Personal loans are an essential tool in South Africa that can help one meet significant expenses, consolidate debt, or even work toward individual goals. The best option is somewhat elusive, as there are many choices available. This article covers some of the best personal loans available in South Africa by looking at different types, benefits, and ways through which people can get the most favorable terms possible. Grasping these elements enables you to make informed decisions regarding your finances based on your circumstances.

What Is A Personal Loan?

A personal loan is one of the many unsecured quick loans a financial institution provides, used for miscellaneous purposes. Unlike secured loans, personal loans do not require collateral; therefore, more people can afford them. The borrowers are given a lump sum, after which they then service the amount in fixed monthly installments. The figure borrowed, the interest rate charged, and the time frame for repayment depend, however, on the debtor’s creditworthiness. Claims of these loans range from R1,000 to R350,000 in South Africa, while their respective repayment periods can be flexed from 6 to 72 months, making this a versatile solution for financial needs.

Why Take A Personal Loan?

They have several advantages that help make them very alluring to South Africans. First, they allow one to access cash instantly for any sudden or significant expenses—be it medical bills, house renovations, or education. Two, personal loans can consolidate multiple debts into a single monthly payment, making it much easier to handle and probably cutting interest costs in total.

Furthermore, personal loans can be used to establish or improve credit scores if one pays the loan regularly on time. Again, for business investors or significant purchasers, personal loans give an individual the required capital without necessarily subjecting the owner to rigid and uncomfortable collateral requirements like in secured loans. To sum it up, personal loans are flexible, convenient, and readily available for many different personal and professional purposes.

Types of Personal Loans

There are many kinds of personal loans available in South Africa, and most of them vary to suit all financial needs. The essential types of loans are:

- Personal Loans: These are unsecured options availed solely on the debtor’s creditworthiness. They are ideal for those who need quick access to funds without risking their assets.

- Secured Personal Loans: These involve using collateral, such as cars or property. They usually have lower interest rates since it’s not much of a risk for the lender, but on click, there is the potential loss of that collateral if repayments are not made as expected.

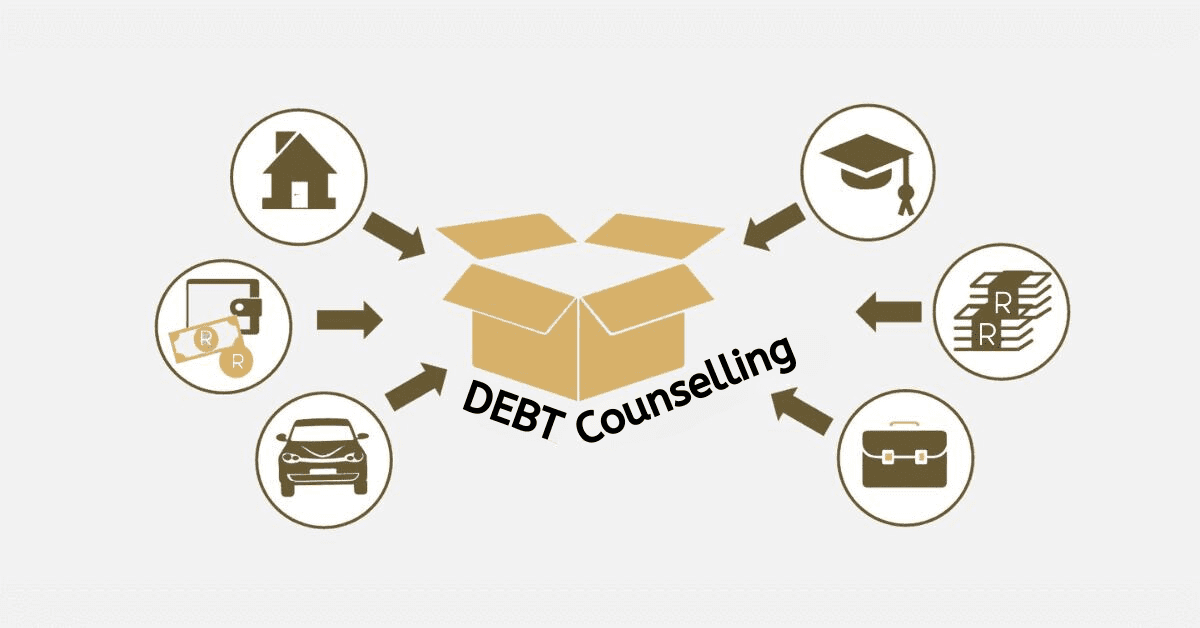

- Debt Consolidation Loans: They bundle several debts into a single loan with a monthly payment, generally at a lower interest rate. In this way, debt is easily managed, and interest costs are considerably reduced.

- Payday Loans: These are short-term ones in small amounts, usually up to R2 500, which one needs to pay back by the next payday. They can be ideal for really urgent minor expenses but at high rates of interest and fees.

- Pensioner Loans: These are loans specially structured for pensioners, considering the regular pension to their credit and offering terms suited to pensioners’ financial situations.

- Business Loans: While not strictly personal loans, some personal loans meet small businesses’ needs when they require capital to get started or expand without much business documentation.

How to Get Personal Loans With the Best Interest Rate in South Africa?

Getting the best interest rate in South Africa on a personal loan has to do with specific strategic measures. First, maintain a good credit score by paying your bills on time and reducing existing debts; higher scores qualify one for lower interest rates. Compare several loan offers from different lenders for competitive rates and terms, including banks and online platforms.

Third, if you have any collateral, then opt for a secured loan; these loans charge relatively lower rates of interest compared to unsecured loans. Watch out for seasonal promotions or other special offers most financers have. Negotiate with the lenders in the end. They might want to give better rates if you can prove your financial stability and its history.

Basic Requirements for Personal Loans

The most straightforward requirements for applying for a personal loan in South Africa would be that applicants be at least 18 years old and have a valid SA ID. One also needs to show proof of residence, usually a utility bill or lease agreement. Most lenders also require proof of income; applicants can use their recent payslips or bank statements as long as they show a stable source of earnings. Moreover, good credit history offers higher chances of approval and more favorable loan conditions. Compliance with the requirements guarantees the applicants a reliable financial profile facing the lenders for approval.

South African Banks With the Best Personal Loans

Some of the best banks in South Africa that offer excellent personal loans with competitive terms and benefits are:

- African Bank: One of its very flexible features is the “Choose your Break,” in which you do not have to pay for a month. Personal loans of up to R250,000 are provided at very convenient repayment terms, as long as 84 months.

- FNB: Offers personal loans with quite several features not usually found with most loans, like the January payment break and no penalties for early repayment. Once you can get up to R300,000 as loan money, the repayment may go up to 60 months.

- Nedbank: Offers personal loans with very tough eligibility needs, proof of permanent employment, and a minimum monthly income. Their loans are tailor-made to individual needs with flexible repayment tendencies.

- Capitec Bank: Provides access to personal loans of up to R250,000 over 84 months while also offering free retrenchment and death cover for added security in borrowing.

- Absa: Being a member of the Barclays Group, Absa offers you a personal loan of up to R350 000 with flexible repayment terms and an optional Credit Protection Plan just in case.