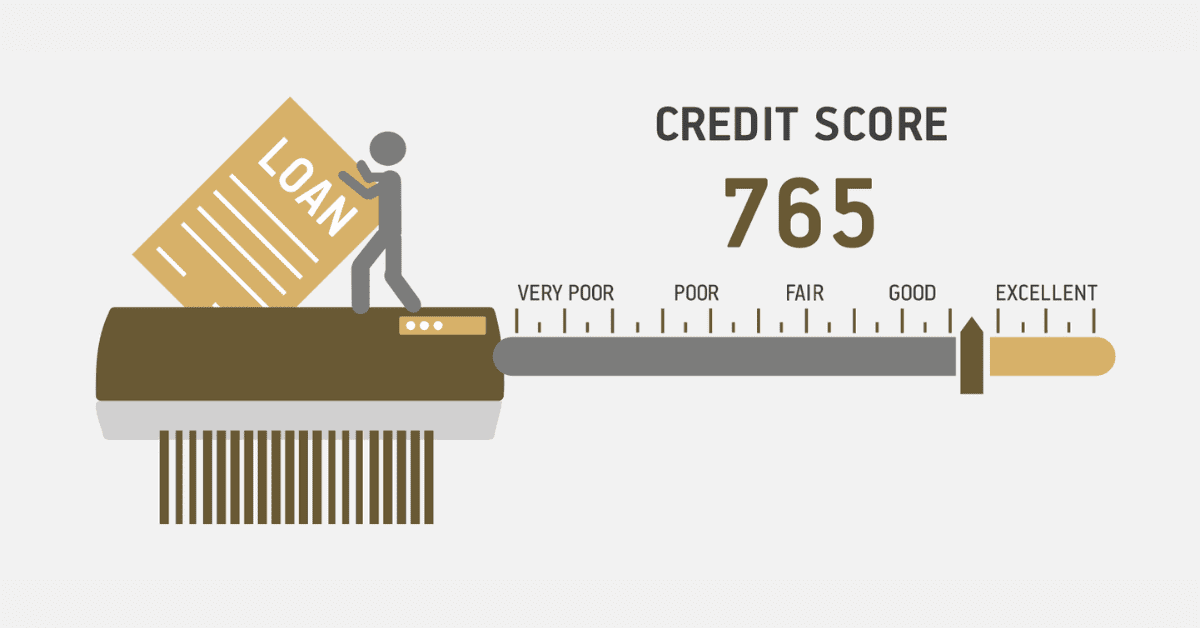

A credit score plays a critical role in South Africa since lenders and credit card issuers use it to determine your eligibility for credit and interest to be paid. You can only have a credit score when you have some credit history. However, building credit from scratch seems like a daunting task, but the good thing is that you can achieve your goal by starting from humble beginnings. For example, opening a credit account with Edgars can help you jumpstart your credit-building journey. Read on to learn how to improve your credit score through Edgars in South Africa.

Can Credit Score Improve Through Edgars in South Africa?

Yes, opening a credit account with Edgars is the easiest way of building your credit from scratch. After securing your first job, you cannot rush to a car dealership to apply for a car loan because of a lack of credit score, or it may be inadequate for such a big transaction. The modest way of building your credit is to open a credit account with a clothing store like Edgars or any retail shop that offers credit-based services.

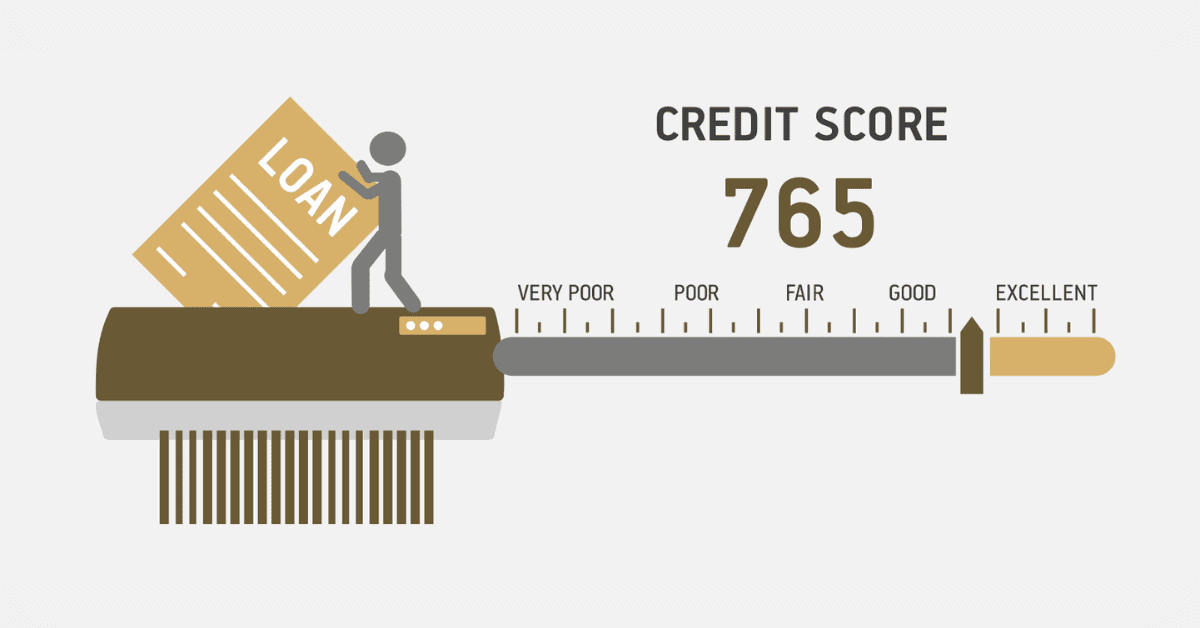

When you open your account with Edgars Store, make sure send your payments on time, and you don’t miss any. You can start with a small purchase like a pair of shoes, and this will mark a turning point in your financial history. Your account will put you on the map of credit agencies who will begin to gather your financial details, which will be used in the calculation of your credit score. Your credit score with Edgars will provide a reference when you intend to open other accounts that will contribute to the growth of your credit score.

A retail credit account like Edgars works because it provides the information sought by credit bureaus like TransUnion to produce credit reports for consumers and lenders. All credit bureaus in South Africa specifically look at your credit usage patterns to gain insight into how you manage your credit commitments. With no credit history, the lender may not be able to assess a consumer’s creditworthiness.

Therefore, consumers should begin by buying smaller credit-based items to build their credit scores. Retailers offer favorable credit agreements to beginners which makes it simple for them to manage their accounts. Once you establish your credit, it becomes easier to scale it. You can do this by opening a credit card account with a small limit. These short steps will help you build a strong credit score that allows you to apply for loans to make bigger purchases like auto loans or mortgages.

Which Credit Bureau Does Edgars Use?

Edgars uses TransUnion and Experian to obtain credit reports for potential customers. These credit bureaus gather information from different sources which makes it credible for assessing potential clients’ creditworthiness.

How Do I Increase My Edgars Credit Limit?

If you are thinking of increasing your Edgars credit limit permanently, you can contact the management by telephone or in writing. Make sure you clearly state what you want and provide the relevant details that may be required. The account holder is the only person who can make this formal request to have their credit limit increased. Therefore, never delegate this task to someone.

How Do I Settle My Edgars Account?

If you intend to settle or close your Edgars account, you need to obtain a settlement quote first. You should contact the call center on 0860 111 862 and choose the self-service function. You can also do this in-store by visiting the customer service desk or sending the request via edgarsclosure@rcsgroup.co.za. You will be required to pay any outstanding money on the settlement quote in-store or via EFT. All the payments must be submitted within five days of getting the quote.

Before sending a request to close your Edgars account make sure you cancel all Value-Added Services like Insurance products or Club. If you don’t cancel these services, your account may experience continued billing even when you have closed it.

How Long Does It Take to Clear My Name From Credit Bureau?

Credit bureaus often add names of people who fail to pay outstanding debts to a blacklist. Once you have been blacklisted, it might be difficult to obtain a loan in the future. The good news is that when you pay off your debt, your name will be cleared from the blacklist. After paying off your debt, it can take between seven and 20 days for your name to be cleared from the credit bureau.

Building a credit score from scratch takes time, especially when you are new to the world of credit. However, opening a credit account at Edgars Store can help you build your credit with relative ease. Your account will allow you to make small credit-based items that contribute to the growth of your credit history and report.