You’ve worked hard, done the right things, and been very responsible with your debt. Yet your credit report doesn’t show that! Or perhaps you have had a great credit score until recently, haven’t changed anything, and have seen a sudden drop. Maybe you’ve never checked it at all and are very shocked to see it is poor. Regardless of the specifics, we’ve all had a credit score scare at some point in our lives. Luckily, you don’t have to stay in the dark! Today, we will walk you through working out what is affecting your credit score and how to fix it.

How Do I Find Out What’s Affecting My Credit Score?

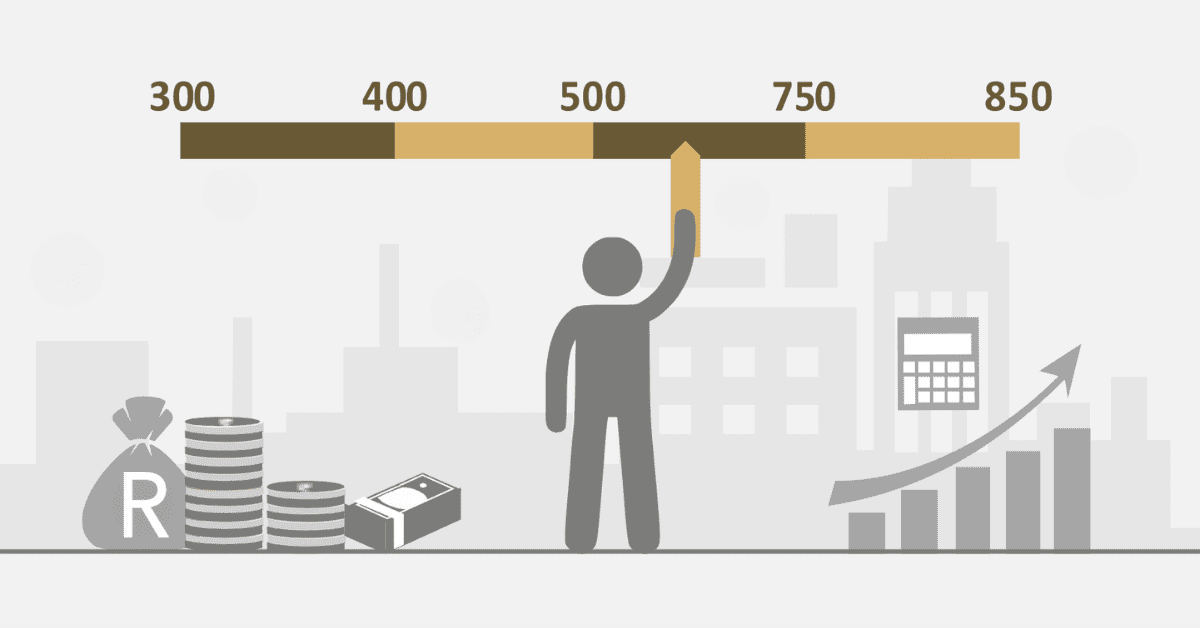

Finding out what is negatively impacting your credit score starts with a thorough knowledge of what that credit score is. The best way to do this is to pull a credit report from each of the Big 4 bureaus in South Africa- XDS, Experian, TransUnion, and Compuscan.

Unlike many of the free tools and integrated banking credit score trackers, your credit report from the credit bureau will give you the full picture of what is being reported to the bureaus. Start by carefully scrutinizing each item. Is this legitimately your debt, or is it an error or fraud? Do they have incorrect or outdated information? If you encounter mistakes or fraudulent activity, you can report this to the credit bureau to resolve- called a dispute. If your dispute is valid and you can prove it, the item will be removed from your credit report.

If you have active defaults or judgments, you will need to make a payment plan to address them. While legitimate judgments and defaults cannot be removed, they should fall away naturally after the ‘retention period’. This is a time limit set by the National Credit Act on how long specific types of bad (or good) behavior can impact your credit score. Judgments will last for 5 years, and bankruptcy even longer, but most types will be removed after 1 to 2 years. If it seems like a once-legitimate default/judgment is still on your report, you can also dispute it and motivate the reason. After all, the credit bureaus can make mistakes.

Once everything on your report is accurate, it is time to assess your debt position honestly. Are you making late payments, especially regularly? Are you using more than 50% of your available credit limits (where applicable)? Have you applied for a ton of credit in a short period? Do you have too much debt or too many types of credit and are approaching over-indebtedness? These factors will all negatively impact your credit score. These genuine bad credit behaviors cannot be magicked away and will need to be addressed. Once you have fixed them, your credit score will slowly recover.

There’s one last factor to consider, however. Your credit score will also be poor (or non-existent) if you have never had credit before, have paid it all down, or have recently paid off and closed lines of credit. This is where a good credit score and good financial habits don’t line up, regrettably. There’s little to be done about this except slowly and responsibly taking on some debt and managing it well.

Does Paying Interest Affect Credit Score?

All credit lines come with interest built in. It’s the lender’s repayment for letting you use money you don’t have. However, it doesn’t directly impact your credit score in any way. It’s built into the product. Of course, it has an indirect impact, as the interest rate you pay on your credit lines will have a big impact on the total amount you pay and how manageable it is. This could have a knock-on effect on your repayment level and ability to service your debt.

How Do I Find Out Why I Have a Bad Credit Score?

We walked you through the basics of finding out why you have a bad credit score above. Here is a recap:

- First, get your credit report from each of the Big 4 bureaus so you better understand your position.

- Check for errors, mistakes, and fraud, and dispute these.

- Next, deal with any legitimate ‘red flags’ (unpaid debts, defaults, and judgments) by settling them or making a plan to do so.

- Now, assess your overall debt position. Does your report show good or bad credit behavior? Take proactive steps to fix anything you find.

- Remember that having no credit or little credit will also lead to a poor credit score, ironically.

If you address all these matters, you will soon work out what is affecting your credit score and can take the needed steps to fix it.

Why is My Credit Score So Low When I Have No Debt?

The million-dollar question! How come having no debt negatively impacts your credit score? Isn’t no debt good? It doesn’t seem fair, and it isn’t. Here, we have to reveal a rather sad financial truth. While a good credit score is an important financial tool, credit scores tell you nothing about how good your financial habits are, just how responsible you are with credit. You could be a multi-millionaire with tons of assets and have a poor credit score because you have never used debt. You could be struggling to meet your debt load every month and living on pap and dreams, but have a fantastic credit score because your creditors are always paid on time.

If you have no debt, the credit bureaus have no idea how you act with debt. You could be responsible, or awful. There’s no data to tell. If you have never had debt, you will have no credit score at all. If you have used debt- even well- in the past, but now don’t use it at all, your score will gradually fall. Unfortunately, a good credit score hinges on continuing to use debt responsibly over time. It isn’t a measure of your overall financial health in any way. Having no debt is excellent from a financial wellness perspective, but it will kill your credit score. You have to strike a balance as best you can.