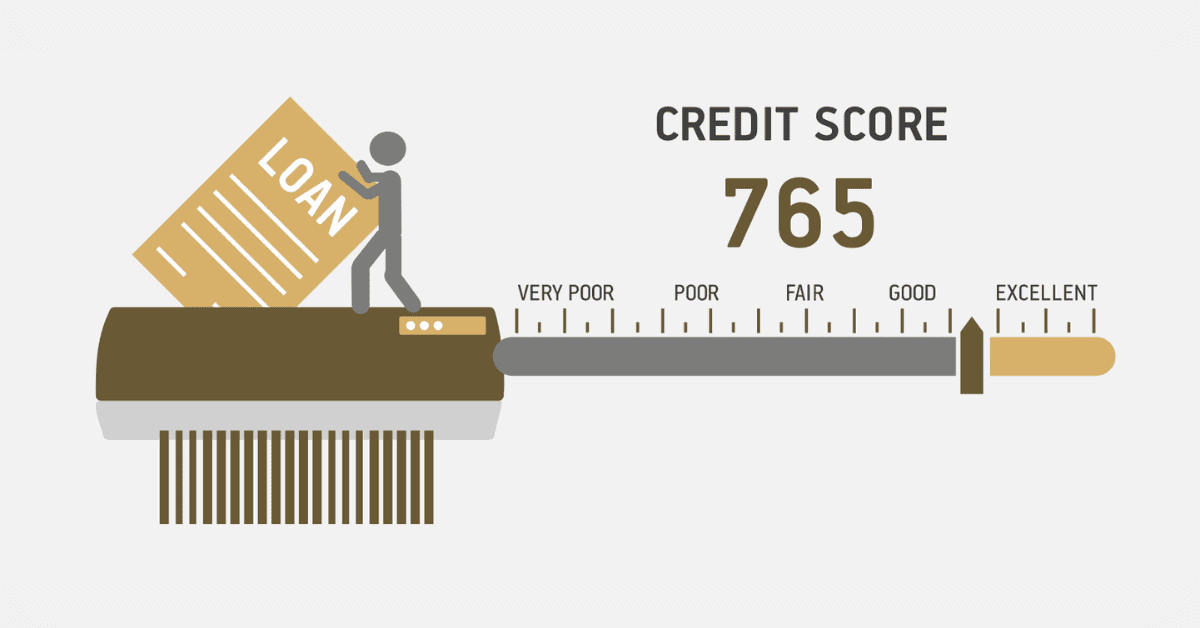

If your credit score is good, there is a higher chance of getting a loan with a lower interest rate and other credit packages. Regular checks of your credit score can quickly help you identify any issues or instances of identity theft, thereby safeguarding your financial well-being. Capitec’s platform makes it incredibly easy to accomplish various tasks. With Capitec, you can easily monitor your credit score at any time. This safety measure is in place to protect your money. Make sure to regularly check your Capitec credit score to make informed and wise financial choices.

Here is how to check your credit score at Capitec.

- Visit the Capitec Bank website or their online platform.

- Enter your details and log into your account.

- Navigate to the “personal” tab.

- Click on the “credit” tab.

- Choose the credit estimate button.

- Input your personal details.

- Confirm your details.

- At the final part you will see “Get your results”, click on it to view your credit score.

How do you build a credit score with Capitec?

To have a solid credit history, having access to credit is crucial. More insight will be shared on the need to have good credit and how you can easily build a credit score with Capitec. Below are some tips to help you.

- An excellent way to start building credit score with Capitec is to be at least 18 years old, provide evidence of address, and have a steady income of at least R3,000 to R5,000. Your other monthly costs will help the bank determine an appropriate credit limit for you. It is promptly issued if the necessary documentation is submitted.

- Establishing an account with a reputable store can also contribute to the development of your credit record, provided that you fulfil your instalment payments promptly. Another viable choice is a mobile account.

- Get as many utility invoices as you can in your name, including water, power, rates, fixed landlines, etc. This will assist in establishing your credit.

- Do not apply for a flood of new credit lines all at once or too frequently; doing so will have a negative impact on your credit score. Lenders will see your capacity to repay loans in a positive light if you have a small number of lines of credit from reputable organisations. Pay off all of your debt each month by sticking to your budget.

- Being punctual with your payments is essential if you want to have a solid credit history.

- Try not to use the full amount of credit that is available to you; doing so can result in negative consequences. Instead, pay off your debt promptly and keep your balance between 25% and 50% of your total maximum. Your prudent handling of debt is evident here.

- Get out from under your debt faster: If you’re already in over your head with your spending, a personal loan from Capitec could be the way to go. Repaying many credit lines becomes much easier when you consolidate them into one affordable debt. Affordable unsecured loans are available from Capitec.

- Creditors will see that you are disciplined with your money and plan if you put money away regularly in a savings account. Interest will also be accrued on the funds. Your credit score will benefit from having both a credit card and an account where you can save money. Take a look at the Global One savings possibilities offered by Capitec.

- Be consistent with checking your credit score and ratings on the app. It is free and easy to use.

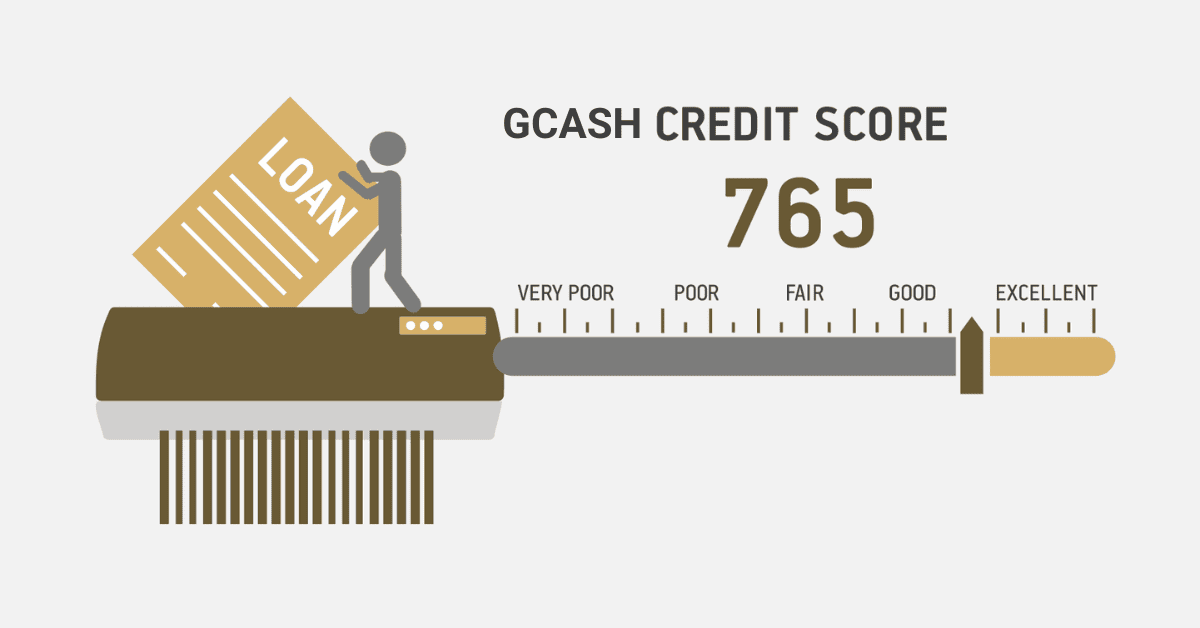

How do I increase my Capitec credit limit?

It is possible to increase your credit limit on Capitec. the ultimate way to do this is to be financially disciplined. Capitec provides tips and advice on how to spend your money to keep you in the right credit score category. applying this in your daily financial life can influence your credit limit on Capitec; mostly increasing your credit limit.

Furthermore, if you want to check your available credit limit and increase it on the Capitec platform, all you need is to log into your account.

Get to your balance and adjust the limit set for you. this may be available depending on the type of account and the credit score rating.

Which credit bureau does Capitec use?

A relevant credit supporter in this process is a credit reporting company, which is often referred to as a credit bureau. The bureaus have the important task of maintaining a comprehensive record of your credit history and financial activities. When you decide to apply for credit, like a loan or a credit card, the lender usually asks for a copy of your credit report from one or more credit bureaus. Capitec Bank uses Experian as its credit bureau. Experian provides support systems and credit records for banks who choose to partner with them.