Credit score, in general, speaks more for many people when seeking financial opportunities. These numbers that are generated speak about individual financial behaviour and creditworthiness.

The idea behind South Africa’s credit score system is to help lenders make smart choices about which loans to approve and what interest rates to charge. A higher credit score shows that you are good with money and lowers the risk for lenders, which could mean better loan terms for the user. On the other hand, a smaller credit score means you are a bigger risk, which could mean you do not get the loan or get it with difficult terms.

A good credit score is important for getting loans, credit cards, and mortgages, among other financial items. It can also affect other parts of your life, like your ability to rent an apartment, be financially credible and many more.

What are the benefits of having a good credit score?

A good credit score and the ability to get credit are both very important traits. Some tools that will help you save money and get better loan terms are available if you have good credit. This is because these chances will come your way. After all, you are a reliable borrower. If you know how to handle your credit well, you can get rewards, pay less interest, and keep building your credit score.

Your credit score is directly linked to interest, which is the cost of getting money. If your credit score is high, you can get the best interest rates. This means that you will pay less interest on loans and credit card bills, which will help you pay off your debts faster and have more money for other things.

- A good credit past makes it more likely that you will be approved for new credit. Your credit score does not determine whether you get a loan or credit card, but it does make your application seem more trustworthy, which can boost your confidence.

- If you do not already get the best interest rates on your credit cards or loans, having a good credit score can help you get better terms. It gives you more choices, which gives you more buying power than people with lower credit scores, who have fewer options.

- Banks will lend you more money if you have good credit because it shows you can be trusted to repay loans. You can still get loans even if you have bad credit, but the amounts you can borrow are usually limited. This shows how important it is to keep your credit score good.

- Credit scores are often a part of the renter screening process for landlords. Some people need help finding landlords who are ready to rent to people with bad credit, but if you have good credit, you have a better chance of getting a rental.

- Auto insurers often punish people with bad credit by making their rates more expensive. The opposite is also true: people with good credit tend to have lower insurance rates because insurers see them as less of a risk.

- If you keep your credit in good shape, you can get cell phone contracts without having to put down a security fee. This not only speeds up the process but also lets people with good credit get better lease terms and cheaper phones, while people with bad credit may have to deal with restrictions or extra fees.

What does a good credit score mean?

There is a need to have a good credit score as this could elevate your financial abilities. When you have a good credit score, life as far as finances are concerned becomes liberal.

When you have a good credit score it means your credit score is within a good range that allows you to secure loans, like car financing, mortgages, personal loans and many more.

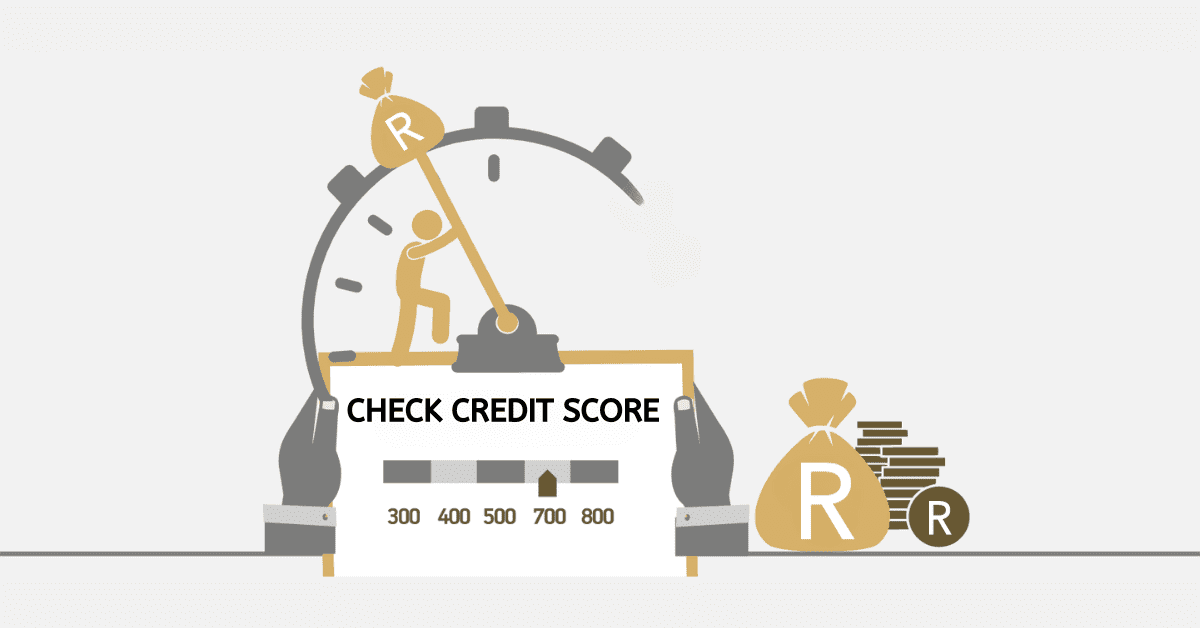

A good credit score could mean a number higher than 700 which indicates your creditworthiness.

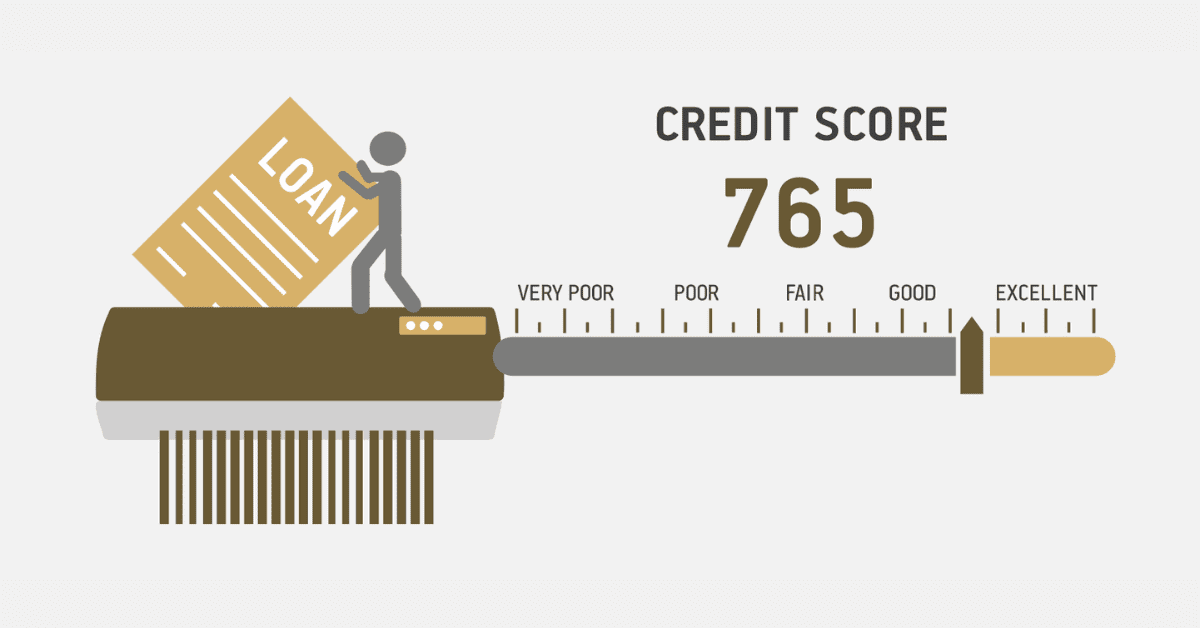

How can your credit score affect your life?

In the financial landscape where credit score is used as a measure to provide financial support to people; your credit score could have an adverse effect on your life.

Your credit score opens the financial doors for you to get any type of loan you have, once your score is considered to be good.

When you have a good credit score, it makes it easier for you to get approval for any type of loan you need. A good credit score can have a positive effect on your life.

On the other hand, a bad credit score omits you from a lot of financial opportunities. Once your credit score is bad, it makes it difficult for lenders to trust your ability to pay back your loans.

Why is it important to have a good credit score?

It is important to have a good credit score if you want to get loans, mortgages, or better interest rates. It is a big part of figuring out how reliable someone’s finances are and can have a big effect on their ability to get housing, car loans, and jobs. If you have bad credit, you may have to pay more for interest, have fewer financial options, and have trouble renting or buying a home. A person’s credit score can also affect their job chances and housing options because employers and landlords often use them to judge how reliable and responsible a person is. Because of this, it is very important to have a good credit score to keep your finances stable and to get new chances in your personal and professional life.

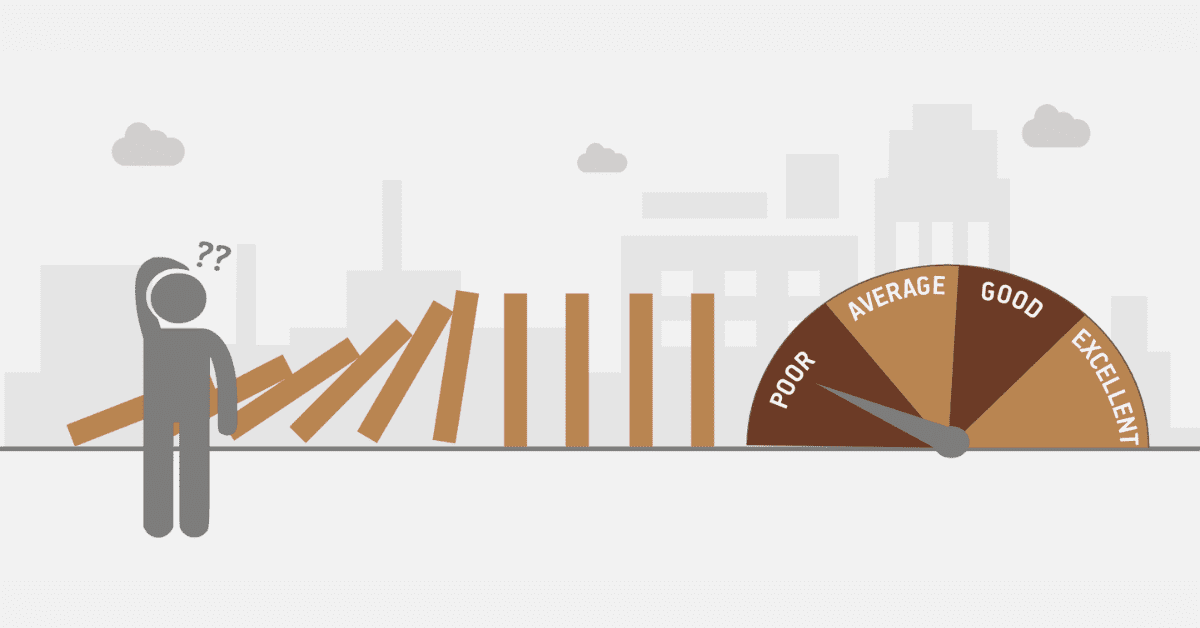

What is a bad credit score?

A bad credit score is like a bad note; it reminds you of mistakes you made in the past with your finances. There are numbers that show how irresponsible someone is by showing they can not handle their debts and financial responsibilities. A number figure that is less than 550 could mean that you have bad credit. Occasionally, a bad credit score could be anywhere from 300 to 570. These numbers are turned into financial terms that show how trustworthy you are as a whole. It is a clear sign of how well someone is doing financially and a warning sign of possible future problems. A bad credit score is a heavy load that judges and condemns you without saying a word.