This investment brings SA capitalists closer to the world’s biggest corporations, from tech giants to blue-chip stocks. This is much easier than it may appear once one has the correct set of tools and knowledge regarding South African regulations concerning exchange. This article will be a how-to on the necessary steps South Africans should take towards buying shares on the NYSE and crucial considerations.

Buying Shares on NYSE from South Africa: How to Do It

Buying shares in the New York Stock Exchange from South Africa is not difficult. Here is how you do it:

- Choosing Your Broker or Trading Platform

Choose an appropriate trading platform or broker that offers NYSE access: some local ones like EasyEquities or an international broker such as InteractiveBrokers, eToro, or Saxo Bank. Check with the brokerage firm that this broker supports the NYSE-listed stocks.

- Open an Account

Create an account on your chosen online investment platform. The process typically covers information such as personal details and identification documents. In some cases of foreign investments, a certificate for tax clearance is even required.

- Deposit Funds

Deposit cash into your trading account. Most platforms accept a transfer in ZAR, which they immediately convert to USD. Remember to take into consideration both currency conversion fees and platform commissions.

- Choose Stocks

Research the listed companies on the NYSE and use various available analytical tools on your trading platform to determine the performance of every stock. Make purchases that match your financial goals.

- Place an Order

Choose the order you would like to utilize. These include a market order versus a limit order. Fill in how many shares you’d like to purchase, complete your transaction, and your brokerage will carry out your trade.

- Monitor Your Portfolio

Monitor the performance of your stocks through various tools provided by your brokerage firm. Periodically review your portfolio to ensure it remains within your determined investment strategy.

What is the Minimum Price of Stock in NYSE?

The minimum price of stocks on the NYSE is not specific, as the exchange does not try to impose a fixed minimum on listings. However, there are criteria that companies must satisfy:

- Listing Standards

Companies listing in this NYSE should at least have a share price of $4 during the time of its listing. A company below that threshold would offer a danger for delisting when its stock fell and remained that way for a very extended period.

- Penny Stocks

Stocks with a price lower than $5 are commonly known as “penny stocks.” These typically will not be listed anywhere on the NYSE; most just do not meet the strict requirements set by the exchange.

- Fluctuations in Market Price

While the listing price has to be qualified, the trading prices of NYSE shares are products of market forces, corporate earnings, and leading economic trends. Some shares, therefore, may be traded for way below their face values despite their listing.

What’s the Difference Between Nasdaq & NYSE?

The leading exchanges in Nasdaq and the NYSE lie across the globe, but they differ significantly in some of the following key areas:

Focus and Composition

- NYSE: Historically, it has been home to large-cap, established firms. These include blue-chip stocks such as Coca-Cola & IBM.

- Nasdaq: Hosting numerous tech and growth-oriented organizations. These include Apple, Amazon, & Google.

Trading Platform

- NYSE: It has a hybrid model that uses electronic trades and mixes them with human oversight in the form of floor traders.

- Nasdaq: It is electronic, making fast and cheaper transactions efficient.

Volatility

- NYSE: Less volatile in general since it is mainly concerned with established companies.

- Nasdaq: It shows more volatility as it lists high-growth stocks.

Listing Requirements

- The NYSE has higher requirements and, as such, mostly appeals to larger, more stable companies.

- For this reason, Nasdaq gives a hand to small or new companies; hence, it is a better startup platform.

What Does It Take to Be Listed on NYSE?

The NYSE set listing requirements to enable only reputable and economically stable companies to come on the board. Some of the critical factors that have gone into consideration include:

Financial Performance

- These figures indicate that companies must achieve a minimum of $10 million in earnings from the prior year and a minimum of $2 million for the most recent two quarters. That is an alternative standard of $200 million in market capitalization worldwide.

Share Price

- The minimum price at which the share shall be initially listed is $4 a share.

Public Float

- There must be at least 1.1 million shares publically traded.

Shareholders

- There should be at least 400 shareholders, each owning over a hundred shares.

Corporate Governance

- The same will have to adhere to high standards of corporate governance, including an independent board of directors.

On Which Trading Platform Does NYSE Operate?

The NYSE is a hybrid trading system where electronic trading precedes human floor traders.

- Electronic Trading

This means that a massive volume of trade takes place electronically through the NYSE proprietary system, NYSE Pillar, which treats the processing of the deals with efficiency and speed.

- Designated Market Makers

DMMs are human traders responsible for specific stocks. They add liquidity and normalcy to their particular stocks during highly volatile periods.

- South African Access

While NYSE is closed as a system to individual investors through brokers and platforms, such as Interactive Brokers or Saxo Bank, it smoothly interfaces with NYSE trading tools.

What Time Does the NYSE Open in South Africa?

The NYSE functions from 9:30-AM to 4:00 P.M. ET. In South African Standard Time, this translates to:

- 4:30-11:00 P.M. (non-Daylight Savings Time).

- 3:30-10:00 P.M. (during Daylight Savings Time).

What is the Minimum NYSE Requirement?

Minimum conditions whereby companies maintain listings on NYSE include:

- The company share price is at least 1 dollar for 30 consecutive trading days.

- A minimum global market capitalization of $15 million.

Final Thoughts

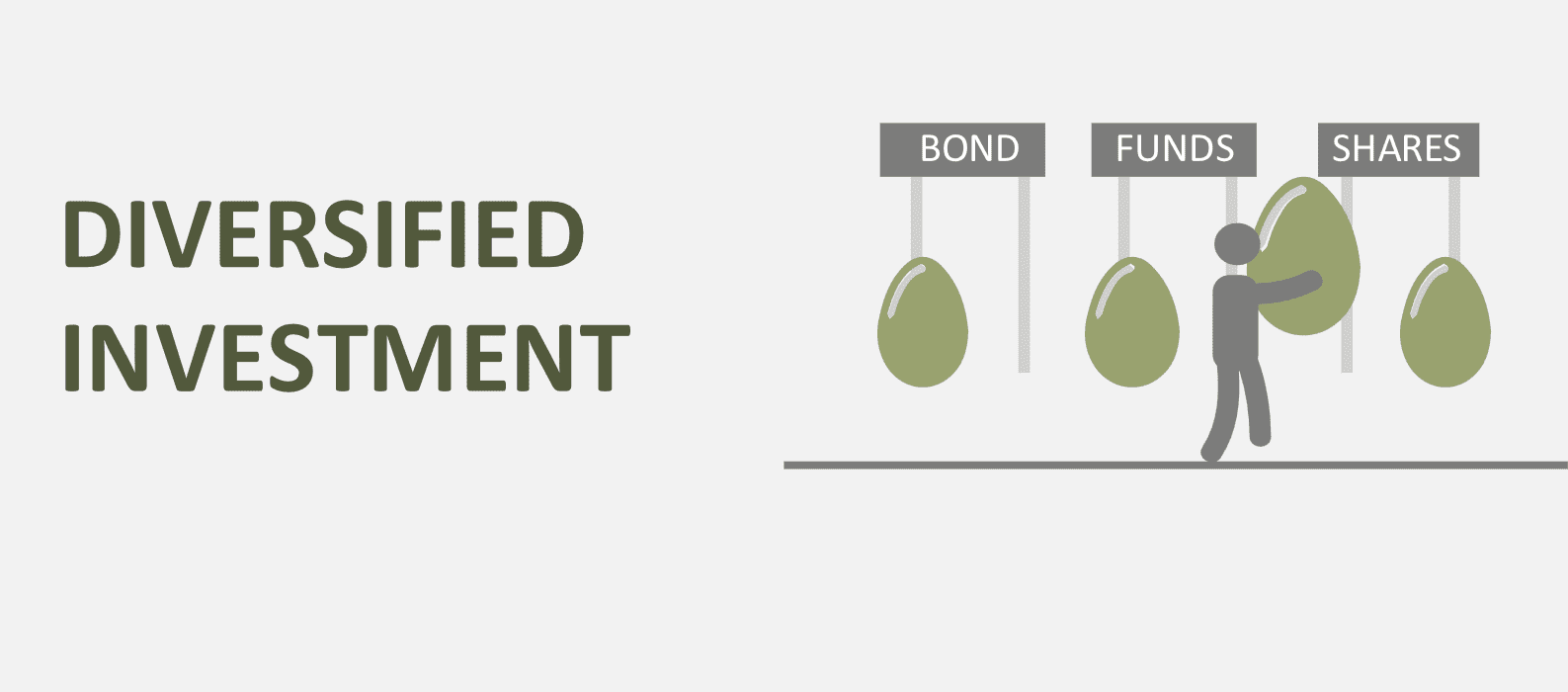

Buying NYSE stocks from South Africa is a very effective way of portfolio diversification and exposure to world markets. Understand how it works and choose a good trading platform, which will open up new lucrative opportunities for South Africans. Remember that dynamically changing regulation of the exchanges should always correspond to long-term investment objectives.