Using a business credit score is a reliable method to assess a company’s ability to meet financial commitments. The scores normally vary from 0 to 100, where lower scores suggest a lower credit risk. This score is utilised by suppliers and lenders to assess the likelihood of payments being made on time, which affects the terms of loans, credit, and partnerships. Factors such as payment history, credit utilisation, firm size, public records, and others can all influence the score. Maintaining a positive business credit score is crucial to securing funding, negotiating favourable conditions, building trust with stakeholders, and ensuring the company’s long-term financial health and performance.

The talk about credit scores has been going on for some time, but has it taken the path of “business”? What do you know about business credit scores?

Today, we will walk you through a series of questions related to business credit scores, the relationships between personal and business credit scores, the benefits of having a business credit score and many more.

Does Business Credit Score Affect Personal Credit Score?

This is a genuine question by most people who may have businesses. Although our input is opinionated, there is a bit of truth in there.

Having a business credit may or may not affect your personal credit. This situation is based on factors that are interconnected with business credit and personal credit.

There is a distinction between personal credit and business credit. Having a solid personal credit score can open up opportunities for individuals to secure important financial commitments like a mortgage or an auto loan. Business credit scores can also assist a corporation in achieving similar outcomes.

Nevertheless, business credit solely reflects the financial well-being of the company rather than the personal wealth of the owner or directors.

It is important to maintain a clear separation between your personal and business credit, but both can still affect your business. If you operate as a sole proprietor, your personal credit can greatly impact your business. Providing your Social Security number on a credit card or lease application will likely result in a thorough examination of your personal credit.

Lenders may be interested in reviewing your personal credit score if you have a young firm, as it can indicate your track record of bill repayment. It is possible that you might have to provide a personal guarantee, essentially acting as a cosigner for your company. Your personal credit score can affect the lending options available to your business.

Is business credit linked to personal?

There is a clear distinction between business credit and personal credit. The model that operates under business credit is different from personal credit.

Business credit is not directly linked to personal but there are instances where one can be shared as a reference. If you are a sole proprietor managing your business, it is possible for lenders to fall on your personal credit history to ascertain your qualification for a loan. However, your business credit and personal credit will never be linked although one can be used as a guarantee to secure a loan.

Do business loans show up on personal credit?

It is very uncommon for your business loans to show up on your personal credit. Lenders typically focus on assessing the creditworthiness of larger businesses that have distinct legal structures, such as corporations or limited liability companies.

In certain cases, the loan may not have a direct impact on personal credit unless a personal guarantee is necessary.

The impact of a business loan on personal credit depends on the business structure and the reporting standards of the lender. When applying for a loan as a solo proprietor or small business owner, most lenders take into account your personal credit history. Consequently, the loan could show up on your personal credit record, which would lower your credit score and restrict your future access to personal credit.

What are the disadvantages of a business using credit?

The demerits of business using credit can vary, but it all depends on the company structure, business model and idea. It is always necessary for business owners to look into the pros and cons of business credit.

In the first place, interest payments can be compounded, which can raise total costs and possibly cause a decline in profit margin.

A company’s credit report can also be hurt by having too much debt, which can make it hard to get loans with good terms in the future.

Also, depending too much on credit can give the wrong impression of financial security, hiding problems with how things are run. Changes in the market or sudden drops in sales can make it hard for a company to pay its bills, which could put it at risk of going bankrupt.

To sum up, strict repayment plans can make it harder for a business to invest in growth possibilities. Ultimately, organisations that depend too much on credit may be vulnerable to financial instability, higher costs, and less freedom in making strategic decisions.

Does a company credit card in my name affect my credit?

The effect of a credit card in your name does not come directly. If you are a primary account holder for your company, your details may be captured on the credit card. However, the process of repayment and how the credit card will be used can affect your credit.

Ultimately, the type of card that is issued to the company has a great influence on the effect of the card on your credit.

All things being equal, if your details are used completely for the issuing of the company credit card, there are possibilities it can affect your credit. In the case where only your name is attached to the card and you bear no authorisation to the card, it is very unlikely for the credit card to affect your name.

What are business credit scores and personal credit scores?

Have you thought about the difference between business credit score and personal credit score? What is your verdict on these two credit score categories?

Is there any clear distinction between a business credit score and a personal credit score?

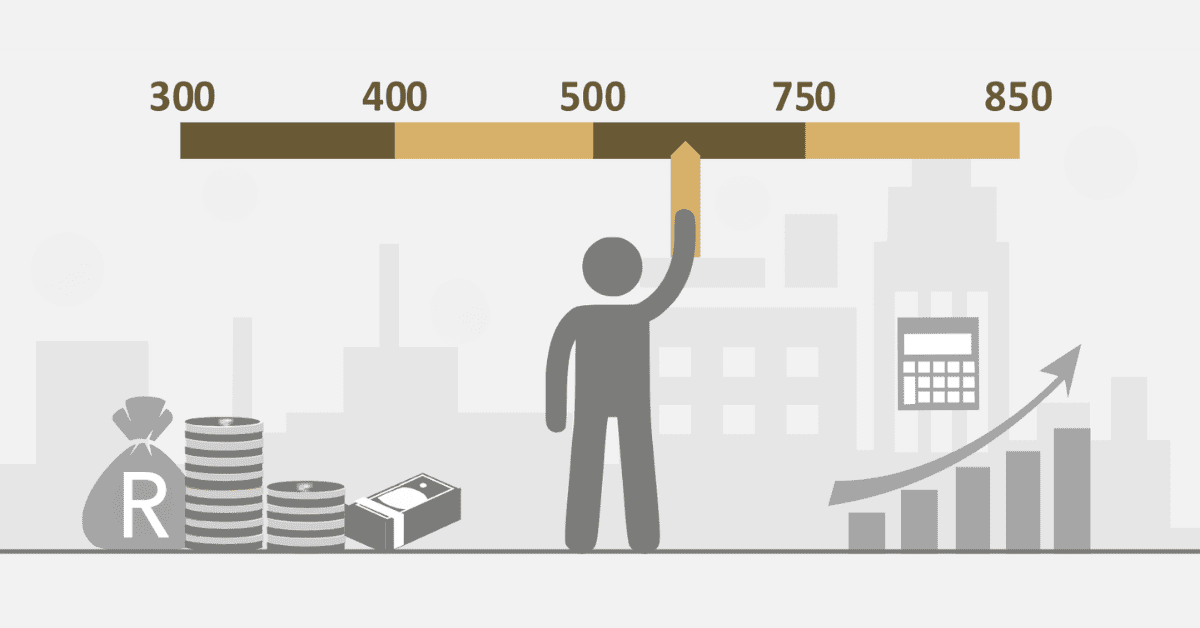

Credit scores are numerical indicators that assess an individual’s creditworthiness by summarising their financial history. The range of these numbers is from 300 to 850, and they are determined by factors such as payment history, debt amount, credit history length, types of credit used, and new credit accounts.

In order to secure favourable interest rates on loans and credit cards, it is crucial to possess a good credit score.

However, business credit scores are specific for businesses and provide lenders and suppliers with an assessment of the company’s creditworthiness. On a scale from 0 to 100, a higher business credit score indicates a lower likelihood of the company defaulting on its debts.

These numbers consider factors such as the company’s size, public records, payment history, and outstanding balances. Establishing and maintaining a robust business credit score holds significant value in securing loans, negotiating favourable terms with suppliers, and cultivating a reputable financial standing in the business realm.

How do I check my business credit score?

A business credit report summarises the credit history of your company. This is similar to a personal credit report, which gives you a quick overview of your credit usage. Financial institutions rely on the data in your credit report to assess your ability to repay borrowed funds.

Although there are numerous free resources available for consumers to access their credit scores and reports, it can be challenging to find equivalent options for businesses. There are free business credit score sites available, but the information they provide may not be as comprehensive as that of a paid service.

We have curated a comprehensive list of the top free credit report resources, providing a convenient solution for busy business owners. Our summaries highlight the key features and benefits of each resource.

Businesses have the option to make payment to any of the well-established credit bureaus in the region in order to obtain their business credit report.